Perspective on the Stock Market's Return in November 2023 and a Look at the Probable December 2023 Return

- November's 9% return on the S&P500 was strong, but past Novembers have seen even higher returns.

- Historical data suggests that December is likely to deliver a positive return, with a 77.3% chance of success.

- The US stock market's performance this year is puzzling given global turmoil, but it may be influenced by investors seeking shelter from crises. It won't work.

November’s 9% return on the S&P500 was stellar, but there have been even higher returns in past Novembers. And there’s a good chance that December will deliver a positive return based on history – the odds favor a positive return.

But before I delve into the history of monthly returns over the past 98 years, I’d like to pose a question that I’ll try to answer in the Conclusion to this article. Why is the US stock market up 20% this year while the world is in shambles with terrible wars, enormous debt, inflation, social unrest, global warming, gender confusion, open borders …?

History of monthly returns

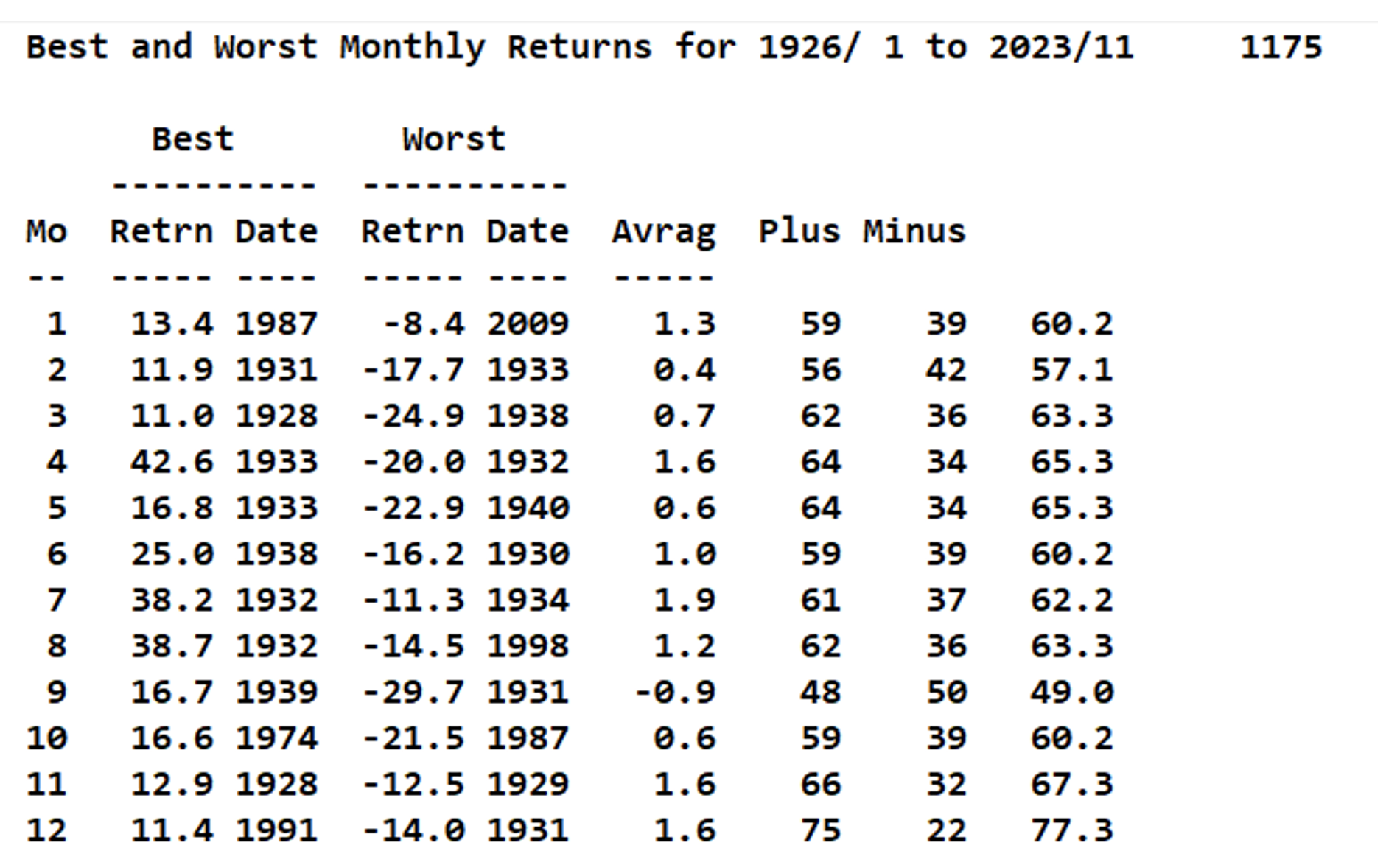

Let’s focus on November first and then talk about what December probably has in store. The best November return was 12.9% and occurred in 1928, the year preceding the worst November return of -12.5%. The average return over the past 98 years has been 1.6%, and returns have been positive in 66 years, so 67.3% of the time. This November’s 9% return is well above the average 1.6% but still short of the highest return ever.

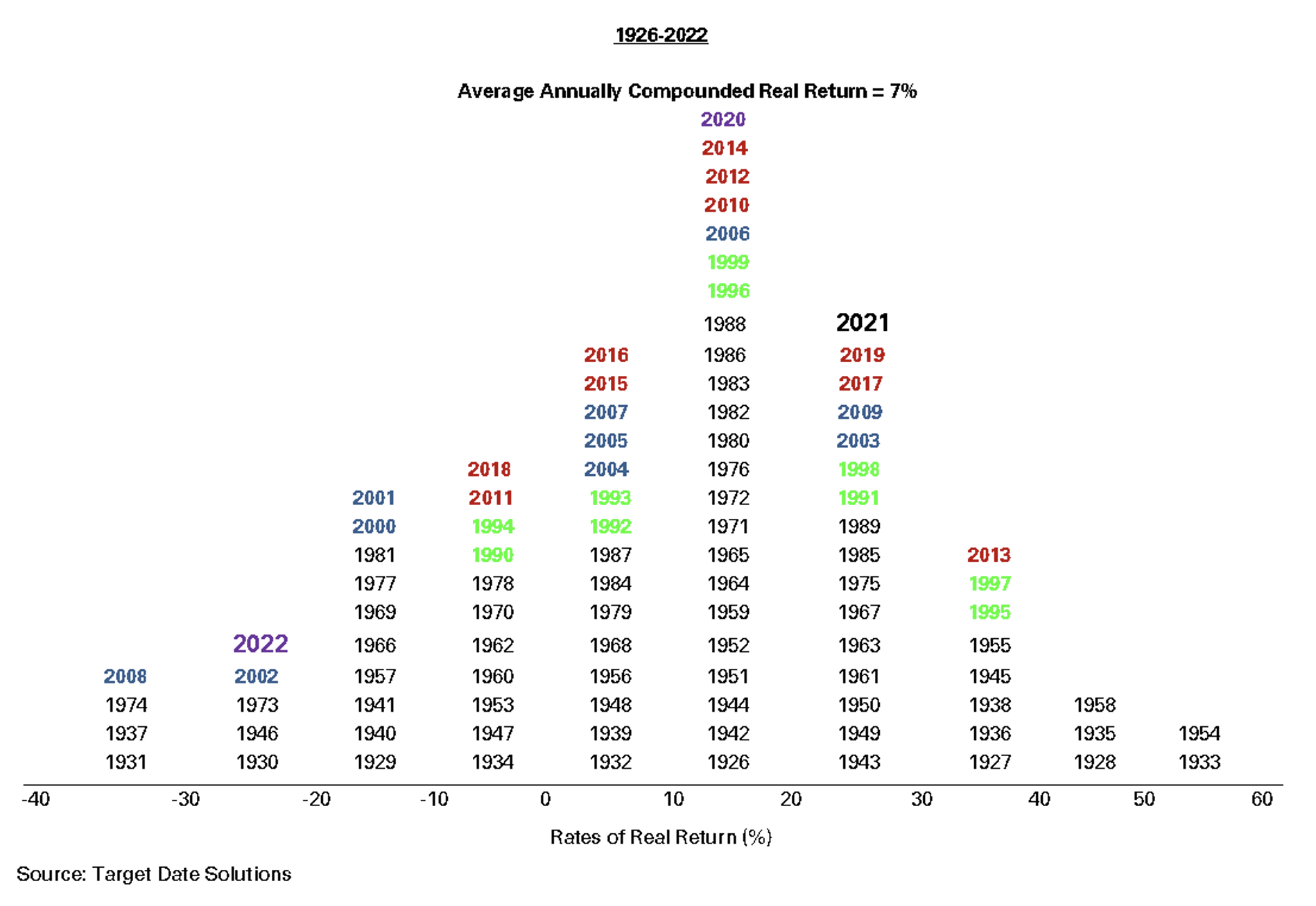

Looking forward to this December, the odds of success (positive return) are 77.3%, the highest of any month (the Santa Rally), suggesting that 2023 will deliver a return above 20%, placing it in the top third of historical returns – a very good return.

The good news and the bad news

The press says that the good news driving stock markets is that the Fed is sure to pivot in 2024 and re-instate its ZIRP – Zero Interest Rate Policy. But this chess game is not looking to moves ahead. The last time the Fed pivoted was in the 2013 Taper Tantrum when inflation was low. As shown in the following diagram, pivoting now will re-inflate inflation fires, but even more importantly the Fed has a dilemma that is essentially unsolvable. It’s out of moves. It’s like Chevy Chase caught in the roundabout in National Lampoon’s European Vacation.

If the Fed allows interest rates to say rise to 5% and stay there, debt service will escalate to $1.7 trillion which is 43% of tax revenues, pushing down payments for Social Security and/or forcing “monetization” – i.e. money printing. If it suppresses interest rates again it will need to print money, starting the whole inflation cycle over again. It’s ugly.

Conclusion

Now I’ll take a guess at what is propelling the US stock market despite very serious concerns. It’s a lesson from the fall of Venezuela when investors in that country moved to defend themselves from their crises.

Venezuela’s stock market taught a lesson in 2016 when the Venezuelan stock market performed best in the world, earning 114% versus 13% on the Dow. This event has direct application to the recent US stock market. According to this Marion West article:

The curious case of the Venezuelan public equities market is a prime example of why it can be misleading to use stock markets as indicators of economic performance. Most economists agree that Venezuela’s economy is in turmoil, and that there is no end in sight. The real reason behind the market’s astronomical rise has little to do with ebullient investor sentiment, but instead is one of the symptoms of the government’s inflationary monetary policy. In short, owners of the country’s currency protected themselves from the currency’s severe devaluation by exchanging their bolivars for seemingly safer assets, including stocks. With huge volumes of money pouring in, the stock market artificially inflated.

Here's a quote by Ralph Waldo Emerson:

Life is a succession of lessons which must be lived to be understood. All is riddle, and the key to a riddle is another riddle.

Time will answer the riddle of recent stock market advances. Millennials have not yet experienced a stock market crash. A crash is long overdue.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.