A mostly graphical daily curated roundup of the markets and the economy from Nasdaq's IR team.

| PCE (inflation reading) tomorrow | subdued tone in equities this week

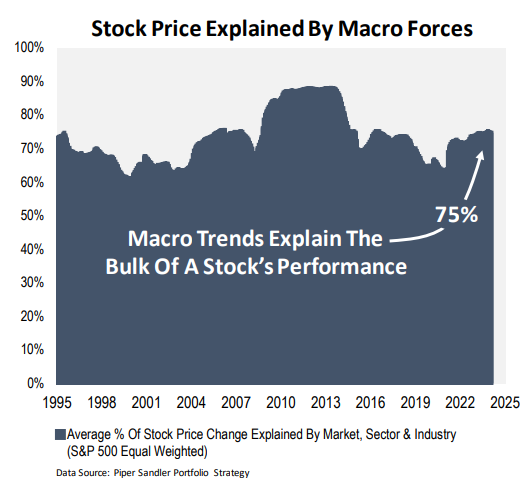

| "Macro Forces Always Play A Dominant Role In Markets: The Macro Du Jour Since 2022 Is Inflation!"

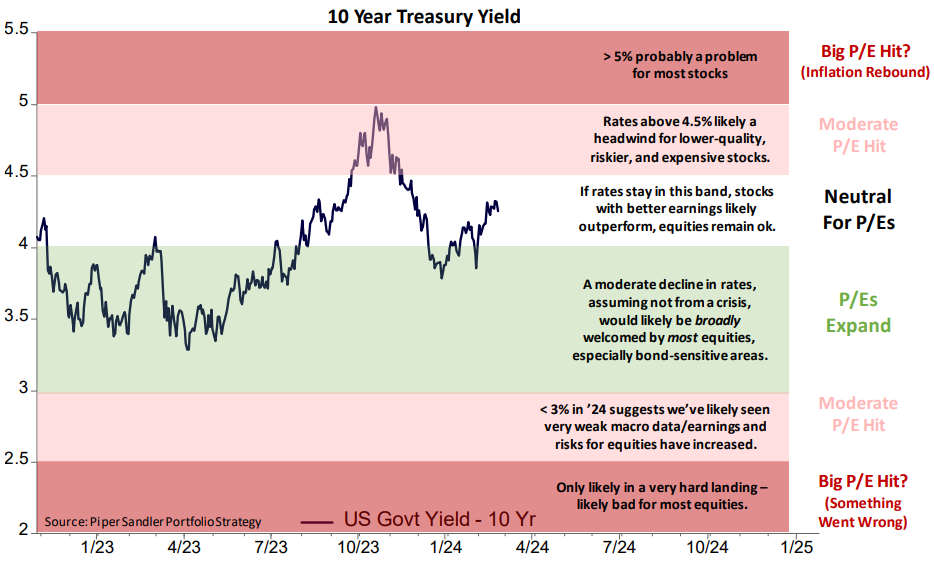

"Interest rates have become the primary driver of equity market breadth. For the foreseeable future, market corrections are more likely to come from higher rates rather than weaker economic growth."

-Michael Kantrowitz, Piper Sandler

bad addiction and not good for market discipline:

easy policy, bailouts, and handouts...

interest rates to remain the main determinant of equity market breadth

Likely Impact Of Various Rate Levels On Equity Multiples In 2024

* source: Piper Sandler

| concentration risk (Mag 7 + several others) a concern | "There is little doubt equity market technicals are looking stretched ...Toppish technicals and narrow breadth mean further upside hinges on broadening of the rally..."

-Barclays' Emmanuel Cau

* source: Barclays' Emmanuel Cau

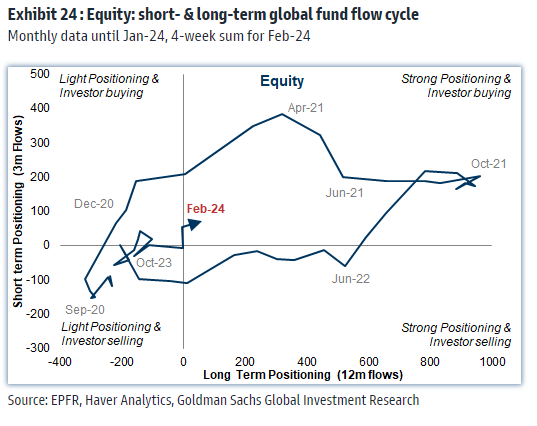

| in 2024 investors have been buying and entering strong positioning territory... | "More bullish positioning but still room to broaden out"

* source: Goldman Sachs Global Investment Research

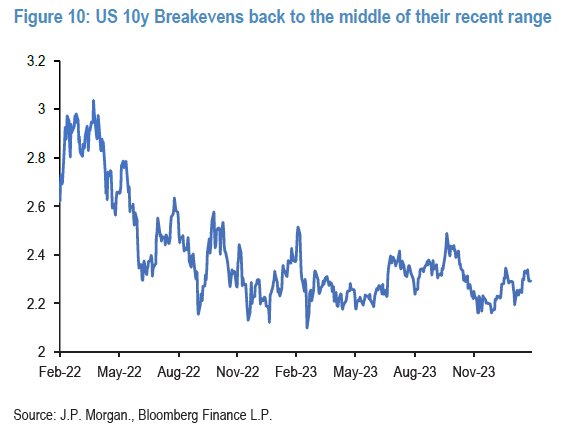

| "there’s been a notable uptick in market expectations of near-term US inflation...we’ve had continued good news on growth and the labour market, which has added to the sense that inflation could prove more persistent as demand remains strong.

10yr breakevens don’t suggest there’s a longer-term concern for investors at the moment. But the short-term jump goes some way to explain why markets have shifted from pricing nearly 7 Fed rate cuts this year in mid-January to just over 3 now, and that might be why 10yr breakevens are better behaved as the market currently thinks the Fed will do what it takes to ensure long-term price stability. "

-Deutsche Bank, Jim Reid

-Short term inflation a concern? -RTRS

* source: Deutsche Bank, Jim Reid

* source: JP Morgan

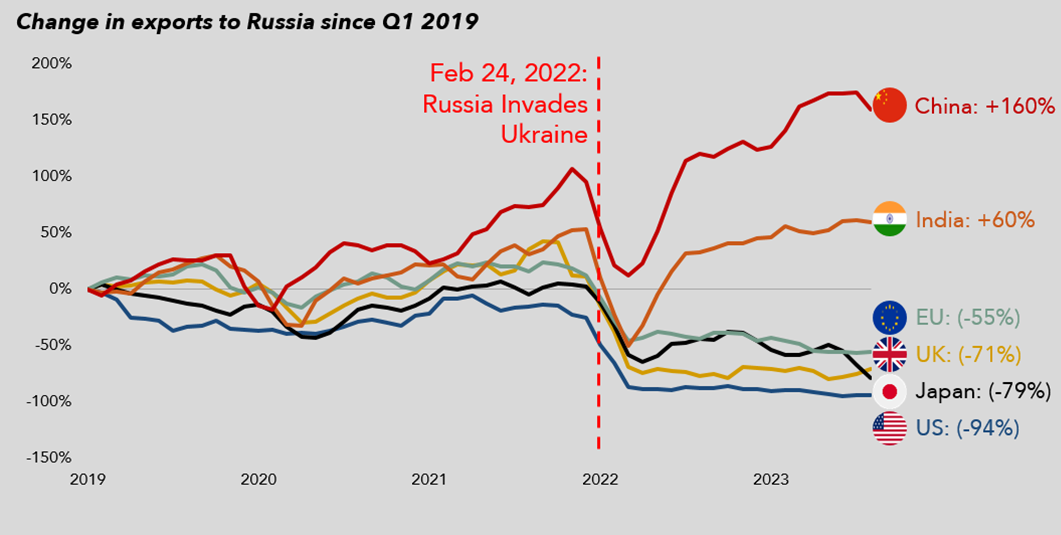

| Food for thought: geopolitics | Russia's Global Trade Realignment -Tom Joyce MUFG Capital Markets Strategy

Sino-Russian Trade Flows Rising

* source: Tom Joyce MUFG Capital Markets Strategy

| concentration risk + commercial real estate are concerns as per JPM survey...

* source: JP Morgan

| "High concentration (Mag 7 + several others) means broadening out could be needed for further upside"

* source: Barclays' Emmanuel Cau

| "The recent re-coupling between Bitcoin performance and our Risk Appetite Indicator could be another sign of further bullish sentiment build-up across investors"

* source: Goldman Sachs Global Investment Research

Bitcoin jumps above $60,000 for the first time since November 2021

* source: CNBC

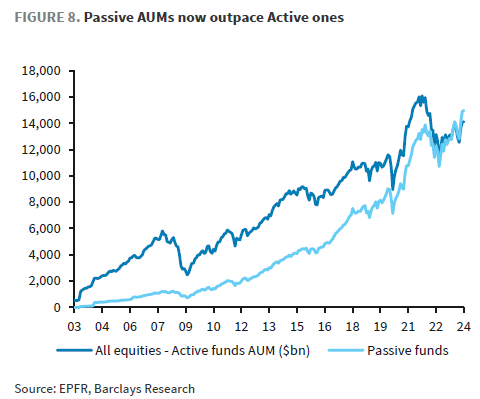

| lower cost + better performance (as per Goldman's analysis of large cap mutual funds) = passive > active... | On average, 38% of large cap mutual funds outperform their benchmarks...

* source: Barclays' Emmanuel Cau

* source: Goldman Sachs Global Investment Research

| "All in all, while a resilient macroeconomic picture and a positive earnings season in the US have continued to support the bullish sentiment backdrop, investors are generally exposed to concentrated positions. On one side, this inevitably increases concerns around potential near-term setbacks in case of related shocks, but on the other side it suggests there is space for bullish sentiment and positioning to be further supported, especially if we start seeing a more meaningful rotation out of cash and into risky assets and laggards within equities"

-Goldman Sachs Global Investment Research

* source: Goldman Sachs Global Investment Research

1) KEY TAKEAWAYS

1) Equities + TYields LOWER / Dollar + Oil + Gold HIGHER

Inflation data in focus on Thursday (PCE) | ISM Manufacturing on Friday

DJ -0.5% S&P500 -0.4% Nasdaq -0.7% R2K -0.5% Cdn TSX -0.1%

Stoxx Europe 600 -0.4% APAC stocks LOWER, 10YR TYield = 4.295%

Dollar HIGHER, Gold $2,032, WTI +1%, $79; Brent +1%, $84, Bitcoin $60,971

2) "Rising concern over labor market conditions and the US political environment drove a decline in consumer confidence in February. Consumers grew less optimistic about their present situation and their future expectations, although the index remains above its long-term average."

-Oxford Economics

* source: Oxford Economics

3) Durable goods orders dragged down by transportation

* source: Oxford Economics

4) THIS WEEK:

"focus will be on the US PCE inflation release, with other inflation reports also due in Europe and Japan. Otherwise, several economic activity indicators will be released for key economies, including PMI gauges in China.

Corporate earnings feature Berkshire Hathaway, Salesforce and Dell."

-Deutsche Bank

* source: Barclays' Emmanuel Cau

2) ESG, COMPILED BY NATHAN GREENE

Wall Street Synthetic Risk Transfer Trade Gets Green Makeover - BNN

-The European Investment Bank wants to enlist eight commercial banks in a program that will let them shed some of the risks from €11.5 billion euros ($12.5 billion) of loans. It’s offered to put up €800 million through mezzanine tranches referencing those assets, in order to free up loan capacity at the banks.

-The banks will then commit twice that amount, €1.6 billion, to green financing, according to Nicolas Mardam-Bey, a Luxembourg-based loan officer at the EIB

House Committee Seeks Details From Fed About Funds’ ESG Pledges - Yahoo

-In a letter sent Monday to Federal Reserve General Counsel Mark Van Der Weide, Comer said the managers’ pledges on environmental, social and governance issues may suggest climate groups “control” their decisions, making the managers subject to regulation under the Bank Holding Act, the Home Owners Loan Act and the Change in Bank Control Act.

3) MARKETS, MACRO, CORPORATE NEWS

- ECB awaiting data before starting to cut interest rates, De Guindos says-RTRS

- New Zealand softens threat of rate hike, sending currency lower-BBG

- World economy has growing chance of soft landing, G-20 says-BBG

- Australia's Jan inflation holds at two-year low, eyes on Feb release-RTRS

- Biden won the Michigan primary decisively-POL

- Top lawmakers mull funding patch ahead of Friday shutdown deadline-POL

- China’s Country Garden gets winding-up petition in Hong Kong-BBG

- Hong Kong scraps property curbs and raises taxes for highest earners-BBG

- China vows to break down barriers to aid economic recovery-SCMP

- China's food delivery market explodes to $208bn as workers scrape by-NIKKEI

- Europe must ramp up defenses to threats, Von Der Leyen warns-BBG

- Leaked Russian military files reveal criteria for nuclear strike-FT

- How Western boots on the ground in Ukraine could play out-TELE

- Hamas plays down talk that a cease-fire deal could come soon-NYT

- Lebanon's Hezbollah will halt fire if Hamas OKs Gaza truce, sources say-RTRS

- US launches antitrust investigation into UnitedHealth, WSJ reports-RTRS

- KKR considers selling stake in India’s $3 billion JB Pharma, sources say-BBG

- SocGen said to be in talks with BPCE over equipment finance unit—BBG

- Apple met with DOJ Antitrust Chief in last-ditch bid to avoid expected suit-BBG

- Glencore eyes Shell Singapore assets as CNOOC pulls out, sources say-RTRS

- Swisscom nears €8 billion deal for Vodafone’s Italian unit-BBG

- ADIA cashes out of Precinct Properties; Jarden on trade-AFR

- EU set to fine Apple in Spotify music streaming case, sources say-RTRS

- US renews inquiry into Applied Materials’ Chinese business-BBG

- EBay beats earnings estimates on strong U.S. holiday spending-RTRS

- Intel aims to deliver chips for 100 million AI PCs by 2025-NIKKEI

- Klarna in talks with banks for US IPO at $20 billion value-BBG

- Toyota gives no answer to union demands at second round of wage talks-RTRS

Oil/Energy Headlines: 1) China’s oil demand growth could halve from pre-Covid levels as property, auto sectors struggle-CNBC 2) New sanctions threaten Russian oil sales to India-RTRS 3) FUJAIRAH DATA: Oil product stocks rebound from four-month low-PLATTS 4) Oil market 'comfortable' at current prices, says Vitol CEO-RTRS 5) Trans Mountain pipeline sees second-quarter service date, higher cost-RTRS

About the author

Massud Ghaussy, CFA, is part of Nasdaq's IR Insights team and delivers daily insights that empowers readers to get a sense of the important issues impacting the day's trading.