A mostly graphical daily curated roundup of the markets and the economy from Nasdaq's IR team.

"Prices are important not because money is considered paramount but because prices are a fast and effective conveyor of information through a vast society in which fragmented knowledge must be coordinated." -Thomas Sowell, American Economist

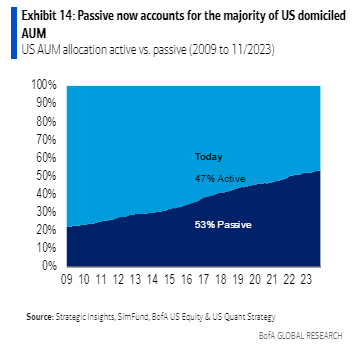

| Passive vs Active investing | Passive investing rules Wall Street now, topping actively managed assets in stock, bond and other funds -CNBC

* source: BofA

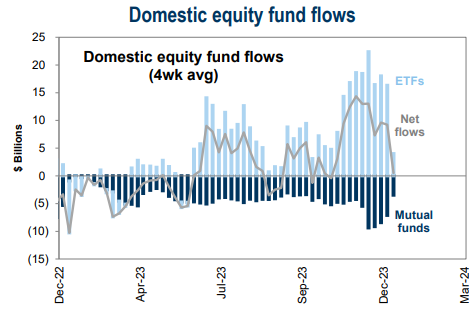

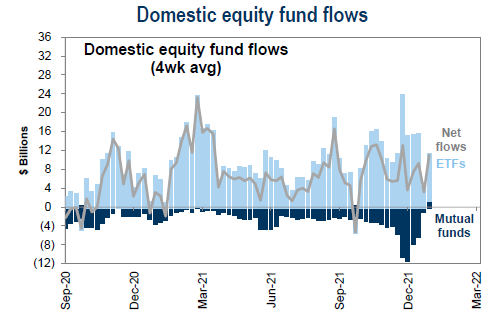

look at the almost uninterrupted flows into ETFs and out of mutual funds since Sept 2020!

* source: Goldman Sachs Global Investment Research

Jan Theme:

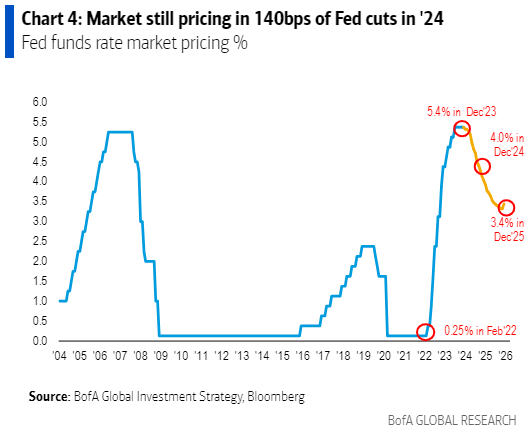

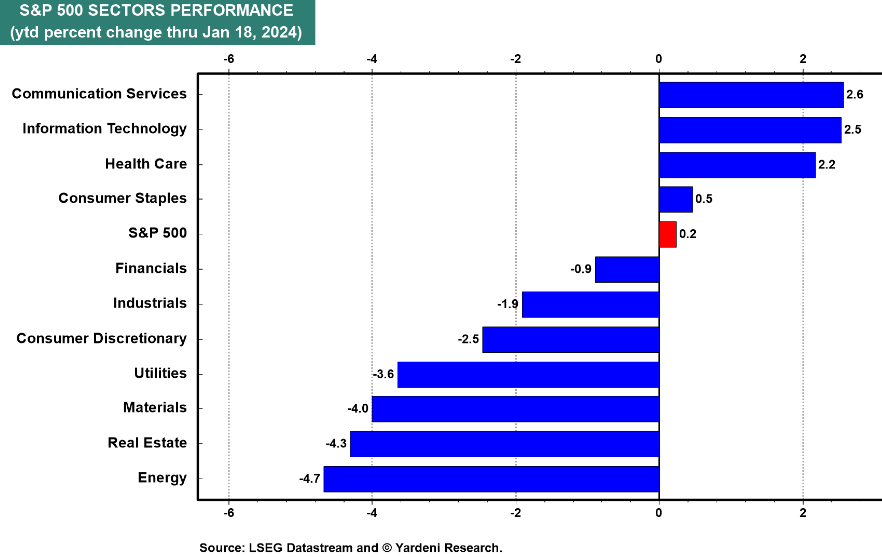

Fed's rate cut odds (the paring back of) continue to dominate markets

* source: BofA', Michael Hartnett, The Flow Show

| MegaCap outperformance is back...

Top Graphs = S&P 500 Market Weight divided by Equal Weight

* source: Yardeni Research

| Eyes on geopolitical tensions... | The Red Sea Conflict Is Scrambling Shipping. Europe Is Bearing the Brunt -WSJ

* source: Oxford Economics

| A Hot Debt Market Is Slashing Borrowing Costs for Riskier Companies - Companies with low credit ratings are rushing to reduce their borrowing costs even before the Federal Reserve makes a single interest-rate -WSJ

* source: Yardeni Research

1) KEY TAKEAWAYS

1) Equities MIXED / Gold + Oil + TYields HIGHER / Dollar LOWER

-last day of Fed speak before the blackout period

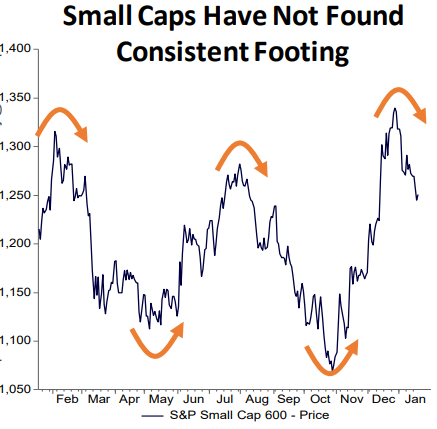

-Tech outperformance / Russell 2K (Small Cap) underperformance

DJ +0.2% S&P500 +0.1% Nasdaq +0.5% R2K -0.6% Cdn TSX -0.2%

Stoxx Europe 600 -0.2% APAC stocks MIXED, 10YR TYield = 4.176%

Dollar LOWER, Gold $2,026, WTI +1%, $75; Brent +1%, $80, Bitcoin $40,854

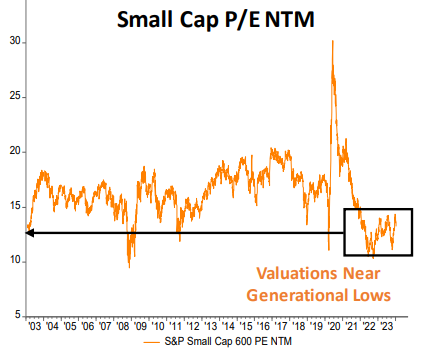

2) More tidbits in Small Caps...

Small Caps Continued To Underperform In 2023 Despite Being “Cheap"

Investors Sought Out Quality (Not Value or Cheap) In 2023

* source: Piper Sandler

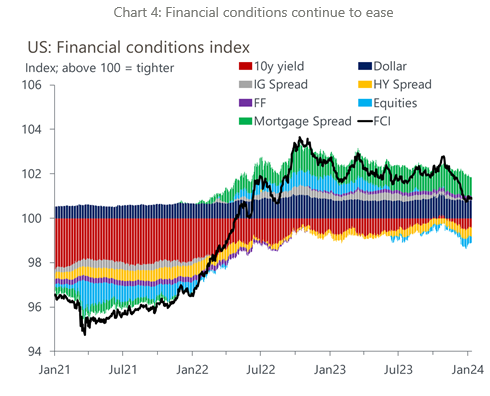

4) Financial conditions have been easing...

* source: Oxford Economics

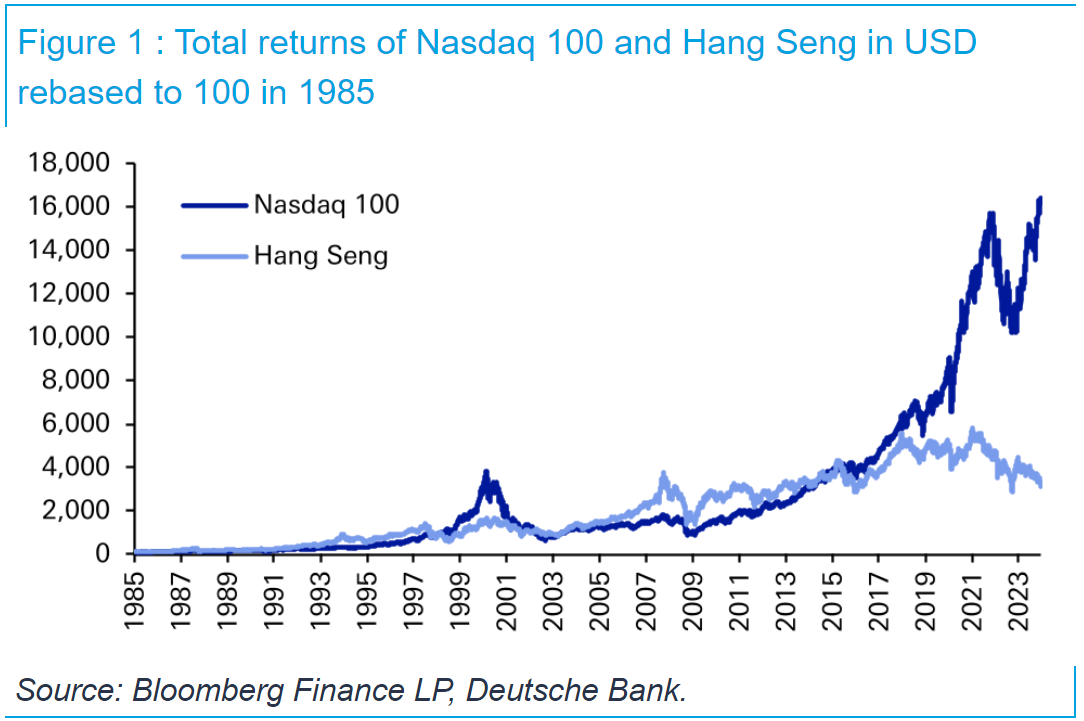

5) Nikkei at 34-year high China at 2008 GFC lows

* source: BofA, Michael Hartnett, The Flow Show

"the two have diverged since the GFC. The former has been treading water whilst the latter has gone to the stratosphere." -Jim Reid, Deutsche Bank

* source: Deutsche Bank

6) "Indices & sectors don’t always reflect the stocks within"

* source: Piper Sandler

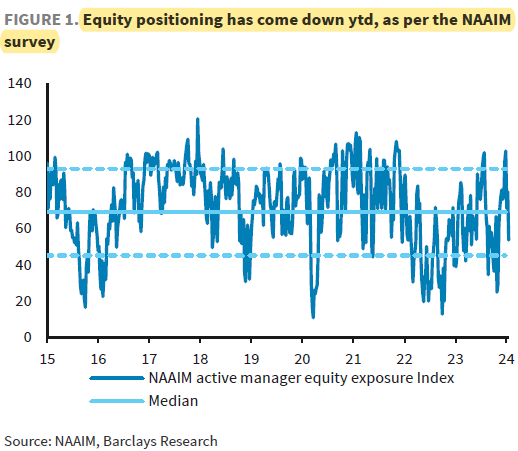

7) "YTD markets have quickly reversed some of the goldilocks exuberance, but fundamentals haven't changed much. Although geopolitics don't tend to have lasting impact on markets, they could affect investor sentiment more this year. The US Presidential election is already taking centre stage." -Emmanuel Cau, Barclays

source: Barclays' Emmanuel Cau

8) NEXT WEEK:

"Growth indicators will be in focus with key releases including the preliminary Q4 GDP reading in the US and the global flash PMIs.

On the inflation front, there will be prints for US PCE and Tokyo CPI.

In US politics, the spotlight will be on the New Hampshire primary on Tuesday.

From central banks, there will be decisions from the BoJ, the ECB and the BoC, with the ECB's bank lending survey also due." -Deutsche Bank

* source: Barclays' Emmanuel Cau

2) ESG, COMPILED BY NATHAN GREENE

IMF chief urges countries to shift fossil fuel subsidies to fight climate change - Reuters

-Georgieva told the World Economic Forum in Davos, Switzerland that the total fossil fuel subsidies include $1.3 trillion in direct government subsidies as well as indirect subsidies that include failure to price carbon emissions, adding that this price needs to be set at $85 per ton by 2030.

‘Toxic’ Attacks on ESG Lead Wall Street to Mount a New Defense - BNN

-This month, the Paris Aligned Asset Owners became the latest green coalition to change the language on its website to clarify that signatories make “individual” commitments in line with their “fiduciary obligations.” Other net zero groups have made similar adjustments to show that members aren’t coordinating CO2 reductions, and that the ultimate goal is to protect asset values.

3) MARKETS, MACRO, CORPORATE NEWS

- Fed’s Bostic urges caution on rate cuts amid global uncertainty-BBG

- US prepares rule forcing banks to tap Fed discount window-BBG

- ECB to pick right moment for first rate cut, economists say-BBG

- India central bank not discussing rate cuts yet, Das says-BBG

- US mortgage rates fall to lowest level since May-BBG

- Red Sea crisis pressures China's exporters shipping delays, costs mount-RTRS

- Japan's core inflation slows for 2nd month, takes pressure off BOJ-RTRS

- British retail sales fell more than expected in run-up to Christmas-FT

- UK chancellor signals he wants more tax cuts before election-FT

- TSMC outlook drives $165 billion chip rally in 2024 rebound bet-BBG

- Private lenders are opting to go public after valuations jump-BBG

- US Congress passes bill to avert government shutdown, sends it to Biden-RTRS

- China’s biggest broker curbs short sales after stock rout-BBG

- China's mutual funds implode at fastest pace in five years as stocks sink-BBG

- China orders indebted local governments halt some infra projects-RTRS

- China's ageing population threatens switch new economic growth model-RTRS

- US presses ahead with ‘least bad’ option in confronting Houthis-BBG

- Netanyahu rebuffs U.S. calls start working toward Palestinian statehood-NYT

- NATO to hold biggest drills since Cold War with 90,000 troops-RTRS

- US, China urges calm as Pakistan, Iran look to ease tensions-BBG

- Macy’s is cutting about 3.5% of workforce and closing five stores-BBG

- Michael Burke named LVMH Fashion Group chairman and CEO-RTRS

- Failed JetBlue buyout leaves Spirit Airlines with a tough path forward-CNBC

- Amazon’s latest layoffs hit its Buy with Prime unit-CNBC

- Investment banks beat out private credit in CVC’S latest buyout deals-BBG

- JG Summit to expand solar business beyond Gokongwei group-MB

- Giant tandem eyes MRT-3 takeover-DT

- Apple plans iPhone camera button as creators shift to horizontal videos-INF

- Champion sale process enters final phase: source-WWD

- Mark Zuckerberg indicates Meta spending bln dollars on Nvidia AI chips-CNBC

- YouTube and Spotify won’t launch Apple Vision pro apps, joining Netflix-BBG

- iRobot shares tank 30% on report EU plans to block Amazon acquisition-CNBC

- Tata Steel confirms Port Talbot steel closures, putting 3,000 jobs at risk-TIMES

- Zee-Sony Merger: Fate on creation $10bn media giant likely decided today-ET

- Deutsche Bank CEO:acquisitions not ‘priority’ Commerzbank rumors swirl-CNBC

Oil/Energy Headlines: 1) Oil falls as China's economic recovery disappoints and dollar strengthens-ECON 2) Cheap Russian oil cuts OPEC's share of India imports to record-low 50%-RTRS 3) Red Sea dangers delay Saudi and Iraqi oil export as ships divert-BBG 4) IEA signals ‘substantial surplus’ of oil this year as demand growth slows-FT 5) US oil, gas rig count falls 11 to 663 on week, lowest level since mid-November 2021-PLATTS 6) Pakistan's fuel oil exports hit all-time high in Dec as domestic utility demand falls-PLATTS 7) Three Norwegian oil and gas field permits invalidated on environmental grounds-RTRS

About the author

Massud Ghaussy, CFA, is part of Nasdaq's IR Insights team and delivers daily insights that empowers readers to get a sense of the important issues impacting the day's trading.