Owens Corning OC has been focusing on its Composites business to offer higher-value material solutions. In line with this strategic decision, the company has recently partnered with Pultron Composites for the manufacture of industry-leading fiberglass rebar. This accord expands Owens Corning’s market opportunities, providing additional capacity and service in the market.

Pultron Composites has been developing a leading fiberglass rebar production process for more than 20 years. This joint venture (JV) will provide more sustainable product solutions and higher-performance concrete reinforcement products. This JV will also enhance market access to PINKBAR+ Fiberglas Rebar (used for flatwork and residential applications) and MATEENBAR Fiberglas Rebar (used for heavy-load structural applications).

Pertaining to the partnership, Owens Corning Composites president, Marcio Sandri, said, “Joining forces with Pultron Composites combines our core glass-fiber material technology, expansive channel access, and extensive industry experience with Pultron’s manufacturing expertise and process efficiency."

This partnership now has bigger access to the $9-billion rebar market, including expansion in the United States. Notably, the rebar market is expanding at an annual rate of about 4%. Currently, fiberglass rebar constitutes less than 1% of this market and has the potential to grow over the coming years.

Owens’ Focus on Composites Business

The Composites business segment has been generating higher volumes backed by its efforts on higher-value applications for glass non-wovens and specific markets like India. It is expanding and adding a new production line to its current facility in Fort Smith, AR. The company has a two-fold focus. First, it is focused on key markets and geographies where it has a market-leading position like North America, Europe and India.

Second, the company is focused on making composite business the most cost-effective network, mainly focusing on productivity and manufacturing performance. Notably, the company focuses on improving its low-cost manufacturing position through strategic supply agreements, accomplished large-scale furnace investments and additional productivity.

Also, Owens Corning continues to invest in accelerating new product and process innovation to support customers and generate additional growth. During first-quarter 2022, the company launched 16 new or refreshed products across global businesses. These products span across core product platforms, including roofing shingles and components, insulation XPS foam and mineral wool, and wind, non-woven, and other composite materials.

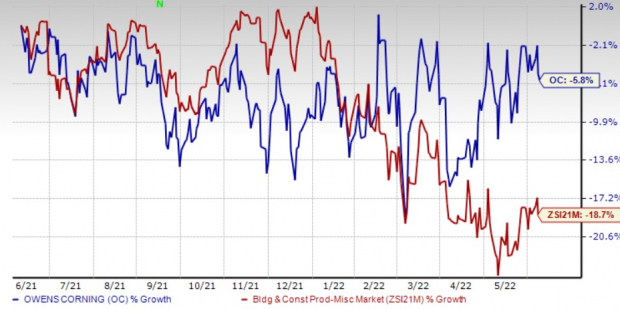

Image Source: Zacks Investment Research

Given the above-mentioned tailwinds, shares of this Zacks Rank #3 (Hold) company have strongly outperformed the industry in the past year. The company is benefiting from market-leading businesses, innovative products and process technologies, and capabilities.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

3 Top-Ranked Construction Stocks to Buy

Some top-ranked stocks, which warrant a look in the Construction sector, are NVR, Inc. NVR, Patrick Industries PATK and Beazer Homes USA BZH.

NVR, also carrying a Zacks Rank #1, is engaged in the construction and sale of single-family detached homes, townhomes and condominium buildings, all of which are primarily constructed on a pre-sold basis. In order to serve homebuilding customers, NVR operates a mortgage banking and title services business.

NVR’s expected earnings growth rate for the current year is 68.4%. The Zacks Consensus Estimate for current-year earnings has improved 20.4% over the past 60 days.

Patrick Industries — carrying a Zacks Rank #2 (Buy) — is a leading component solutions provider for the RV, marine, and manufactured housing industries. Patrick Industries, like many others in the broader RV and consumer marine space, is seeing a massive run of revenue growth that began about a decade ago.

Patrick Industries’ expected earnings growth rate for 2022 is 33.1%. The Zacks Consensus Estimate for current-year earnings has improved 16.6% over the past 60 days.

Beazer Homes, carrying a Zacks Rank #2, designs, builds and sells single-family homes. BZH designs homes that appeal primarily to entry-level and first move-up homebuyers. Beazer Homes USA’s objective is to provide customers with homes that have quality and value. BZH’s subsidiary, Beazer Mortgage, originates the mortgages for the company's homebuyers.

Beazer Homes’ expected earnings growth rate for fiscal 2022 is 48.9%. The Zacks Consensus Estimate for current-year earnings has improved 14.6% over the past 60 days.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Beazer Homes USA, Inc. (BZH): Free Stock Analysis Report

NVR, Inc. (NVR): Free Stock Analysis Report

Owens Corning Inc (OC): Free Stock Analysis Report

Patrick Industries, Inc. (PATK): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.