October 2021 Review and Outlook

Executive Summary

- Stocks hit new all-time highs as earnings season kicked into high gear.

- The yield curve flattened as investors questioned whether the U.S. can handle higher rates.

- Headlines out of Washington boosted risk sentiment as Democrats appear to be close to a compromise on a social spending package.

- CPI figures came in hotter than expected, while PPI data came in lighter, potentially pointing to easing of pricing pressures ahead.

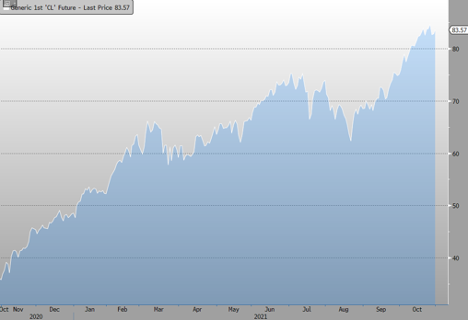

After cooling off in September, stocks surged to new highs in October as the S&P 500 recorded its best month of the year. Stocks were buoyed by earnings and increased risk appetite as congressional leaders pushed towards a robust spending package. As stocks climbed, so did oil prices as West Texas Intermediate jumped over 10%, registering a seven-year high price of $85 during the month as consumption outpaced supply, draining stockpiles. Oil has been a leader in the commodities space as the recovery from the pandemic continues to drive increased energy usage.

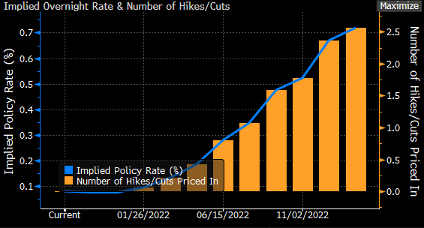

Despite the positive start to earnings season, economic data provided a bit of a muddy picture as consumer prices continued to climb, while the Personal Consumption Expenditures figures showed prices rising less quickly than they were over the summer. If prices continue to rise, the Fed could begin to cut back on its monetary support for the economy and raise rates which tends to hurt stocks. With that said, the U.S. economy grew at just 0.5% in the third quarter, the weakest growth since the pandemic recovery began. The Fed has signaled that it does not plan on raising rates any time soon but is widely expected to start winding down bond purchases.

On a total return basis, large-cap growth stocks stepped on the throttle in October, as the Russell 1000 Growth index surged 8.4%, while Value stocks climbed 5.1%, and small and microcaps climbed 4.2% and 2.2%, respectively.

As expected, given the broader index returns, all 11 sectors finished higher in October, led by Consumer Discretionary and Energy stocks which each finished up over 10%. Despite varying reasons, Technology, REITS, Basic Materials, Financials, and Industrials all climbed between 7-8% to start the final quarter of 2021. Healthcare, Utilities, and Staples rose between 4-5%, while Communications companies brought up the rear, edging up 2.5%.

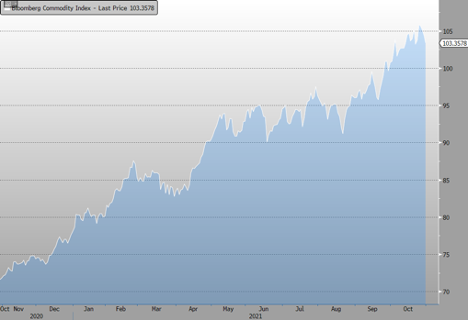

Commodities:

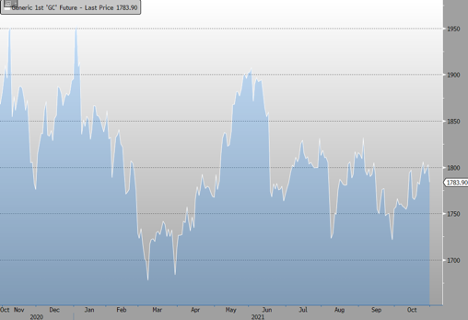

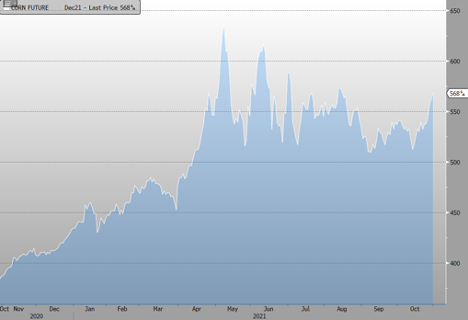

The Bloomberg Commodity (BCOM) index also notched new highs to start the new quarter, finishing up 2.6%. After spiking to start the month, Natural Gas futures cooled to close the period, finishing lower by 9.0%, while Gold edged higher by 1.6%. The largest and most impactful gains were seen in the oil market as Brent Crude futures finished up 8.0%, and WTI futures closed higher by 10.2%. Corn futures also climbed during the month by 5.9%.

Natural Gas:

Gold:

Oil:

Corn:

CPI Inflation – YoY:

CPI Inflation – MoM:

Earnings:

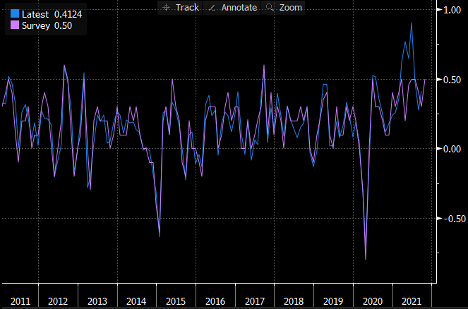

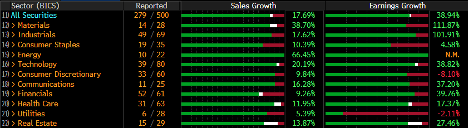

As we pass the halfway point of the second-quarter earnings season with just over 55% of S&P 500 companies reporting, we have so far seen positive earnings surprises in 82%, with an average beat of ~9.7%. These figures top the five-year average of 76% and 8.4%, respectively. The numbers are equally as impressive when looking at earnings growth, as just under 82% reported positive earnings growth with an average rate of 38.9%. Although bottom-line figures are currently beating the historical averages on both counts, revenue figures are more muted as 67% of companies have reported positive sales surprises with an average beat of ~2%. The 67% is in line with the 5-year average, while the 2% beat is above the 1.4% average.

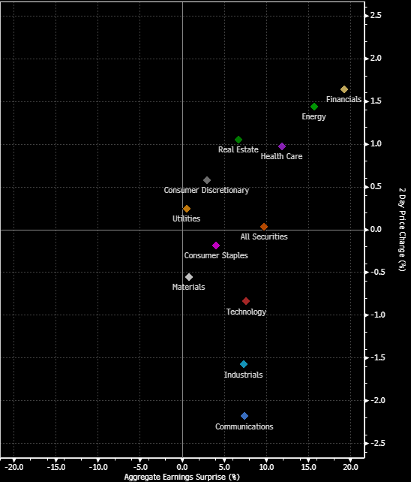

Financials led the way in terms of earnings surprises as large banks saw a boost from reserve releases, investment banking results, including strong equity and fixed income trading, solid loan growth, and better operating leverage. The Energy sector also saw strong earnings results, with an average beat of just under 16%, followed by Healthcare with 12%. Materials and Industrials were the driving force behind the reported earnings growth figures as they printed 112% and 102% EPS growth, respectively, while Consumer Discretionary and Utilities were the laggards, dropping 8% and 2%, respectively.

The forward 12-month PE for the S&P 500 is 21.1, which is above the five and 10-year averages.

In terms of price action following earnings prints, Energy stocks saw the biggest 2-day move, climbing on average of 1.4%, followed by Financials at 1.3%, Real Estate at 1.2%, and Healthcare at 1.0%. Consumer Staples (-0.7%), Industrials (-0.7%), Basic Materials (-1.0%), and Communications (-2.2%) stocks all saw 2-day declines following earnings prints despite the positive earnings surprises.

Rates:

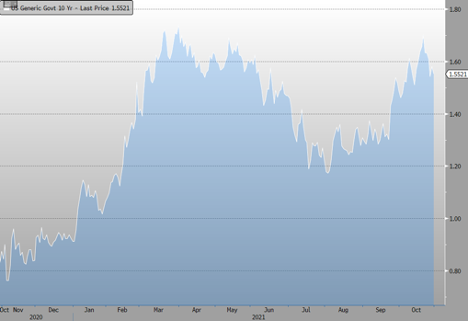

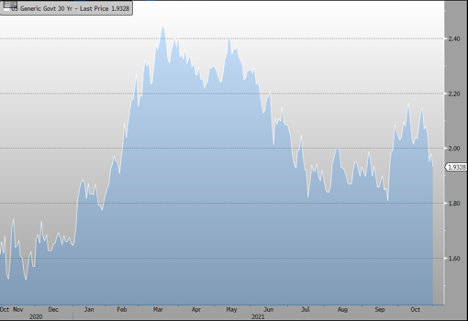

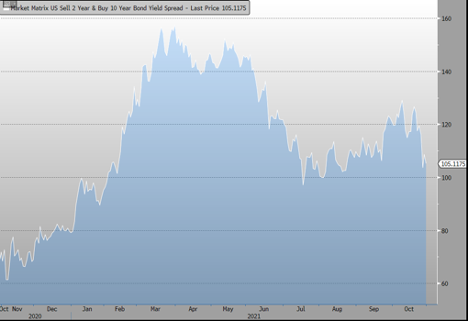

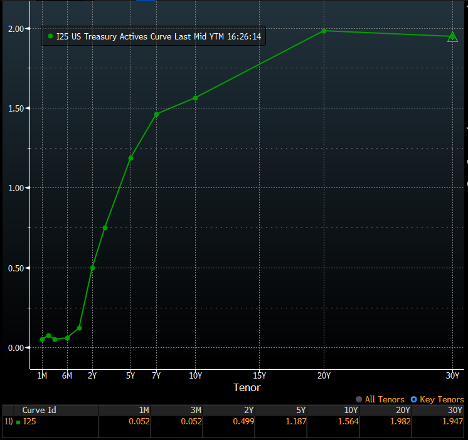

The yield curve flattened in October, as 2YR Treasury yields spiked higher, closing at just under 0.55%, up from 0.28% in September. 10YR yields also climbed but at a more moderate pace, ending at 1.55%, up from 1.49% in September. Alternatively, 30YR yields fell to start the fourth quarter, finishing at 1.93%, down from 2.04% at the end of September. Although there is still over 1% of room between the 2YR and 10YR yields, an inversion of that spread is usually followed by a recession. According to Krishna Guha, a former Fed staffer and now Vice-chairman of Evercore ISI, “The start of tapering increases the risk of yield spikes and changes the balance of optionality between policymakers and risk-takers in ways that may weigh on equity volatility and risk premia, even as ultra-low longer-term yields continue, for now at least, to provide support for risk.”

US 2YR Yield:

US 10YR Yields:

US 30YR Yields:

2YR10YR Spread:

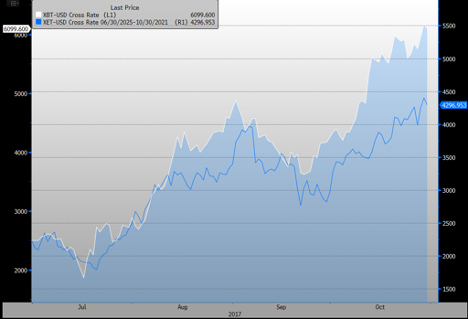

Crypto:

After trading mostly lower during September, Bitcoin surged to new highs in October, hitting just below $66,000 before settling in around $61,000 as the first Bitcoin ETF came to the market. Ethereum also saw new highs in October, hitting a high of just over $4,400 after an upgrade to the network’s system proved to be successful.

The Ethereum 2.0 Altair Beacon Chain update had a successful start, with 98.7 nodes upgraded at the time of this writing. This upgrade is crucial to Ethereum as the network switches from Proof of Work protocol (mining) to a Proof of Stake protocol (ownership) which is substantially less energy-intensive. It is interesting to note that the recent price action in Ethereum since the summer is tracking very similar to Bitcoin’s run higher during the same time period in 2017.

Looking Ahead:

With stocks already at record highs, it is likely that we will see new highs in November if history repeats itself. Since 1950, and over the past 10 years, November has been the best month for market returns. With the remainder of corporate earnings and the upcoming holiday shopping season, stocks should have tailwinds to boost prices into year-end. It will be worth watching whether the pent-up demand can be satisfied given continued supply chain constraints, rising prices at the register, and Fed bond-buying tapering.

The information contained herein is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. All information contained herein is obtained by Nasdaq from sources believed by Nasdaq to be accurate and reliable. However, all information is provided “as is” without warranty of any kind. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.