A mostly graphical daily curated roundup of the markets and the economy from Nasdaq's IR team.

#marketseverywhere | Amazon.com Inc. (AMZN) will REPLACE Walgreens Boots Alliance Inc. (WBA) in the Dow Jones Industrial Average as of close of February 25.

| NVDA earnings this afternoon

| concerns around commercial real estate | Bad property debt exceeds reserves at largest US banks -FT

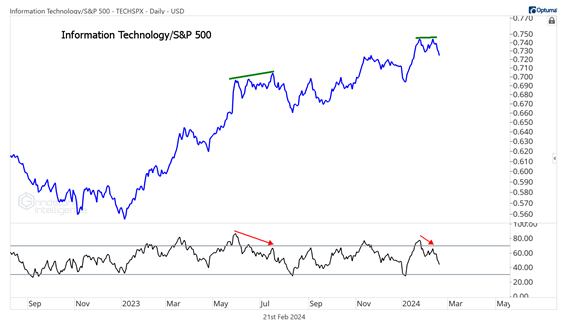

| S&P 500 graph below - markets hovering near at all time- highs but on narrow breadth and some weakness recently

* source: John Stoltzfus, Oppenheimer Asset Management

Is the bull market on hold as rate cut odds getting pared back but prospects of the economy are better than expected?

* source: Grindstone Intelligence

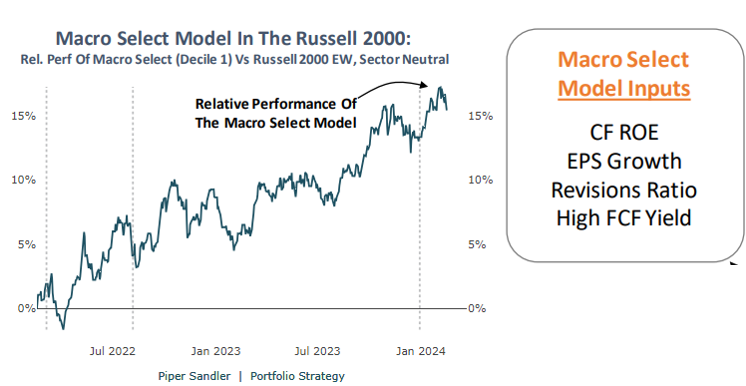

#QualityMatters | market breadth is poor but plenty of small cap stocks that have made gains

"It hasn’t been that investors are specifically seeking larger stocks, but rather that investors have been reaching for quality (i.e. profitability) and larger caps tend to have more of it! That being said, there are high quality stocks to be found within the small cap universe." -Piper Sandler

* source: Piper Sandler, Michael Kantrowitz

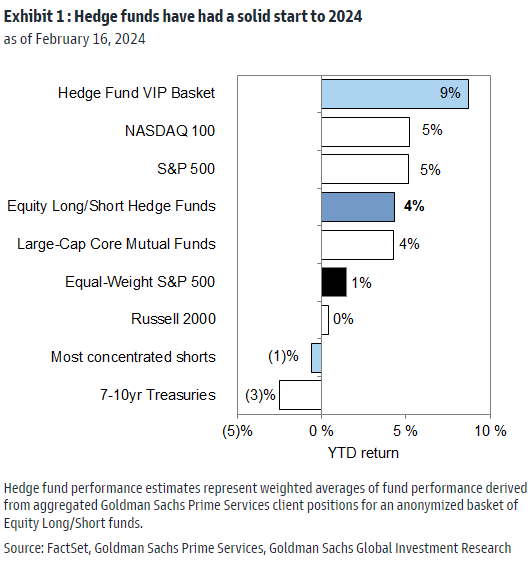

Hedge Funds have been performing well in 2024

"Hedge funds benefit from momentum in magnificent mega-caps while searching for other opportunities"

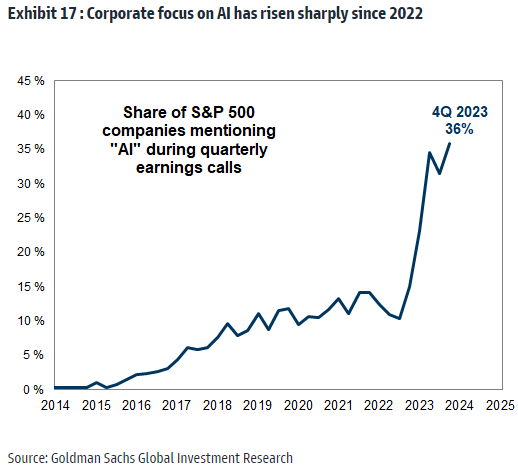

AI the new trend...

* source: Goldman Sachs Global Investment Research

as far as risk appetite goes, we don’t see investors running for safety. High yield bonds relative to US Treasurys are right near their highs

* source: Grindstone Intelligence

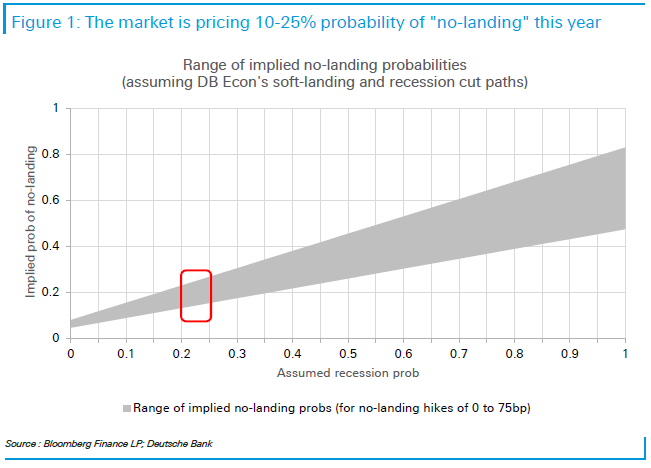

the good news is that the economy is doing better than expected...

* source: Deutsche Bank

1) KEY TAKEAWAYS

1) Equities + Dollar + TYields + Oil LOWER / Gold HIGHER

-FOMC minutes this week / NVDA earnings today

-Fedspeak today

DJ -0.3% S&P500 -0.2% Nasdaq -0.6% R2K -0.5% Cdn TSX -0.2%

Stoxx Europe 600 -0.2% APAC stocks HIGHER, 10YR TYield = 4.266%

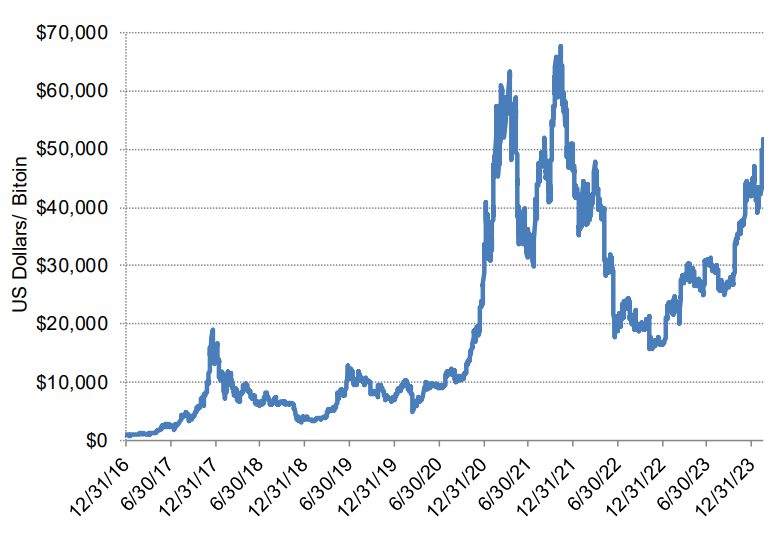

Dollar LOWER, Gold $2,028, WTI -0%, $77; Brent -0%, $82, Bitcoin $50,986

2) Food for thought...

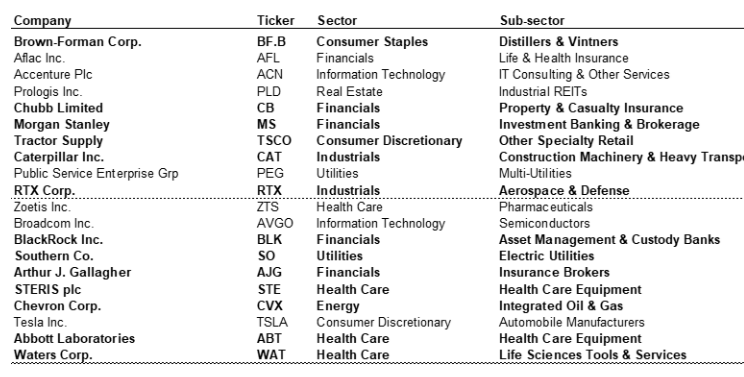

Goldman: 20 S&P 500 stocks with the MOST concentrated hedge fund ownership

Goldman: 20 S&P 500 stocks with the LEAST concentrated hedge fund ownership

* source: Goldman Sachs Global Investment Research

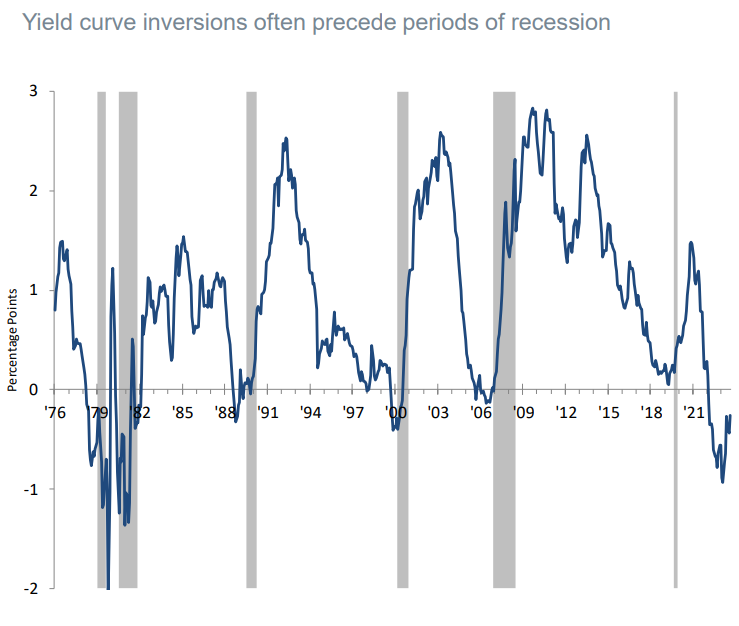

3) yield curve (10YR yield minus 2YR yield) is getting less inverted = economic growth prospects improving...

* source: John Stoltzfus, Oppenheimer Asset Management

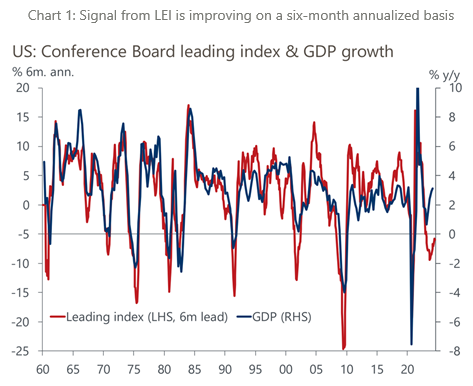

Leading Economic Indicators ..."Despite the continued declines in the leading economic index, the slowing pace of declines on balance rather than the level of the index gives a better indication of recessionary risks. "

* source: Oxford Economics

4) Gold: "Inflation and geopolitical concerns have buoyed the metal’s price in recent month"

"digital gold" (bitcoin) has been rallying

* source: John Stoltzfus, Oppenheimer Asset Management

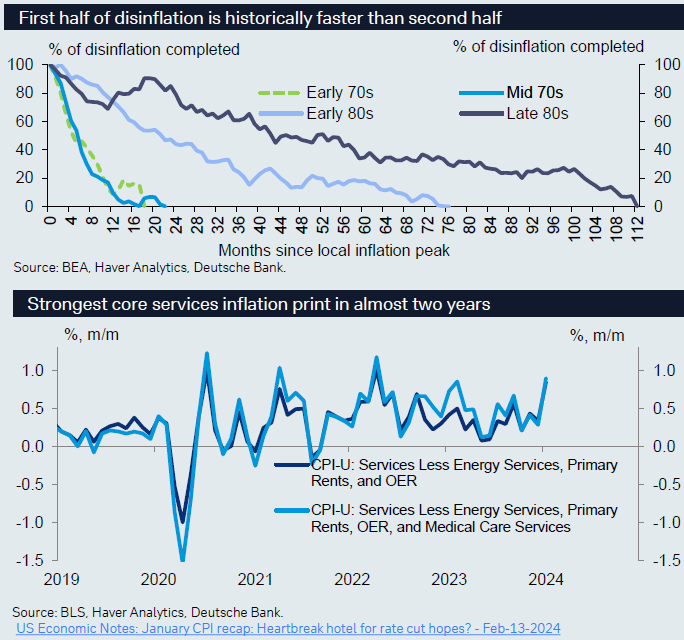

6) The last mile with inflation usually proves to be the most stubborn...

* source: Deutsche Bank

7) THIS WEEK:

Fed FOMC meeting minutes (21 Feb); US existing home sales for Jan (22 Feb) - BBG Cons (3.97m); Preliminary PMI's (22 Feb); China central bank policy decision (18-20 Feb); China new home prices for Jan (23 Feb).

* source: Barclays' Emmanuel Cau

2) ESG, COMPILED BY NATHAN GREENE

China Proposes New ESG Rules to Keep Up With Europe - BNN

-More than 400 companies, including those in key stock indexes, will need to publish sustainability reports by 2026, according to draft guidelines released this month by China’s three main exchanges.

-The corporations, which together account for more than half of the bourses’ combined market value, have to disclose their ESG governance and strategy, along with metrics including their energy transition plans and impact on the environment and society.

Record US renewable energy investment not enough to meet climate goals -report - Reuters

-Large clean energy installations for utilities are being stymied by permitting and grid interconnection delays and challenges sourcing equipment, the report said, while sales of electric vehicles are meeting researchers' forecasts.

3) MARKETS, MACRO, CORPORATE NEWS

- Fed likely to keep shrinking balance sheet while liquidity drain persists-BBG

- Price stability built to last-FRBSF

- Markets start to speculate if the next fed move is up, not down-BBG

- Fed to cut US rates in June, risks skewed towards later move-RTRS

- Bank of England to start cutting rates in Q3, most likely August-RTRS

- Bank of Korea poised to hold interest rate as board undergoes changes-BBG

- Japan manufacturers' gloom rises, adds to growth pains - Reuters Tankan-RTRS

- Germany's economic advisers to cut 2024 growth forecast-RTRS

- (LEAD) Exports fall 7.8 pct from Feb. 1-20; chip sales jump nearly 40 pct-YNA

- Quant hedge funds face China clampdown after rare account freeze-BBG

- China rate cut shows lack of options for boosting economy-NIKKEI

- EU approves more Russia sanctions following Navalny’s death-BBG

- Ukraine outnumbered, outgunned, ground down by relentless Russia-RTRS

- Putin rejects US claim that Russia plans nuclear weapon in space-BBG

- Trump likely to raise tariffs on China in two steps, former official says-NIKKEI

- China circumvents US tariffs bBy shipping more goods via Mexico-FT

- Flipkart weighed acquiring Reliance-backed instant delivery startup Dunzo-TC

- Retailers report 5% Y-o-Y growth in January-ECON

- Disney taps Sony to run DVD business as disc watching wanes-BBG

- Apple rivals lobby EU over App Store dominance-FT

- Poland's LOT ordered 11 Boeing 737 MAX 8 aircraft, says PAP-RTRS

- Danone plans to sell Russian operations to Chechnya-linked businessman-FT

- Metro Pacific eyes buyout of Ayala stake in LRT 1-MLY

- Saint Gobain considers buying Australian rival CSR, sources say-BNN

- Nvidia options signal nearly $200 billion swing after earnings-BBG

- Goldman’s trading desk calls Nvidia ‘most important stock’ on earth-BBG

- Hedge funds cut magnificent seven in last quarter, Goldman says-BBG

- Thoma Bravo is exploring possible $8 billion sale of J.D. Power-BBG

- FTC, states to sue over Kroger-Albertsons deal next week-BBG

- Occidental explores $20 bln-plus sale of Western Midstream, sources say-RTRS

Oil/Energy Headlines: 1) Trans Mountain expansion may not give long-term price relief to Canada's booming oil output-RTRS 2) Iran says Israel is responsible for 'plot' against gas pipelines – Tasnim-RTRS 3) Tighter spot crude supply widens Dubai prompt backwardation to multimonth highs-PLATTS 4) FUJAIRAH DATA: Oil product stockpiles drop to four-month low as demand rises-PLATTS

About the author

Massud Ghaussy, CFA, is part of Nasdaq's IR Insights team and delivers daily insights that empowers readers to get a sense of the important issues impacting the day's trading.