Novo Nordisk A/SNVO reported fourth-quarter 2022 earnings of 83 cents per American Depositary Receipt, which beat the Zacks Consensus Estimate of 81 cents. The company reported earnings of 73 cents in the year-ago quarter.

Revenues of $6.61 billion missed the Zacks Consensus Estimate of $6.74 billion year over year and sales were driven by higher Diabetes and Obesity care sales as GLP-1 sales increased.

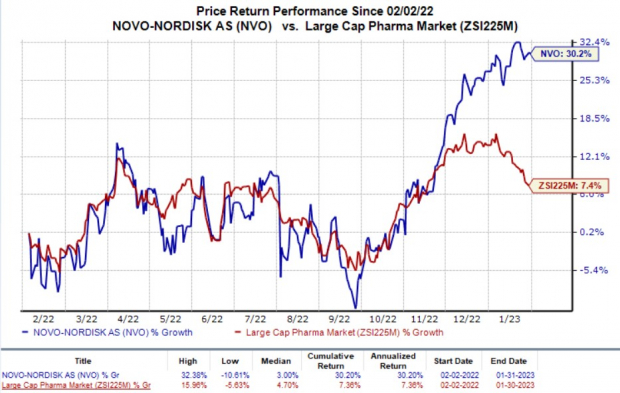

In the past year, shares of NVO have increased 30.2% against the industry’s rise of 7.4%.

Image Source: Zacks Investment Research

All growth rates mentioned below are on a year-over-year basis.

Quarter in Detail

Novo Nordisk operates under two segments: Diabetes and Obesity Care and the Rare disease segment.

The Diabetes and Obesity Care segment’s sales sales reported DKK 43 billion, which is a growth of 20% at CER. In Diabetes Care, fast-acting insulin, Fiasp’s revenues were down 2% at CER. NovoRapid revenues were down 5% at CER. Human insulin revenues were also down 10% at CER. Premix insulin (Ryzodeg and NovoMix) revenues declined 12% at CER. Also, sales of long-acting insulins (Tresiba, Xultophy and Levemir) decreased by 20% at CER.

Ozempic which has witnessed a strong launch and a solid uptake so far, recorded sales of DKK 16.98 billion for the quarter, up 45% at CER. Rybelsus too witnessed a strong uptake and recorded sales of DKK 4.05 billion for the quarter, up 105% at CER.

Obesity Care (Saxenda and Wegovy) sales were up 105% at CER year over year.

Per the company, all Wegovy dose strengths were again made available in the United States in December 2022.

Sales in the Rare disease segment were down 2% at CER year over year to DKK 4,853 million. Sales of rare blood disorder products were DKK 2,881 million, up 9% at CER. Sales of hemophilia A products increased by 6% at CER. Hemophilia B products’ sales were also up 38% at CER. Sales of NovoSeven were up 5% at CER to DKK 1,911 million.

Sales and distribution costs climbed 18% in DKK and increased 11% at CER year over year. This increase was due to International Operations and North America Operations owing to promotional activities related to Ozempic and Rybelsus as well as Obesity care market development activities. The cost increase also shows the phasing of spending in 2021 because of COVID-19 and higher distribution costs.

Research and development costs were up 44% in DKK and increased 37% at CER from the year-ago quarter figures. Higher costs were driven by clinical activity for late-stage studies.

Administrative costs increased 13% in DKK and were up 8% at CER from the year-ago quarter figures.

2022 Results

Sales for the year were DKK 177 billion, representing growth of 26% in DKK and 16% at CER over 2021 figures.

2023 Outlook

Novo Nordisk expects both sales and operating profit to grow in the range of 13-19% at CER in 2023. The guidance indicates steady sales growth in North America and International Operations, primarily driven by Diabetes and Obesity care. The guidance also reflects the sales growth of Wegovy in the United States upon meeting the demand in 2023. This apart, the outlook implies intensifying competition in both Diabetes care and Rare disease units.

Persistent pricing pressure within Diabetes Care, especially in the United States, might also negatively impact sales.

Our Take

Novo Nordisk's earnings beat estimates in the fourth quarter, while the revenues missed on the same. Ozempic is off to a solid start and the launch of Rybelsus looks encouraging. Both drugs continue to drive growth, witnessing a solid uptake. Saxenda, too, has witnessed strong uptake so far. The marketing authorization application approval by the European Medicines Agency for Wegovy in January 2023 is likely to boost sales.

Zacks Rank & Stocks to Consider

Novo Nordisk currently carries a Zacks Rank #2 (Buy).

Some better-ranked companies in the medical industry are LianBio LLC LIAN and Cabaletta Bio, Inc. CABA, currently sporting a Zacks Rank #1 (Strong Buy) and Sanofi SNY currently carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 90 days, the estimate for LianBio’s 2022 loss per share has narrowed from $1.65 to $1.23. During the same period, the loss estimate per share for 2023 has narrowed from $1.68 to $1.30. In the past year, the shares of LianBio have decreased by 33.8%.

LIAN’s earnings witnessed an average earnings surprise of 7.06%, beating three out of four estimates in the trailing four reported quarters.

In the past 90 days, the estimate for Cabaletta’s 2022 loss per share has narrowed from $1.89 to $1.76. During the same period, the loss estimate per share for 2023 has narrowed from $2.00 to $1.77. In the past year, the shares of Cabaletta have shot up by 323.2%.

CABA’s earnings witnessed an average earnings surprise of 22.88%, beating all four estimates in the trailing four reported quarters.

In the past 90 days, the estimate for Sanofi’s 2022 earnings per share has increased from $4.04 to $4.32. During the same period, the earnings estimate per share for 2023 has increased from $4.24 to $4.41. In the past year, the shares of Sanofi have decreased by 6.5%.

SNY’s earnings witnessed an average earnings surprise of 9.50%, beating all four estimates in the trailing four reported quarters.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>Sanofi (SNY) : Free Stock Analysis Report

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

Cabaletta Bio, Inc. (CABA) : Free Stock Analysis Report

LianBio Sponsored ADR (LIAN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.