Whales with a lot of money to spend have taken a noticeably bullish stance on Northrop Grumman.

Looking at options history for Northrop Grumman (NYSE:NOC) we detected 8 trades.

If we consider the specifics of each trade, it is accurate to state that 37% of the investors opened trades with bullish expectations and 37% with bearish.

From the overall spotted trades, 3 are puts, for a total amount of $158,315 and 5, calls, for a total amount of $259,181.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $470.0 and $540.0 for Northrop Grumman, spanning the last three months.

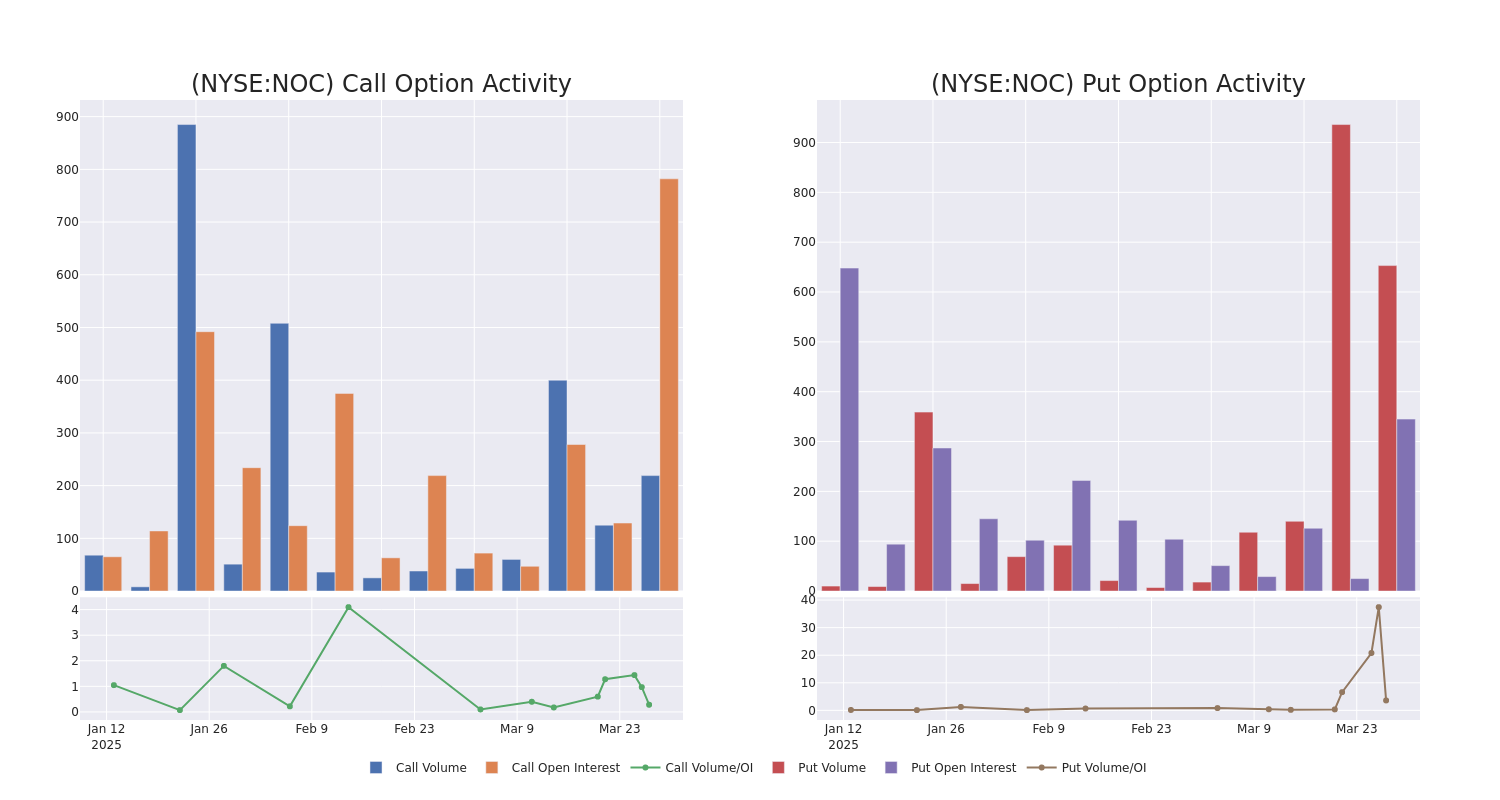

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Northrop Grumman's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Northrop Grumman's substantial trades, within a strike price spectrum from $470.0 to $540.0 over the preceding 30 days.

Northrop Grumman Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NOC | CALL | TRADE | BULLISH | 04/17/25 | $12.7 | $9.4 | $11.8 | $520.00 | $116.8K | 653 | 114 |

| NOC | PUT | SWEEP | BEARISH | 04/17/25 | $8.4 | $8.2 | $8.41 | $505.00 | $74.6K | 282 | 407 |

| NOC | PUT | TRADE | BEARISH | 04/17/25 | $5.6 | $5.0 | $5.4 | $495.00 | $53.4K | 63 | 104 |

| NOC | CALL | SWEEP | BULLISH | 09/19/25 | $26.6 | $25.9 | $26.6 | $540.00 | $47.8K | 30 | 62 |

| NOC | CALL | TRADE | NEUTRAL | 09/19/25 | $67.9 | $63.4 | $65.6 | $470.00 | $32.8K | 10 | 5 |

About Northrop Grumman

Northrop Grumman Corp is a diversified company which is aligned in four operating sectors, which also comprise our reportable segments namely Aeronautics Systems, Defense Systems, Mission Systems and Space Systems. The aerospace segment designs and builds military aircraft, including the F-35, Global Hawk drones, and the B-21 bomber. Defense systems develops artillery, missile systems, and missile defense technologies. Mission systems focuses on radar, navigation, and communication systems, while space systems manufactures satellites, sensors, and rocket motors.

Current Position of Northrop Grumman

- Currently trading with a volume of 362,654, the NOC's price is up by 1.22%, now at $513.34.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 26 days.

What The Experts Say On Northrop Grumman

In the last month, 3 experts released ratings on this stock with an average target price of $555.67.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * Maintaining their stance, an analyst from Wells Fargo continues to hold a Overweight rating for Northrop Grumman, targeting a price of $547. * An analyst from Wells Fargo persists with their Overweight rating on Northrop Grumman, maintaining a target price of $545. * An analyst from RBC Capital has elevated its stance to Outperform, setting a new price target at $575.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Northrop Grumman with Benzinga Pro for real-time alerts.

Latest Ratings for NOC

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2025 | RBC Capital | Upgrades | Sector Perform | Outperform |

| Mar 2025 | Wells Fargo | Maintains | Overweight | Overweight |

| Feb 2025 | Wells Fargo | Maintains | Overweight | Overweight |

View More Analyst Ratings for NOC

View the Latest Analyst Ratings

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.