Nokia Corporation NOK recently announced that its optical networking solutions were selected by TenneT, one of Europe’s leading offshore transmission systems operators, to connect the latter’s offshore wind farms in the Dutch North Sea to onshore telecommunications infrastructure. The move is part of a broader initiative to focus on renewable energy sources to help Europe achieve its climate neutrality target by 2050.

TenneT has commissioned eight new 2-gigawatt (2GW) platforms in the Dutch North Sea to deliver offshore wind energy to the land. These unmanned remote platforms are required to be monitored and managed continuously to ensure reliable energy transmission. This is where Nokia’s 1830 PSS (photonic service switch) DWDM (dense wavelength division multiplexing) solution came to the fore for a resilient future-ready optical network connecting the offshore sites to TenneT’s onshore assets.

NOK’s 1830 PSS DWDM

The DWDM technology combines several narrowband signals in a single optical fiber for a complex optical networking solution that provides maximum efficiency for data transmission. This increases the network capacity without infrastructure upgrades and is especially useful for telecom operators and service providers who want to increase capacity without incremental costs. Nokia DWDM systems are developed with an emphasis on large transmission distances and high data rates for scalability and reliability. It is suitable for extended networks that assist in maintaining connections and optimum data flow in an ever-growing digital space.

Nokia’s 1830 PSS DWDM offers multilayer transport platforms for efficient transport at any scale, from compact access to the converged Optical Transport Network (OTN)/DWDM core. As part of TenneT’s offshore deployment, Nokia will provide advanced amplification and transponder technologies to support long-distance transmission of up to 400 km across the challenging environment. It will also offer comprehensive design, testing and operational care, ensuring the network meets TenneT’s high standards for resilience and performance during each phase of construction and long-term operation.

Will NOK Stock Benefit?

The deal reinforces Nokia’s leading position in optical network technology. The implementation of reliable communication network transmission positions the company at the forefront of greater scalability and easy upgrades for handling the increasing requirements of a growing network while maintaining an uninterrupted standard of service delivery.

The agreement is likely to boost the stock on incremental revenue generation on the back of higher demand for high-performance optical networking technology solutions. The deal is also expected to strengthen Nokia’s position as a leading telecommunications equipment provider in the region.

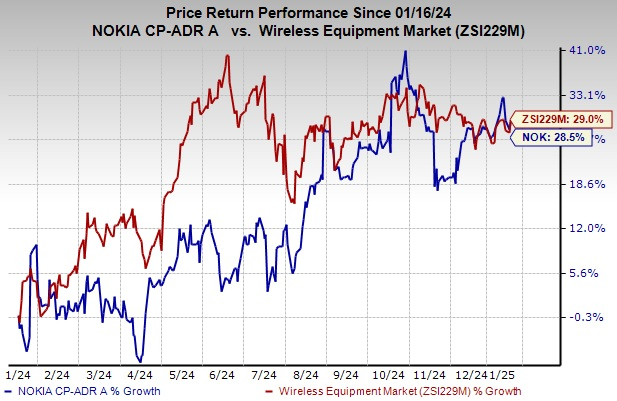

The stock has gained 28.5% over the past year compared with the industry’s growth of 29%.

Image Source: Zacks Investment Research

NOK Zacks Rank

Nokia currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Key Picks

InterDigital, Inc. IDCC sports a Zacks Rank of 1 at present. It has a long-term growth expectation of 15%. IDCC is a pioneer in advanced mobile technologies enabling wireless communications and capabilities. The company designs and develops a whole range of advanced technology solutions for use in digital cellular as well as wireless 3G, 4G, and IEEE 802-related products and networks.

Arista Networks, Inc. ANET, carrying a Zacks Rank #2 (Buy), is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experiences. Arista delivered an earnings surprise of 14.8%, on average, in the trailing four quarters. It is well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

Qualcomm Incorporated QCOM, carrying a Zacks Rank #2, is another solid pick. The company is well-positioned to meet its long-term revenue targets driven by solid 5G traction, greater visibility and a diversified revenue stream. Qualcomm is increasingly focusing on the seamless transition from a wireless communications firm for the mobile industry to a connected processor company for the intelligent edge.

Free Today: Profiting from The Future’s Brightest Energy Source

The demand for electricity is growing exponentially. At the same time, we’re working to reduce our dependence on fossil fuels like oil and natural gas. Nuclear energy is an ideal replacement.

Leaders from the US and 21 other countries recently committed to TRIPLING the world’s nuclear energy capacities. This aggressive transition could mean tremendous profits for nuclear-related stocks – and investors who get in on the action early enough.

Our urgent report, Atomic Opportunity: Nuclear Energy's Comeback, explores the key players and technologies driving this opportunity, including 3 standout stocks poised to benefit the most.

Download Atomic Opportunity: Nuclear Energy's Comeback free today.QUALCOMM Incorporated (QCOM) : Free Stock Analysis Report

Nokia Corporation (NOK) : Free Stock Analysis Report

InterDigital, Inc. (IDCC) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.