In a concerted effort to thwart the growing menace of cyberattacks and strengthen cyber resiliency, Nokia Corporation NOK recently launched a cybersecurity-focused testing lab in Dallas, TX. The first end-to-end testing lab in the United States seems to be the call of the hour with a surge in cyberattacks across the globe, making it imperative for the company to set up core testing facilities for effective security measures.

The Advanced Security Testing and Research (ASTaR) lab will primarily focus on cybersecurity through a holistic approach to researching and testing secure solutions to mitigate potential risks and threats to network security. Leveraging state-of-the-art technologies and data analytics expertise, Nokia will aim to assess the security resilience of 5G networks and the associated software, hardware and applications amid the backdrop of real-life threat scenarios. ASTar will strive to utilize these assessments to thwart potential threats and vulnerabilities and will operate as the central repository for the dissemination of cybersecurity knowledge to its clients.

This central lab will be dedicated solely to security forensics and research and will be guided by domain experts and cybersecurity specialists. Capitalizing on artificial intelligence, machine learning and automation techniques, it brings together human expertise and advanced technologies for faster response, efficiency and transparency through a holistic approach to secure networks.

Nokia is driving the transition of global enterprises into smart virtual networks by creating a single network for all services, converging mobile and fixed broadband, IP routing and optical networks with the software and services to manage them. It is transforming the way people and things communicate and connect with each other through a seamless transition to 5G technology, ultra-broadband access, IP and Software Defined Networking, cloud applications and IoT.

The company facilitates its customers to move away from an economy-of-scale network operating model to demand-driven operations by offering easy programmability and flexible automation to support dynamic operations, reduce complexity and improve efficiency. Nokia remains focused on building a robust, scalable software business and expanding it to structurally attractive enterprise adjacencies. The company’s end-to-end portfolio includes products and services for every part of a network, which are helping operators to enable key 5G capabilities, such as network slicing, distributed cloud and industrial IoT. Accelerated strategy execution, sharpened customer focus and reduced long-term costs are expected to position the company as a global leader in delivering end-to-end 5G solutions.

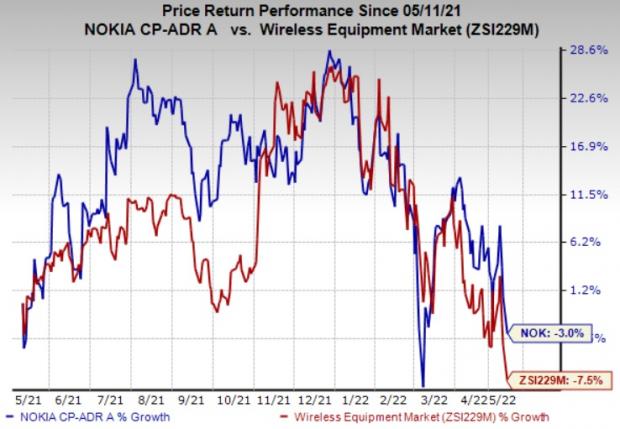

Shares of the company have declined 3% in the past year compared with the industry’s fall of 7.5%. Nevertheless, we remain impressed with the inherent growth potential of this Zacks Rank #3 (Hold) stock.

Image Source: Zacks Investment Research

Clearfield, Inc. CLFD, sporting a Zacks Rank #1 (Strong Buy), is a solid pick for investors. You can see the complete list of today’s Zacks #1 Rank stocks here.

Clearfield delivered an earnings surprise of 37.5%, on average, in the trailing four quarters. Earnings estimates for the current year for the stock have moved up 114.7% since May 2021. Over the past year, Clearfield has gained a solid 45.4%.

InterDigital, Inc. IDCC also sports a Zacks Rank #1. It has a long-term earnings growth expectation of 15% and delivered a stellar earnings surprise of 141.1%, on average, in the trailing four quarters. Earnings estimates for the current year have moved up 88.5% since May 2021.

InterDigital is focused on pursuing agreements with unlicensed customers in the handset and consumer electronics markets. The company aims to become a leading designer and developer of technology solutions and innovation for the mobile industry, IoT and allied technology areas. InterDigital’s global footprint, diversified product portfolio and the ability to penetrate different markets are impressive.

Viasat, Inc. VSAT, carrying a Zacks Rank #2, is another key pick. It pulled off a trailing four-quarter earnings surprise of 129.9%, on average. The company attracts millions of U.S. consumers and enterprises with its high-quality broadband service.

Viasat’s impressive bandwidth productivity sets it apart from conventional and lower-yield satellite providers that run on incumbent business models. Viasat has a competitive advantage in bandwidth economics, global coverage, flexibility and bandwidth allocation, making it believe that mobile broadband will act as a profit churner.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nokia Corporation (NOK): Free Stock Analysis Report

InterDigital, Inc. (IDCC): Free Stock Analysis Report

Viasat Inc. (VSAT): Free Stock Analysis Report

Clearfield, Inc. (CLFD): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

%20Boosts%20Cybersecurity%20Resilience%20With%20Testing%20Lab%20%7C%20Nasdaq&_biz_n=10&rnd=690798&cdn_o=a&_biz_z=1743104161991)

%20Boosts%20Cybersecurity%20Resilience%20With%20Testing%20Lab%20%7C%20Nasdaq&rnd=120149&cdn_o=a&_biz_z=1743104161996)