NMS II: Why Proposed Rule Changes May Make Markets Less Fair for All

The middle of a Coronavirus shutdown is probably not the right time to look at reworking the whole U.S. equity market structure. But deadlines are (still, currently) deadlines.

Earlier this year the SEC released almost 700 pages of proposed National Market System (NMS) rule changes, as well as denying Cboe’s unprotected lit speed bump before they deferred their decision on IEX’s protected lit speed bump.

Within the next four weeks, we’re all meant to submit comments on these plans as well as doing our day jobs, from home. Today, I plan to focus on the SEC’s proposal and spell out how its plan would truly impact markets.

There is a lot more here than people might realize. This doesn’t streamline what we have or remove complexities or inefficiencies. But these rules touch almost all facets of Reg NMS and beyond, and our core understanding of a single protected and actionable NBBO (National Best Bid and Offer). Something that is, ironically, the envy of the fragmented world.

Instead, the proposed rules are designed to create additional new infrastructure, which will likely have unintended as well as intended consequences. In that sense its looks a lot like a U.S. version of MiFID-II.

Where have we come from?

Before we contemplate the problems to solve, let’s first think about how we got here.

In the “old days,” exchanges listed stocks and investors went to the individual exchanges to trade them.

Then, back in 1994 with the introduction of Unlisted Trading Privileges (UTP), the U.S. Congress mandated that new competitors could set up to trade any stock without the myriad setup costs incurred by those venues that also invest in capital formation and bringing companies to investors. Not surprisingly, competition flourished. There are now dozens of venues that can trade any ticker.

Over time, it became clear that this also created fragmentation and that added to complexity. There was a lack of transparency into who had the best prices when, which made it difficult to ensure investors were not worse off.

The simplifying principles behind NMS

Then along came Reg NMS. Short for “National Market System,” NMS in principle stitched the complex and fragmented market back together.

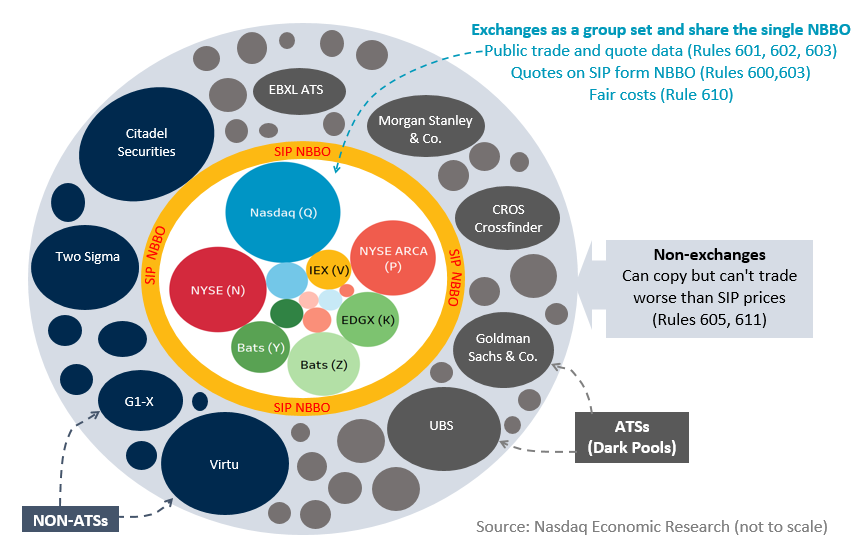

Concepts like the NBBO and the SIP (Securities Information Processor) were put into their current forms, creating a single “golden source” of best prices for investors—a “virtual single market” in the newly dispersed world.

Routing and execution quality standards were then created to leverage this new NBBO.

Although exchanges also had to provide their pricing data to the SIPs for free, economics were put in place to try to reward them for their data’s contribution to market quality of the combined network.

Chart 1: NMS creates a single NBBO out of a network of competitors

We talked in Reg NMS for Dummies about what each of the NMS rules do. There are 14 rules that can be grouped into six general categories (Table 1).

Table 1: A summary of NMS rules

What’s wrong with U.S. Markets?

It’s clear that U.S. markets aren’t “broken.” Data shows they are the most liquid, largest and cheapest to trade in the world. And their performance during the recent Coronavirus selloff confirms they have remained liquid and transparent.

That’s in stark contrast to parts of the bond markets which have virtually stopped providing liquidity and pricing, requiring unprecedented intervention from the Fed to remain functional for investors.

Chart 2: U.S. market liquidity leads the world

But there are some things that many people would like to change:

- Probably the most consistent position is that markets are too complex. Whether that be due to too much fragmentation, order types, message traffic or speed bumps.

- We’ve talked about the odd lot and tick size problems in the U.S. market that make trading harder.

- Speed and latency created by the fragmented markets have created their own list of sometimes conflicting proposals. Some want to make everyone more “equal,” removing the “two tier” market the direct feeds are said to create. Others want to give traders more choice by removing the order protection rule and prohibition on locked and crossed markets, making markets much less equal.

- Other proposals include moving economic “rents” from one group of market participants to another without ensuring a net benefit to investors. We’d include in this the data debate, access fees, SIP governance and speed bump

The only thing people seem to agree on is that everything being equal isn’t fair either.

This year’s actions touch almost every NMS rule

Despite all these facts, there is pressure to “do something.” So back in January, the SEC proposed consolidating the three tapes into a single SIP. This simplification and streamlining of markets would modify Rule 608 and Rule 609 that determine how SIPs work. This rule also changed SIP governance, giving consumers and competitors votes on potential new data revenue decisions (Rule 601), arguably increasing conflicts of interest, but we digress.

Then just one month later, a Valentine’s Day proposal suggested the opposite (multiple SIPs) and much more. The rule proposed changes to Rule 600 and Rule 603 as well as adding a new Rule 614, but these changes will likely have unintended consequences on other rules too.

- Creating competing SIPs and consolidators will fragment the NBBO. Without a single SIP there is no gold-sourced NBBO. Instead, we will have MBBO’s (Many Best Bids and Offers) and the concept of locked and crossed markets (Rule 610) and execution quality (Rule 605) will depend on your data provider and location.

- That in turn makes “fair access” of exchange data (Rule 602) a little redundant. The SEC hopes there are around a dozen consolidators, so it’s likely some will be faster than others.

- Splitting the definitions of protected quotes (still 100 shares or more) and best quotes (smaller round lots to be included in NBBO) seems unnecessarily complex, but it will also legitimize trade throughs (Rule 611) and make retail best ex (Rule 605) more complicated

- What defines a protected quote (Rule 611) is also open for discussion. In a separate February action the SEC denied the Cboe its 4 milliseconds (ms) (unprotected) speed bump. Coming after the CHX denial (which wanted a protected speed bump quote), this seemed to solidify the view that all lit quotes should be accessible, protected or not. So it was surprising just a week later that the IEX D-limit order type request was extended. Why deny Cboe and CHX but extend the IEX decision? The IEX D-limit would also fade market-wide takers (like Cboe) but was to be “protected” (like CHX). The main thing protection provides clearly isn’t liquidity. But by substituting for rebate economics, it likely earns IEX more SIP data revenues. That is ironic given IEX’s position on rebates and market data. But I digress again…

Rules that affect retail trading, from the ability to price improve (Rule 612) to disclosures of routing and broker incentives (Rule 606 and Rule 607), are the only NMS rules that aren’t changed. Despite that, retail seem to be net losers from the changes to PBBO (Protected Best Bid and Offer), which will make it harder to police whether orders got the best fills available.

What market structure do we want?

The overwhelming desire of most investors is to make markets fairer, more equal or simpler.

Although these rule changes touch almost all of NMS, they seem to mostly help sophisticated traders and others with the time and expertise to navigate more complex and fragmented markets.

We all want to improve markets and believe there are ways to do so. But comments are due soon on these sweeping SEC proposals. So it’s important we put our heads together and look at the data to make sure we don’t do more harm than good.

Speaking of data, there is lots to do to understand the potential costs, benefits and unintended consequences of these changes. This discussion should just be a place to start.