If you've heard it once, you've probably heard it a hundred times: There's an intense electric vehicle (EV) price war going on in China. The price war has clobbered many automakers' earnings results, and a number of competitors hinted that the situation is likely to get worse in 2025.

That's not a great backdrop for Nio (NYSE: NIO) investors. That said, there's reason to believe that despite the price war and intense competition, Nio's delivery growth will finally impress investors in 2025.

Shifting into higher gear

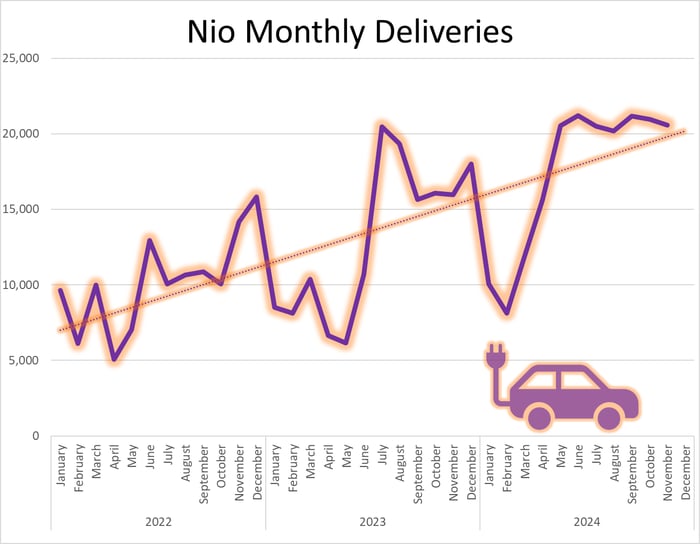

Nio investors have a lot to process in December, with the recent three-hour-long media event and the upcoming Nio Day 2024 on Dec. 21, where it officially launches the ET9 and the Firefly brand. While investors might be happy with the consistent 20,000-plus deliveries in recent months, some might also be asking if the company can break through that range in 2025 with the ongoing price war and increasing competition.

Data source: Nio press releases. Chart by author.

Initially, investors might have been disappointed that the company expects its primary Nio brand to grow only moderately in 2025, but that's not where the growth story is currently. Thanks to its sub-brands, Onvo and Firefly, it not only will increase its deliveries, but it could double them in 2025. One of the biggest takeaways is that its Onvo brand is expected to average 20,000 deliveries per month in 2025 alone.

If Nio were to double sales in 2025, that would put the target around 440,000 vehicles, and that should certainly impress investors. But there is a caveat to that strong growth; its Onvo brand is more affordable compared to its Nio brand, which could ding the company's margins.

What to look for next

Right now, if you're intrigued by Nio as an investment, you want to dial in on three primary things: margins, revenue growth, and break-even timeline.

Let's start with margins, the silver lining in the company's third quarter. Many expected the company's margins to feel the pressure of the ongoing price war in China, but during the third quarter Nio's gross margin increased to 10.7%, up from the prior year's 8%. Better yet, vehicle margins jumped from 11% to 13.1% over the same time frame. One quarter doesn't make a trend, but it does give investors hope that management can control costs amid the growth of lower-priced brands.

Revenue growth will be tied to its production and delivery growth and, if deliveries double, revenue will be along for the ride and likely to surge in 2025. The question will be how much can revenue surge amid the price war. Another big takeaway recently was management outlining its target to reach breakeven by 2026. That's not just a one-quarter break-even target. It's for the full-year 2026, which would be impressive with the condition of the Chinese market.

Sneak preview

The fourth quarter could actually be a preview of what's to come. With Onvo production continuing to ramp up, the company would need to deliver slightly more than 30,000 vehicles in December to reach its fourth-quarter delivery guidance. That would require a nearly 50% jump over the prior year.

Investors would be wise to remember that Nio is a young company, remains highly speculative, and should only be a smaller position in your portfolio. Further, despite the EV maker's aims to break even for 2026, don't be surprised if Nio's net loss still widens before it improves. But, as the company launches Firefly very shortly and Onvo production ramps up, it sets the stage for Nio to finally impress investors with delivery and revenue growth in 2025.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $342,278!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $47,543!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $496,731!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of December 16, 2024

Daniel Miller has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.