Nickel saw solid price momentum in the first half of the year, benefiting from investor sentiment and speculation across commodity markets that saw surge in prices for both precious and base metals.

However, price highs were short-lived as nickel supply and demand fundamentals provided pressures that saw steep declines.

Among the influences has been a supply of laterite nickel flooding the market out of Indonesia, which is a contributing factor to mine curtailments in New Caledonia, Australia, and Europe. Meanwhile, high demand for battery production in China has yet to reach levels to make up for the oversupply in the market.

How did the nickel price perform in Q3?

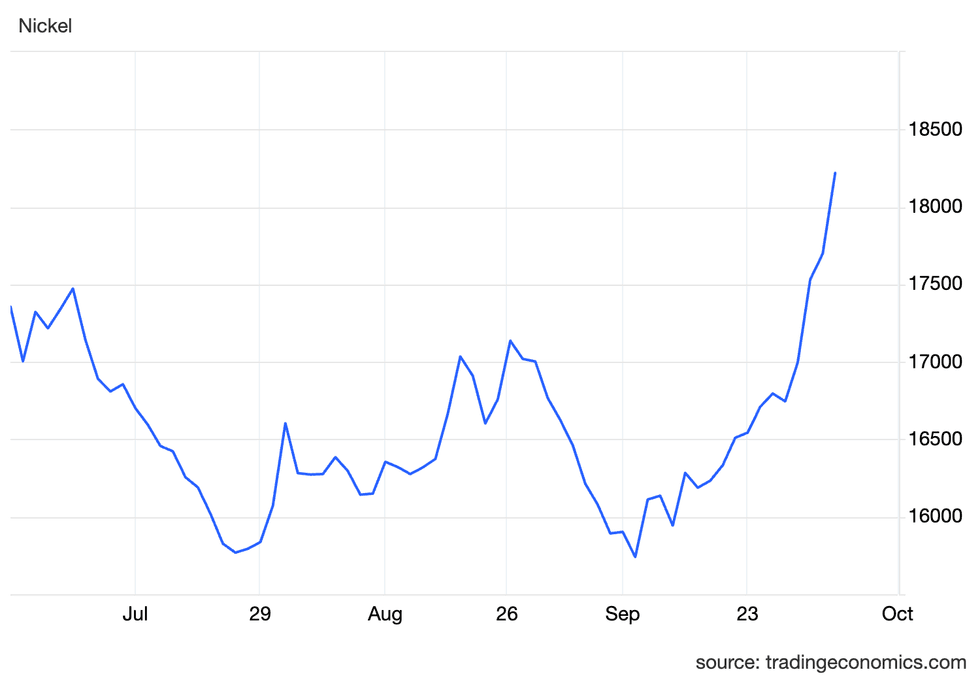

The third quarter opened with the price of nickel facing a downward trend that started after it reached a yearly high of US$21,615 per metric ton on May 20. The price on July 1 had fallen to US$17,357. The following week saw a pause in the downward trend and was briefly lifted to US$17,473 before resuming its downward trajectory to US$15,769 on July 25.

Chart via Trading Economics.

Nickel price, July 1 to October 1, 2024.

After bottoming out, the price quickly climbed to US$16,604 on July 31.

Nickel remained largely rangebound between US$16,150 and US$16,500 for the start of August, but saw upward momentum in the middle of the month that pushed the price to US$17,136 on August 27.

The beginning of September saw the price collapse again, reaching a quarterly low of US$15,741 on September 10 and just shy of the year-to-date low of US$15,668 set on February 9. However, pricing pressure wasn’t to last and the price of nickel saw rapid gains through to the end of September reaching a quarterly high of US$17,698 on October 1.

Supply

The big story for the last several quarters has been an oversupply of nickel from Asian markets, particularly Indonesia and Q3 2024 was no different.

According to data from S&P Global, mined nickel production from the country increased by 99,000 metric tons during the quarter and is forecast to be in the 2.4 million metric ton range by the end of 2024, representing 57 percent of total global production.

However, due to Indonesia’s permitting and quota system, sourcing consistent supply from the country has presented challenges for Chinese smelters who were forced to temporarily curtail output due to a shortage in feeder supply.

Despite having a large percentage of global supply, refiners in Indonesia have increasingly been turning to nickel imports from the Philippines, the number two nickel supplier, to maintain operations. The first seven months saw imports rise to 3.37 million metric tons versus just 374,454 tons produced in 2023.

Although China remains the biggest benefactor and investor of Indonesia’s nickel industry, Indonesia has been working to distance it economically from its partner as it tries to work out deals with Western partners.

While Indonesia has been working to distance itself from Chinese investment over the past few years to better position its nickel market for Western markets and inclusion under the US Inflation Reduction Act, a new trade pact looks to solidify ties with China.

Multiple cooperation deals were signed following a November 9 meeting between Chinese President Xi Jinping and Indonesian President Prabowo Subianto, which would see China investing more than US$10 billion into strategic sectors including nickel.

Among the investments is $1.42 billion agreement between Chinese battery material producer GEM (SZSE:002340) and Indonesian miner PT Vale (OTC Pink:PTNDF,IDX:INCO) for the construction of a high-pressure acid leaching (HPAL) plant. The new processing facility is necessary for the production of battery-grade nickel.

Additionally, Zhejiang Huayou Cobalt (SHA:603799) is working to raise US$2.7 billion in financing for a nickel refining and smelting project in partnership with Ford Motor Company (NYSE:F) and PT Vale. The project will also use HPAL processing and is expected to produce 120,000 metric tons of mixed hydroxide precipitate for use in electric vehicle batteries.

China demand lagging

Even though demand for batteries continues to grow, it hasn’t been able to outpace the oversupply situation, this has largely been due to a weak Chinese economy.

China is the largest consumer of nickel in the world, with a majority of the metal destined to be used in the production of stainless steel, but a beleaguered real estate sector and broad economic deflation have dampened demand.

Nickel found pricing support in September as the Chinese government introduced a raft of stimulus measures that were intended to boost economic growth in the country. Among the measures included a 0.5 percent interest rate cut to existing mortgages and reduce the downpayment to purchase a home to 15 percent from 25 percent.

Although the package was responsible for a surge in nickel prices, in the weeks following the announcement nickel prices retreated, once again approaching yearly lows.

In another attempt to jump-start the economy, China introduced a US$1.4 trillion dollar debt swap on November 11 aimed at tackling “hidden debt” and freeing up funds at the local level by reducing interest payments on debt and helping drive growth.

Additionally, the Chinese government is planning to cut the deed tax for homebuyers to 1 percent from the current 3 percent in a further attempt to prop up the country’s economy.

Western governments may not be working hard enough for critical supply

In Canada, the government pledged C$46 billion for the development of four EV battery production plants that will require more raw materials than the Canadian mining sector can currently supply.

At his address to the Greater Vancouver Board of Trade on September 17, Mining Association of Canada President Pierre Gratton suggested Canada is too focused on downstream development and that in order to meet supply the four EV plants will need the support of 15 new mines.

“That’s only speaking from the standpoint of the four battery factories, to say nothing about all of the other needs that our economy requires, or that the US requires, including its defence industries. Unless we achieve the above, and this is the irony, our reliance on foreign sources for minerals and metals is only going to increase,” he said.

Overall, Gratton believes that there needs to be an additional C$32 billion in financing for mining and midstream processing projects.

In Europe, the implementation of its new Carbon Border Adjustment Mechanism (CBAM) that places a tariff on carbon-intensive products is drawing concern from the industry. The regulation is a complex system designed to balance prices and prevent an exodus of carbon-intensive manufacturing to nations with fewer emission controls.

Some are suggesting CBAM has no benefit for the European stainless-steel industry as it limits pricing to scope 1 emissions and doesn’t include downstream emissions from power generation and transpiration.

European steelmakers have become more dependent on nickel pig iron imports from Indonesia, so far 87,485 metric tons through the first eight months of 2024 versus just 1,006 metric tons in 2023. The increase has come alongside a wave of curtailments as the industry reacts to a flood of Indonesian nickel.

What will happen to the nickel price in 2024?

Investors should consider China’s outsized influence over the nickel market, both in terms of control over refined supply and demand from real estate and battery sectors.

Even though the EV sector in China has shown year-over-year growth of 32 percent through the first nine months of 2024, the industry's nickel demand hasn’t made up for shortcomings in the broader economy.

Surplus scenarios are expected to continue over the next few years with a 5.8 percent compound annual growth rate between 2023 and 2028. This will present a challenge for producers who are looking to restart operations in the short term as prices are expected to remain flat.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.