Serving the Korean local investors for more than half a century, NH Investments & Securities (“NHIS”), part of the country’s influential financial player Nonghyup Financial Group, has always been a pioneer in the local brokerage industry.

With its continuous effort in establishing partnership with overseas key players, NHIS manages to identify global investment opportunities and market intel to its investors. Combined with its local experience and expertise, NHIS has successfully become a local broker that is able to provide local market access to global opportunities, innovative investment solutions and world-class client services.

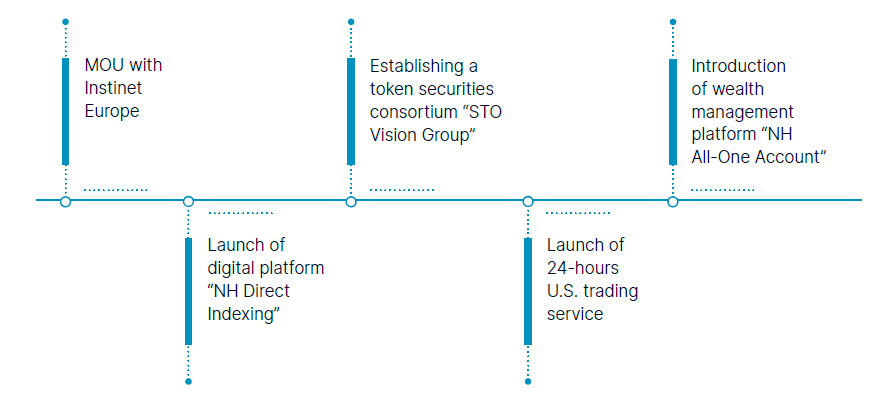

Latest Important Milestones

The way we operate our business and the resources allocation always center around the value enhancement we bring to our clients.

CLIENT CENTRIC

The core value of NHIS is client centric. This leading broker always ensure its clients are at the center of its business philosophy, operations and product ideas. The following key initiatives showcase how NHIS create new horizons by identifying new opportunities for its clients. “The way we operate our business and the resources allocation always center around the value enhancement we bring to our clients,” said Yoon Byungun, CEO of NH Investment & Securities.

ESG Investment – NHIS is dedicated to sustainable investment. It strives to prioritize investments that meet the United Nations Sustainable Development Goals. The broker is also a leading company in the ESG bond market and contributes to the facilitation of ESG bond issuance and secondary markets. The broker adopts green management strategies to ensure carbon neutrality and aligns interest of management, stakeholders and the local community.

Digital Transformation – With huge investment in technology, NHIS transformed its Wealth Management client platform with world-class digital infrastructure that makes timely delivery of market news and access to investment solutions seamlessly. It also developed an AI-based model that prevents unauthorized use of accounts which helps providing additional security to its clients.

Investor Education – NHIS works closely with local universities and industry associations to ensure investor education is in place. Previous themes included blockchain, investment service for millennials investors and stock picks. In 2023, NHIS hosted its 4th Big Data Contest with the objective of educating college and graduate students how to analyze financial data and how to collect the right market news for the right clients.

Given the local investors’ appetite in the U.S. market, NHIS worked with Nasdaq who provided U.S. market data and RSS feeds for the participants of the contest – which made the 2023 contest unique as it was the first time during a contest of this nature when U.S. real time market data was offered.

Winner of the contest was invited by NHIS to view Nasdaq’s Opening Bell Ceremony at the exchange’s headquarters MarketSite which is an iconic spot in New York. The special award is second-to-none in all the trading contests in Korea. It did not only create a special bond between NHIS and the next generation of investor community, it also educated investors the importance of diversification and how to tap U.S. investment opportunities. With investor interest at heart and is dedicated to investor education – the value shared by NHIS and Nasdaq – the contest was well received by the local community.

U.S. INVESTING

With a market cap of over USD50 trillion, the U.S. market is the largest and the most liquid in the world. It allows investors to own shares of the largest companies that have trait of robust growth and accelerated earnings. Diversifying investment with U.S. equities can help mitigate risk of concentrated portfolio of local stocks. Afterall, the U.S. markets include U.S. government bonds, corporate bonds, options, ETFs and even ADRs that provide access to non-U.S. companies. The market is transparent and is regulated by the U.S. Securities and Exchange Commission which promotes market efficiency, integrity and investor protection.

WHY NHIS FOR U.S. INVESTING

U.S. equities market is vibrant and competitive. Markets compete for listings, for order flow and to power the international trading communities’ tools, algorithms, and displays. To provide transparency and access to the U.S. markets, NHIS collaborates with Nasdaq to provide Nasdaq’s golden source for U.S. equity data. Nasdaq’s real-time market data products are provided to millions of users, powering price discovery and investment decisions across the globe.

“Our active retail investors who trade U.S. equities market are demanding access to more granular information. Nasdaq TotalView offers the most complete information investors need to bring their active trading to the next level,” comment Yoon on the importance of Nasdaq TotalView, a premium data feed that displays full order book depth on Nasdaq, including every single quote and order at every price level in Nasdaq-, NYSE- and regional-listed securities trading on Nasdaq.

LOOKING AHEAD

Ongoing investment is made in AI and big data analysis technology. NHIS explores AI and big data analysis model which can work seamlessly with its well-established traditional statistical methodology to ensure quality research is delivered.

NHIS implements various ESG management activities to establish a sustainable management system. In order to implement the goal of being carbon neutral, the firm led the way in sustainable carbon neutral growth by declaring coal phase-out finance on February 2021 and have since then accelerated new Carbon Finance projects, such as creating an emissions trading market.

As a digital innovator in the industry, NHIS ensures sufficient investment and effort are made in talent and technology development. There are a few collaboration projects with research institutes such as KAIST, a local science and technology university, and Seoul National University which look into tech that can drive digital finance innovation initiatives.