Newell Brands Inc. NWL has come up with a restructuring and savings initiative, Project Phoenix, to be implemented by the end of 2023. The plan aims to reduce overhead costs, streamline its operating model, centralize supply-chain functions and increase efficiencies.

Management also intends to reduce international dependence by moving to a One Newell go-to-market approach in key regions. It noted that the updated operating model would include three operating segments. Notably, the company will combine its Commercial Solutions, Home Appliances and Home Solutions segments to form one operating segment, Home & Commercial Solutions. Learning & Development and Outdoor & Recreation will remain the company’s other two operating segments.

The move comes after the success of Project Ovid and is likely to drive significant margin improvement in the long term. The new restructuring initiative will also generate significant savings and help offset the impacts of macro-economic headwinds.

Post implementation, NWL anticipates annualized pre-tax savings of $220-$250 million. Restructuring and related charges are estimated to be $100-$130 million and are likely to be incurred by the end of 2023. The plan will also result in the reduction of office positions by approximately 13%, starting from the first quarter of 2023.

These aforementioned efforts are in response to the tough economic environment, including significant inflation in food, housing and energy, leading to reduced consumer discretionary spending.

On its last reported quarter’s earning call, management expects discretionary spending levels to remain constrained. The strengthening of the dollar is concerning, and is likely to impact the company’s top and bottom lines in the near future.

Owing to the downsides, the company posted dull third-quarter 2022 results, wherein the bottom line surpassed the Zacks Consensus Estimate, whereas the top line lagged the same. Both metrics declined year over year. The company’s third-quarter normalized earnings per share of 53 cents fell slightly from 54 cents a year ago.

Net sales declined 19.2% year over year to $2,252 million. This includes the adverse impacts of the sale of the Connected Home & Security (CH&S) business, unfavorable foreign currency, and the exit of its category and retail store. Also, core sales fell 10.8%, as one of the seven business units witnessed core sales growth.

Consequently, the Zacks Rank #4 (Sell) company slashed its guidance for 2022 to reflect the adverse impacts of unfavorable foreign currency and inflation. The company anticipates net sales of $9.35-$9.43 billion, down from the earlier mentioned $9.37-$9.58 billion. Core sales are expected to decline 3-4% compared with the prior stated 2-4% decrease, excluding the contribution from the CH&S business. The normalized operating margin is expected to be 10-10.3%, down from the prior stated 10-10.5%. Normalized earnings per share are forecast to be $1.56-$1.61, down from the previously communicated $1.56-$1.70 for 2022.

For fourth-quarter 2022, net sales are envisioned to be $2.18-$2.26 billion, with a core sales decline of 9-12%. For the quarter, the company expects a normalized operating margin of 5.1-6.5% and normalized earnings of 9-14 cents per share. Both guidances include the impacts of unfavorable foreign currency, closures of Yankee Candle stores, and the exit of certain product categories, particularly in the Outdoor & Recreation, and Home Appliances segments.

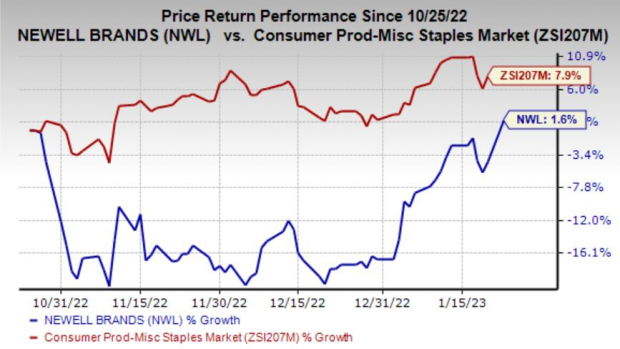

Image Source: Zacks Investment Research

Shares of Newell have gained 1.6% in the past three months compared with the industry’s 7.9% growth.

Stocks to Consider

Here are some better-ranked stocks from the broader Consumer Staples space, namely e.l.f. Beauty ELF, Conagra Brands CAG and Campbell Soup CPB

e.l.f. Beauty currently sports a Zacks Rank of 1 (Strong Buy). ELF has a trailing four-quarter earnings surprise of 77%, on average. The stock has rallied 29% in the past three months. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for e.l.f. Beauty’s current financial-year sales and earnings suggests growth of 17.6% and 8.3%, respectively, from the prior-year reported numbers. The consensus mark for ELF’s earnings per share has moved up a penny in the past seven days.

Conagra Brands, a consumer-packaged goods food company, currently carries a Zacks Rank of 1. CAG has a trailing four-quarter earnings surprise of 1.8%, on average.

The Zacks Consensus Estimate for Conagra Brands’ current financial year’s sales and earnings suggests growth of 5.2% and 3.4%, respectively, from the year-ago reported figures.

Campbell Soup, which manufactures and markets food and beverage products, currently carries a Zacks Rank of 1. CPB has a trailing four-quarter earnings surprise of 8.7%, on average.

The Zacks Consensus Estimate for Campbell Soup’s current financial-year sales and earnings suggests growth of 8.2% and 4.9%, respectively, from the year-ago reported figures.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>Newell Brands Inc. (NWL) : Free Stock Analysis Report

Conagra Brands (CAG) : Free Stock Analysis Report

Campbell Soup Company (CPB) : Free Stock Analysis Report

e.l.f. Beauty (ELF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.