NDX options are an incredibly useful tool for both investors and traders. When two different options are combined into a spread they allow hedgers to protect a position and allow speculators to take any sort of speculative position: bullish, bearish, or sideways. Importantly, spreads allow for all this while limiting risk, even when speculating that the market will move sideways. This makes option spreads fundamentally different from shorting an option in order to express a “sideways” point of view.

The most common type of option spread is the vertical spread. A vertical spread is executed when you buy one option and sell another option of the same type (put or call) and the same expiration date but with a different strike price.

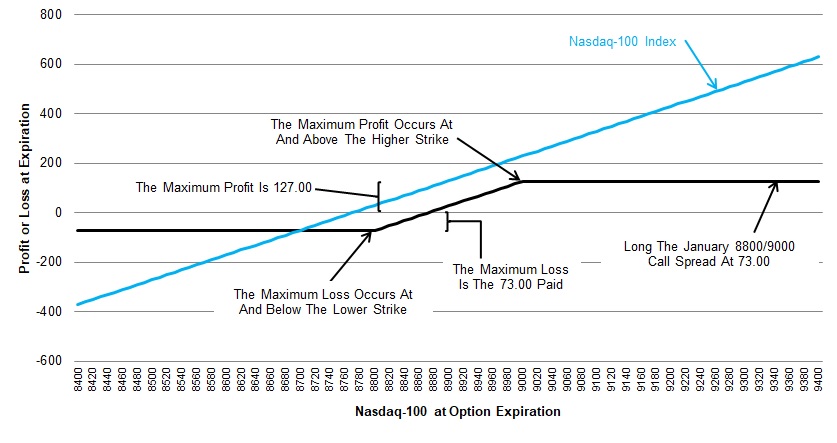

For example, at the close of trading on Friday, December 27, a trader who was bullish the Nasdaq-100 index could have bought a bullish call vertical spread expiring on January 17, 2020. They might have done this by buying the 8800 call option at 93.00 while reducing the cost of the trade by nearly one-quarter by simultaneously selling the 9000 strike call option at 20.00. Buying this vertical call spread would have cost a net of 73.00 (paying 93.00 for the 8800 strike call option, collecting 20.00 for selling the 9000 strike call option).

A trader would say they’re “buying” this vertical call spread because they’ve bought the lower strike call and sold a higher strike call. When buying a call spread a trader will pay net option premium to the seller of the spread. In this case a trader would be paying that 73.00. When buying a vertical spread, either put of call, the maximum risk is always the amount paid for the spread.

The buyer of this call spread on NDX is speculating that the Nasdaq-100 index will continue to rally and will be at or above 9000 at option expiration on January 17, 2020. The maximum profit for the call spread buyer would be 127.00 (the 200.00 maximum value of the spread minus the 73.00 paid) and they would realize that gain with the Nasdaq-100 at or above 9000 at option expiration.

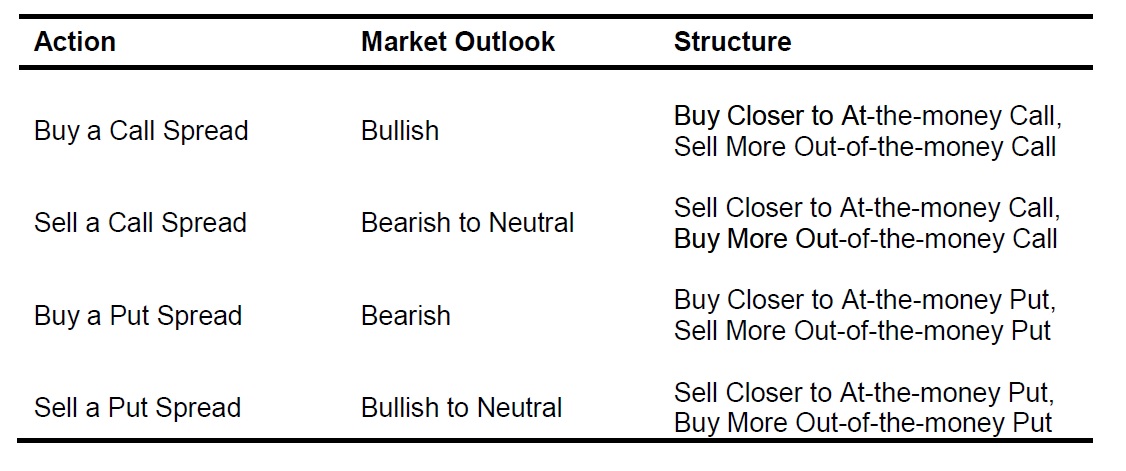

We’ve seen an example of buying a call spread above; a trader would say they’re buying a vertical put spread when they’ve bought the higher strike put option and sold a lower strike put option. Again, the buyer of a put vertical spread will pay some net premium to the seller of the spread.

One reason vertical spreads are so popular is that they reduce the cost for the buyer and limit the potential loss, even for the seller of the spread.

For the buyer of the vertical spread, either put or call, the risk is limited to the amount paid for the spread. For the seller of the vertical spread the risk is similarly limited but it is the maximum value of the spread, meaning the difference between the strike prices, minus the amount of premium received.

Using the call spread example above, the maximum risk for the call spread seller would be 127.00 (the 200.00 width of the spread minus the 73.00 net premium received) while the maximum profit for the seller of the call spread would be the 73.00 collected. You can see the payoff profile for this trade below.

We’ve noted that both call spreads and put spreads can express a range of market sentiments, including neutral or sideways. Let’s look at the entire range of vertical spreads and how investors can use them.

NDX vertical spreads are a simple structure but they provide a vastly larger set of potential outcomes for the hedger and speculator and they limit risk even for those who want to be a net seller. For example, the owner of a stock might be interested in selling a covered call but might not want to surrender all potential appreciation in the stock. That investor could sell a call vertical spread and collect premium while participating in appreciation if the stock rallies above the strike price of the more out-of-the-money call option.

Similarly, an investor might want to sell a put option to buy a stock at a discount but might want to limit downside exposure. In that case the investor might sell a put vertical spread. The investor would collect premium but would not be forced to buy the stock if it is below the lower strike price at expiration.

As you can see, vertical spreads are an incredibly versatile trade structure.

Nasdaq publishes articles about important aspects of the NDX option market each Monday and Thursday. Check back here for our latest post.

You can follow Scott on Twitter: @ScottNations

Performance of an index is not illustrative of any particular investment. Index returns quoted represent past performance which is no guarantee of future results.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.