News & Insights

In January 2024, the 106 Nasdaq indexes covered in this report revealed a dynamic investment landscape. Performance was mixed, with 49 indexes advancing and 57 retreating, highlighting dispersion across sectors, asset types, and regions against a backdrop of widespread economic challenges. The standout was the Nasdaq Sprott Junior Uranium Miners™ Index (NSURNJ™), which surged by 18.9%, highlighting a growing interest in a major alternative to newer forms of sustainable energy that have been struggling. In contrast, the Nasdaq Sprott Lithium Miners™ Index (NSLITP™) faced a significant downturn, dropping by 26.1%, reflecting the volatility in certain segments of the clean energy sector. Overall, the indexes averaged a return of -1.0%.

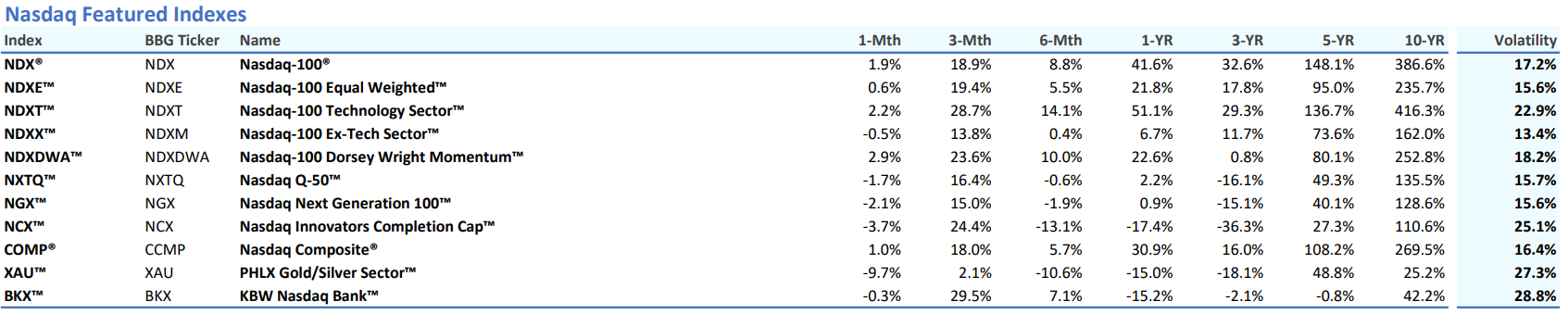

Nasdaq Featured Indexes

Within the Nasdaq Featured Indexes, the Nasdaq-100 Dorsey Wright Momentum™ (NDXDWA™) led the pack with a 2.9% increase. Conversely, the PHLX Gold/Silver Sector™ (XAU™) saw a 9.7% decrease. The Nasdaq-100 Index® (NDX®) wrapped up January in the green with a gain of 1.9%, continuing its historically strong performance in 2023. These indexes had an average return of -0.9%.

Nasdaq Global Indexes

The Nasdaq US Large Cap™ (NQUSL™) was the leader among the Global Indexes, climbing 1.8%. The Nasdaq ASPA Ex Japan™ (NQASPAXJP™) trailed behind with a 4.5% loss. It was a tough month for small caps, which didn't fare as well as their larger counterparts. Developed markets showed more resilience than emerging markets.

Nasdaq OMX Nordic Indexes

Nordic indexes presented a brighter outlook, led by the strength of OMX Nordic 40™ (OMXN40™), which gained 2.5%. The OMX Stockholm 30™ (OMXS30™) was the worst performer over the last month, with a loss of 1.7%. Overall, the average return across the six Nasdaq OMX Nordic Indexes was 1.0%.

Nasdaq Thematic Tech Indexes

Tech continues to shine, with the Nasdaq Global Artificial Intelligence and Big Data™ (NYGBIG™) leading at a 4.0% increase, showcasing the strength of AI in the market. The Nasdaq CTA Cybersecurity™ (NQCYBR™) wasn't far behind with a 3.9% rise. The Nasdaq CTA Global Digital Health™ (BEWELL™) didn't do as well, dropping 6.5%. The thematic tech indexes had an overall positive average return of 0.2%.

Nasdaq Thematic ESG Indexes

The Nasdaq Sprott Junior Uranium Miners™ (NSURNJ™) was the standout in the thematic ESG group, up 18.9%, making it the only index in the group to end January positively. The Nasdaq Sprott Lithium Miners™ (NSLITP™) faced the biggest loss at over 26%. These indexes saw an average return of -7.0%.

Nasdaq Dorsey Wright Indexes

The momentum factor powered the Dorsey Wright Developed Markets Tech Leaders™ (DWADM™), which led the group with a gain of 2.2% in January. Other areas of note include Nasdaq Dorsey Wright DALI1™ (NQDALI™) and Dorsey Wright Tech Leaders™ (DWTL™). Dorsey Wright Basic Materials Tech Leaders™ (DWBM™) was the worst-performing in January, falling 4.7%. On average, the Nasdaq Dorsey Wright Indexes fell 0.3%.

Nasdaq Dividend and Income Indexes

The Nasdaq Technology Dividend™ (NQ96DIVUS™) was the star of the Dividend and Income group, gaining 2.3%. The Nasdaq US Broad Dividend Achievers™ (DAA™) also saw a rise of 1.1%. However, the Nasdaq US Dividend Achievers 50™ (DAY™) experienced a 4.2% decrease. On average, these indexes saw a slight dip of -0.7%.

Nasdaq Options Indexes

The Nasdaq Options Indexes mostly moved higher in January, with the exception of the Credit Suisse Nasdaq Gold FLOWS103 TR™ (QGLDITR™) and Credit Suisse Nasdaq Silver FLOWS106 TR™ (QSLVOTR™), which posted respective returns of -0.4% and -3.3%. The outperformer of the group was Credit Suisse Nasdaq QTI Crude Oil FLOWS 106 TR™ (QUSOITR™), rising 5.9%, followed by the Nasdaq-100 ESG BuyWrite™ (NQYLEI™), up 2.8%. On average, the Nasdaq Options Indexes gained 1.6% in January, the highest gain across all Nasdaq index groups.

Nasdaq Green Economy Indexes

All indexes in the Nasdaq Green Economy suite moved lower in January. The most resilient of the group proved to be Nasdaq OMX Global Water™ (GRNWATERL™), while the worst-performing was the Nasdaq OMX Green Economy™ (QGREEN™), falling 6.6%. The Nasdaq Green Economy indexes fell 4.4% on average over the last month.

Nasdaq Crypto Indexes

All four of the Nasdaq Crypto Indexes managed to move higher in January. Nasdaq Bitcoin™ (NQBTCS™) gained 2.8%, while the Nasdaq Crypto™ (NCIS™) gained 1.9%. The relative laggard of the group was the Nasdaq Crypto Index Europe™ (NCIES™), which finished flat.

As we wrap up the first month of 2024, the performance of the Nasdaq indexes offers a nuanced view of the current economic and market dynamics. The mixed results across various sectors underscore the delicate balance investors are navigating between growth opportunities in technology and AI and the challenges faced in the ESG and emerging markets. The standout performance of thematics like cybersecurity and AI suggests a continuation of a tech-driven market despite broader economic uncertainties. On the other hand, the struggles within the green economy and certain thematic ESG indexes highlight the sensitivity of these areas to macroeconomic factors and regulatory environments. As we move forward, the resilience seen in developed market indexes and certain parts of the tech sector may provide a degree of optimism, but the overall cautious sentiment reflected in the very mixed performance across the full lineup of indexes suggests that investors are bracing for a year of potential volatility and seeking stability amidst the unknowns.

Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED.

© 2024. Nasdaq, Inc. All Rights Reserved.