News & Insights

Performance was largely positive for the 106 indexes tracked in the report for the month of February, with 93 indexes advancing and 13 retreating. The month of February was the fourth consecutive month of gains for the Nasdaq-100. The average return across the 106 indexes was 5.5%, an improvement over the previous month where the average return was -1.0%. The Nasdaq-100 Index® (NDX®) was up 5.3%, marking the index's fourth consecutive month of gains. The best-performing index was the Nasdaq Ethereum™ Index (NQETHS™), which surged by 46.4%, reflecting investors’ enthusiasm for crypto. The worst-performing index was the Nasdaq Sprott Junior Uranium Miners™ Index (NSURNJ™), which declined by 11.4%, a strong reversal from the previous month where it registered gains of 18.8% and was the best performer of the 106 indexes tracked. Prices of uranium dipped in February, a reversal from January, when prices reached a 16-year high after growing indications from top miners about supply woes. Overall, there was strength across all areas, with some of the most significant gains within the Nasdaq Crypto Indexes, Nasdaq Green Economy Indexes and Dorsey Wright Indexes.

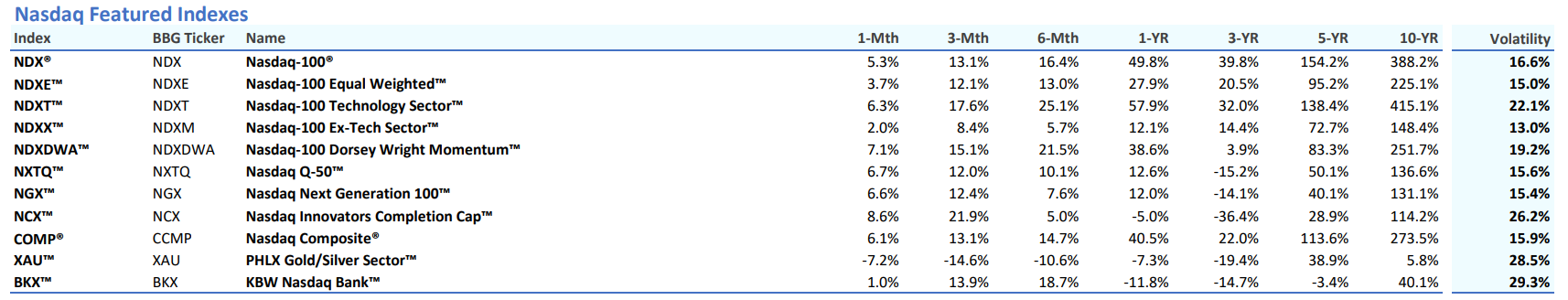

Nasdaq Featured Indexes

Within the Nasdaq Featured Indexes, the Nasdaq Innovators Completion Cap™ Index (NCX™) was the relative outperformer, up 8.6% while the PHLX Gold/Silver Sector™ (XAU™) was the relative underperformer, down 7.2%. While the Nasdaq Innovators Completion Cap™ Index (NCX™) reversed its loss from the previous month, the PHLX Gold/Silver Sector™ (XAU™) registered another decline. The Nasdaq-100 Index® (NDX®) wrapped up February in the green with a gain of 5.3%, continuing its historically strong performance in 2023. These indexes had an average return of 4.2%.

Nasdaq Global Indexes

The Nasdaq US Large Cap™ Index (NQUSL™) was the best-performer among the Global Indexes, climbing 5.3%, followed closely by the Nasdaq US Mid Cap™ Index (NQUSM™) which was up 5.2%. The Nasdaq Europe™ Index (NQEU™) was the relative underperformer, up a modest 1.1%. Developed markets showed more resilience than emerging markets. Overall, there was strength across all indexes, with the suite of indexes registering average gains of 3.7%.

Nasdaq OMX Nordic Indexes

The Nasdaq Nordic indexes also registered mostly positive returns, led by the strength of OMX Stockholm 30™ Index (OMXS30™), which gained 4.1%. The OMX Helsinki 25™ Index (OMXH25™) was the worst performer over the last month, with a loss of 2.8%. Overall, the average return across the six Nasdaq OMX Nordic Indexes was 2.1%, higher than the average returns of the previous month.

Nasdaq Thematic Tech Indexes

Tech continues to shine, with the suite of Thematic Tech indexes posting average returns of 4.7%. Semiconductors, as a theme, gained favor among investors, after leading incumbent Nvidia beat Wall Street’s forecasts for revenue and earnings and projected continued growth in 2025 and beyond. The PHLX Semicondutor™ Index (SOX™) was the relative outperformer, up 10.9% while the Nasdaq US Smart Semiconductor™ Index (NQSSSE™) was the third-best performer, registering gains of 9.0%. The Nasdaq CTA Global Digital Payments™ Index (WALLET™) was the second-best performer, gaining 9.5%, in large part thanks to a monthly gain of 60% in Coinbase. Artificial Intelligence, which dominated within the suite of indexes last year, registered impressive gains this month, with the Nasdaq CTA Artificial Intelligence™ Index (NQINTEL™) posting gains of 7.2% and the Nasdaq Global AI and Big Data™ Index (NYGBIG™) posting gains of 5.7%. The relative underperformer was the Nasdaq CTA Global Video Games Software™ Index (PLAYR2™), which registered a loss of 1.1%. The thematic tech indexes had an overall positive average return of 4.7%.

Nasdaq Thematic ESG Indexes

The Nasdaq Thematic ESG Indexes registered an average gain of 1.0%, an improvement over the previous month when it registered a loss of 7%. The Nasdaq Sprott Lithium Miners™ (NSLIPT™) was the relative outperformer, up 10.4%,a stark reversal from January’s double-digit loss. The Nasdaq Sprott Junior Uranium Miners™ Index (NSURNJ™) was the relative underperformer, registering losses of 11.4%. As a group, these indexes saw an average return of 1.0%.

Nasdaq Dorsey Wright Indexes

All indexes in the Nasdaq Dorsey Wright suite posted gains, with the suite registering average gains of 6.9%. The Dorsey Wright Healthcare Technical Leaders™ Index (DWHC™) was the relative outperformer, up 14.2% while the Dorsey Wright Energy Technical Leaders™ Index (DWEN™) was the relative underperformer, up a modest 1.1%. Three indexes including Dorsey Wright Industrials Technical Leaders™ Index (DWIDX™), Dorsey Wright Consumer Cyclicals Technical Leaders™ Index (DWCC™) and Dorsey Wright Technology Technical Leaders™ Index (DWTY™) registered double-digit gains.

Nasdaq Dividend and Income Indexes

The Nasdaq Technology Dividend™ Index (NQ96DIVUS™) was the best-performing index of the Dividend and Income group, gaining 3.6%. The Nasdaq US Dividend Achievers 50™ Index (DAY™) was the relative underperformer, registering a loss of 2.4%. On average, these indexes saw an average gain of 1.6%.

Nasdaq Options Indexes

All but one index in the suite of Nasdaq Options Indexes moved higher in February, with the exception of the Credit Suisse Nasdaq Silver FLOWS106 TR™ Index (QSLVOTR™), which posted returns of -0.4%. The outperformer of the group was the Nasdaq-100 Quarterly Protective Put 90™ Index (NQTRI™), which was up 5.2%, followed by the Nasdaq-100 Quarterly Collar 95-110™ Index (NQCLRI™), up 4.7%. The relative underperformer of the group was the Credit Suisse Nasdaq Silver FLOWS106 TR™ Index (QSLVOTR™), which registered a loss of 0.4%. On average, the Nasdaq Options Indexes gained 2.8% in February.

Nasdaq Green Economy Indexes

All indexes in the Nasdaq Green Economy suite moved higher in February, a reversal from the previous month when all indexes moved lower. The best-performing of the group was the Nasdaq OMX Solar™ Index (GRNSOLAR™) which was up 17.3%, while the worst-performing was the Nasdaq OMX Wind™ (GRNWIND™), which came in flat for the month. The Nasdaq Green Economy indexes gained 7.4% on average over the last month and was the second-best performer among the suite of indexes.

Nasdaq Crypto Indexes

All four of the Nasdaq Crypto Indexes moved higher in February, registering the highest average gains among the suite of indexes. The Nasdaq Ethereum Index™ (NQETHS™) was the relative outperformer, gaining 46.4% while Nasdaq Bitcoin™ Index (NQBTCS™) was the relative underperformer, gaining 42.2%. Investor sentiment towards cryptocurrency has improved due to the recent SEC approval of bitcoin ETFs and the anticipation of three major crypto catalysts in the coming months, including the upgrade of the Ethereum network.

The strong performance of the Nasdaq suite of indexes in the month of February reflects recent optimism among investors, largely driven by continued interest in AI and crypto along with strong economic data. Strong earnings from tech giants including Nvidia and Meta have strengthened the ongoing narrative surrounding AI. Investor concerns have likely been allayed by recent results as they consider whether the AI-fueled boom has more room to run. Along with AI, cryptocurrency has caught the attention of investors as several positive developments for the industry trickle in. Robust economic data in the fourth quarter along with easing inflation measures are keeping ‘soft landing’ hopes alive, further boosting investor sentiment.

Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED.

© 2024. Nasdaq, Inc. All Rights Reserved.