Nasdaq Index Performance: December 2023

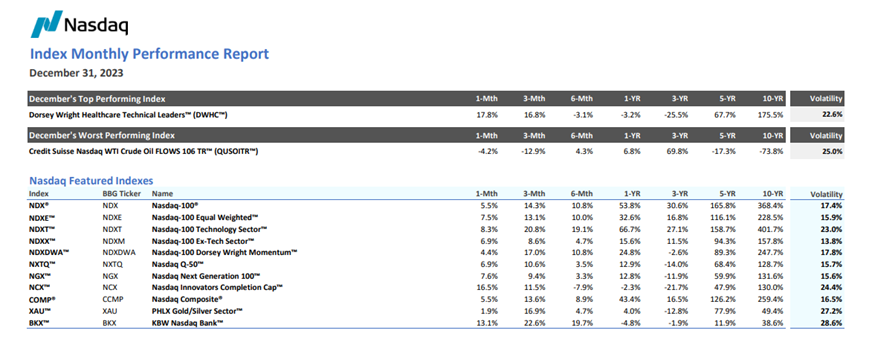

Performance was overwhelmingly positive for the month of December across the 106 indexes tracked in this report, with all but five indexes finishing in positive territory. The average return across all 106 indexes was 7.1%, which followed the best average monthly performance of the year in November. The Nasdaq-100® (NDX®) was up another 5.5%, bringing its performance for the year up to 53.8% on a price return basis. The best-performing index was the Nasdaq Dorsey Wright Healthcare Technical Leaders™ (DWHC™) which gained 17.8%, while the worst-performing index was once again the Credit Suisse Nasdaq WTI Crude Oil FLOWS 106 TR™ (QUSOITR™) which declined by 4.2%, following a 5% drop in November. Overall, there was strength across most areas, with some of the largest gains within the Nasdaq Thematic Tech Indexes, Nasdaq Thematic ESG Indexes and Nasdaq Green Economy Indexes, each of which were up 8-9% on average, while Nasdaq Crypto Indexes were all up by double digits.

Within the Nasdaq Featured Index lineup, the Nasdaq Innovators Completion Cap™ (NCX™) was the relative outperformer, up 16.5% after underperforming throughout much of 2023. It was followed closely by the KBW Nasdaq Bank™ (BKX™) which gained 13.1% on top of a very strong November, but similarly faced a mostly challenging 2023. Both indexes remained negative for the year overall. The PHLX Gold/Silver Sector™ (XAU™) was the relative underperformer, gaining only 1.9% in December. Overall, the Nasdaq Featured Indexes registered average gains of 7.6%.

The Nasdaq US Small Cap™ (NQUSS™) was the relative outperformer of the nine Nasdaq Global Indexes, up 12.7%, while the second-best performer, the Nasdaq US Mid Cap™ was up 8.5%. The Nasdaq Emerging Markets™ (NQEM™) and Nasdaq US Large Cap™ (NQUSL™) were the relative underperformers, up only 4.0% and 4.2% respectively. Overall, the Nasdaq Global Indexes registered average gains of 6.2%.

The Nasdaq OMX Nordic Index suite gained 5.4% on average. The OMX Stockholm 30™ (OMXS30™) was the relative outperformer, up 7.3%. The laggard of the group was the OMX Helsinki 25™ (OMXH25™), up only 3.0%.

The Nasdaq Thematic Tech Indexes posted impressive gains of 8.3%, on average. The Nasdaq CTA Global Digital Payments™ (WALLET™) and Nasdaq Lux Health Tech™ (NQHTEC™) both gained 13.4% and were the top performers. Other indexes in related areas also outperformed, including Nasdaq Biotechnology® (NBI®) up 12.8%, and the KBW Nasdaq Financial Technology™ Index (KFTX™) up 12.6%. Semiconductors, as a broader thematic closely related to AI, also registered another strong month with PHLX Semiconductor™ (SOX™) and Nasdaq US Smart Semiconductor™ (NQSSSE™) registering gains of 12.1% and 12.5%. The relative underperformer of the thematic lineup was Nasdaq CTA Global Video Games & ESports™ (PLAYER™), which gained only 1.8%.

All but one index in the relative-strength driven suite of Nasdaq Dorsey Wright Indexes were up. As previously mentioned, Dorsey Wright Healthcare Technical Leaders™ (DWHC™) was the top performer with a gain of 17.8%, while Dorsey Wright Consumer Cyclicals Technical Leaders™ (DWCC™) was another strong outperformer, up 14.9%. Nasdaq Dorsey Wright DALI1™ (NQDALI™) was the relative underperformer, down 4.0%. On average, the Nasdaq Dorsey Wright index suite was up 7.0%.

All Nasdaq Dividend and Income Indexes were up for the month of December. The Nasdaq US SMID Cap Rising Dividend Achievers™ (NQDVSMR™) was the relative outperformer, continuing the broad trend of strength witnessed across small and midcaps last month, up 11.9%. The Nasdaq US Multi-Asset Diversified Income™ (NQMAUS™) was the weakest performer, up only 3.4%. Overall, the Dividend and Income index suite was up 5.9%, on average.

All but two indexes in the Nasdaq Options Suite finished in the green with an average gain of 1.8%. The Nasdaq-100 Quarterly Protective Put 90™ (NQTRI™) was the relative outperformer once again, registering gains of 5.3%, while the Credit Suisse Nasdaq WTI Crude Oil FLOWS106 TR™ (QUSOITR™) was again the relative underperformer of the group, registering losses of 4.2%.

The suite of Nasdaq Thematic ESG Indexes posted average gains of 8.4%. Nasdaq Clean Edge Green Energy™ (CELS™) was the relative outperformer, registering gains of 15.5% after struggling throughout much of 2023. The Nasdaq Sprott Nickel Miners™ (NSNIKL™) was the relative underperformer, registering losses of 1.9%.

The Nasdaq Green Economy Indexes registered average gains of 9.1%. The Nasdaq OMX Solar™ (GRNSOLAR™) was the relative outperformer, up 11.5%, while the Nasdaq OMX Green Economy™ (QGREEN™) was the relative underperformer, up 7.0%. Nasdaq OMX Wind™ (GRNWIND™) continued its late-year rebound with a gain of 11.0%, but still ended 2023 with a full-year loss of 15.4%.

Finally, all four of the Nasdaq Crypto Indexes posted gains, up 13.4% on average. The relative outperformer was the Nasdaq Crypto Index Europe™ (NCIES™), up 16.4%, while the relative underperformer was Nasdaq Bitcoin™ (NQBTCS™), up 11.5%

The Nasdaq-100 finished the year strong, notching one of the best full-year performances in its history with a gain of nearly 54%. Stocks continued the rally that got going in early November as market participants digested more economic data around cooling inflation, supporting the notion that the Federal Reserve will loosen monetary policy sooner than had been expected throughout much of 2023. This rally was a stark reversal from the August-October sell-off which saw investors weighed down by concerns surrounding higher Treasury yields, a drop in consumer confidence and a new geopolitical conflict in the Middle East. While the biggest technology companies continued to register solid gains to close out the year, the market rally gained considerable breadth and expanded to areas that underperformed throughout much of 2023, especially small caps, biotech/healthcare, clean energy, and financials. As the new year arrives, investor sentiment appears to be cautiously optimistic as a soft-landing narrative continues to gain traction and the technology sector remains well-positioned for growth with expanding adoption of AI.

Disclaimer:

Nasdaq®, Dorsey Wright®, DWA® are trademarks of Nasdaq, Inc., and its licensors (which with its affiliates is referred to as the "Corporations").

Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED.

© 2024. Nasdaq, Inc. All Rights Reserved.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.