Nasdaq Composite Index™: 50th Anniversary Brings New Records and Further Optimism

The Nasdaq Composite Index (COMP) was launched on February 5, 1971, and includes all domestic and international stocks listed on the Nasdaq Stock Market. It tracks more than 3,000 companies using a straightforward market capitalization weighting scheme, with constituents determined each day. There is no minimum requirement for market cap, liquidity, float, geography, industry/sector, or any other eligibility criteria besides being Nasdaq-listed. Over the course of its 50-year history, the Nasdaq Composite has grown exponentially in terms of the number of companies tracked, aggregate market cap, and its overall importance to the U.S. and global equity markets. It provides exposure to the same companies that are in the well-known Nasdaq-100, along with several thousand smaller companies operating primarily in the Technology, Consumer, Healthcare, and Financial sectors.

Index Composition

The top 20 constituents account for more than half (54%) of COMP’s index weightings, with 10 of the top 20 classified as Technology companies (per ICB). As of September 30, 2021, the top 10 had a combined weight of approximately 46%, while the top 5 represented approximately 37%. Clearly, the Nasdaq Composite’s performance is heavily dependent on the strength of its largest members, who also happen to be not only the largest companies in the U.S. but globally as well. The top 5 – especially Apple, Microsoft, Amazon, Alphabet, and Facebook – have all matured into $1 trillion-plus market cap companies with multiple product lines, diversified revenue streams, and globalized customer bases. This group represents the new “diversified industrials” of the 21st century, similar to how companies like GE grew to become the biggest, most important companies in the 20th century.

In terms of overall sector exposures, the Nasdaq Composite is slightly less concentrated in Technology than the Nasdaq-100, with a weight of 48.4%. Health Care is one of the larger sector exposures, as is Financials (which are methodologically excluded from the Nasdaq-100). Moving beyond strict sector definitions, certain Consumer Discretionary names such as Amazon, Tesla, and Netflix blur the lines between what truly qualifies as a Technology company per traditional sector classification systems. Even within Health Care, Moderna has established itself as a uniquely innovative company employing cutting-edge biotechnology to usher in a new age of faster, more efficient, and more effective vaccine discovery and production. Of the 1,024 companies in COMP classified as Health Care, more than half – 649 – fall within the Biotech sub-classification.

And in terms of geographical exposure, the Nasdaq Composite includes 650 non-US companies that choose to list on the Nasdaq Exchange – either via primary or secondary listing. The largest source of non-US listings tends to be China, representing just over 1% of index weight, with ADRs from companies including Pinduoduo, JD.com, and Baidu. The rest of the world, ex-US, ex-China, recently represented just over 5% of COMP’s index weight.

Index Performance

On a price-return basis, the Nasdaq Composite has increased by 536.7% since the end of 2009 (as of September 30, 2021), trailing the performance of the Nasdaq-100 but still significantly outperforming the returns of the S&P 500 (up 286.3%) as well as the MSCI World Index (157.3%). The strong track record of outperformance over the past full decade has continued into 2020 and 2021, despite the challenges of the Covid-19 pandemic. Notably, COMP’s drawdown in March 2020 was less severe than either the S&P 500 or the MSCI World Index, and its recovery from the lows on March 23 was faster. Since then, these two benchmark indexes have increased by 50.3% and 47.8%, respectively, vs. 62.8% for the Nasdaq Composite. With its overweight allocations to companies in the Technology industry as well as other “tech-adjacent” sectors with innovation at the forefront, the companies in the Nasdaq Composite index were less likely to experience severe economic disruption from the pandemic. Their outsized exposure to the “new economy” not only created additional outperformance but also helped facilitate the transition of large segments of the global economy to stay-at-home.

Financial & Fundamental Analysis

The impressive outperformance of the Nasdaq Composite over the past decade-plus naturally invites comparisons to the 1990s, a similar period of outperformance vs. broad equity market benchmarks. By reviewing the growth trends of various financial indicators of fundamental strength, this notion quickly dissipates into irrelevance. Simply put, the companies in the index do not closely resemble their predecessors from two or three decades ago. The largest 200 or so companies that make up more than 80% of COMP’s weightings very closely overlap with the Nasdaq-100 and the Nasdaq Next Generation 100 Indexes (with the exception of a few examples in the Financials industry that neither index accepts as constituents, per methodology); these companies have grown their revenues, earnings, dividends, and cash flows at elevated rates vs. the broader market for a prolonged period of time. Valuations are nowhere near the eye-popping levels leading up to the bursting of the Tech/Internet Bubble two decades ago. Instead, fundamental strength is deep and broad-based, positioning the index for a stable future.

Revenue

The aggregate annual revenues of companies in the Nasdaq Composite Index increased from $1.2 trillion as of January 31, 2003 (the earliest date with sufficient data) to $5.3 trillion as of July 30, 2021, a compound annual growth rate (CAGR) of 8.2% and a cumulative growth of 329.1%. On the other hand, the weighted average revenue of each company was $10.6 billion in 2002, increasing to $116.4 billion as of July 30, 2021. The cumulative growth rate was 995.2%, translating to a CAGR of 13.8% during the period. The revenue growth trend for Nasdaq-listed companies has not only been continuous over the course of the past two decades but has also accelerated in the most recent five years. As the largest companies listed on the exchange have grown exponentially, the rate of growth in the index’s weighted average revenue has significantly outpaced the growth in the aggregate total.

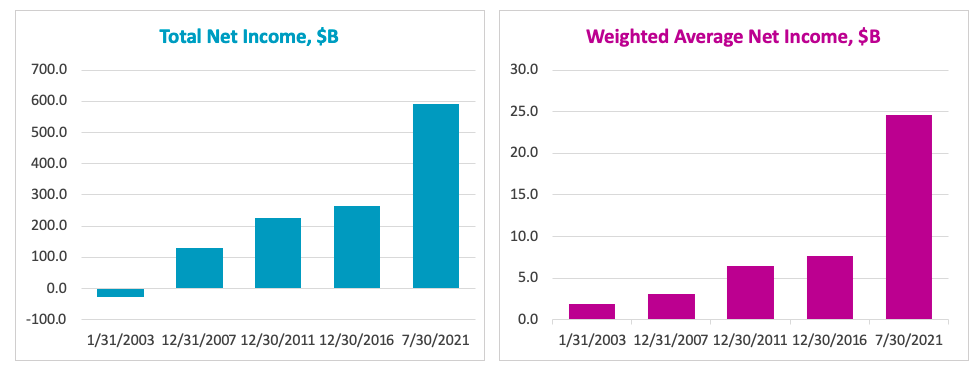

Earnings

Aggregate net income for all companies in the Nasdaq Composite amounted to a loss of $27.0 billion as of January 31, 2003. This was driven by a substantial percentage of companies in the index recording a net loss over the course of the trailing twelve months – 1,280 unprofitable companies in total out of 3,551 in the index, representing 19.3% of index weight.1 Net income turned positive in 2007 and stood at $131.5 billion, rising to $590.3 billion in July 2021. Net income thus grew at an overall rate of 349.0% and a CAGR of 11.7% between 2007 and 2021. Despite aggregate net income being negative in our first observation, the weighted average net income was $1.9 billion in 2002, increasing to $24.6 billion in 2021. The cumulative growth rate and CAGR were 1,222.2% and 15.0%, respectively. Both metrics illustrate a sharp improvement in the fundamental strength of the companies in the index compared to the early 2000s, as well as an acceleration in growth during the most recent five years – but at an even faster rate than revenue. This suggests many companies in the index are increasing their operating leverage.

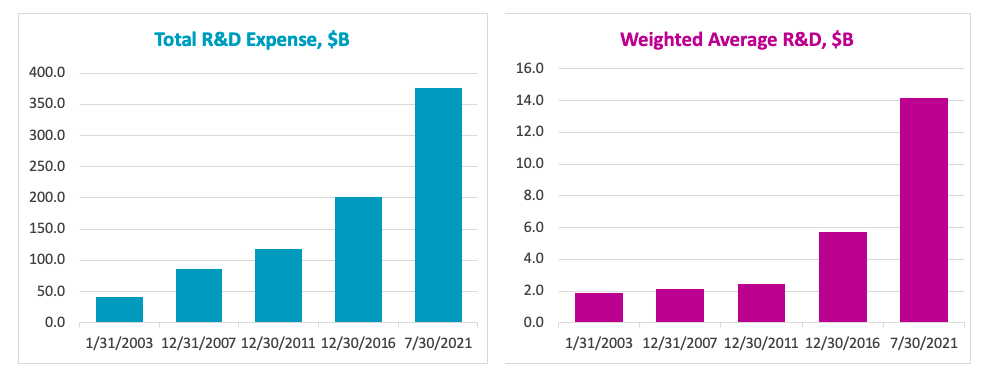

Research and Development (R&D) Expense

The R&D budgets of Nasdaq-listed companies truly ballooned over this timeframe, growing by 803.1% from $41.7 billion to $376.8 billion, equivalent to a CAGR of 12.6%. On a weighted average basis, R&D expense grew from $1.9 billion to $14.2 billion in 2021, an increase of 644.5% and a slightly lower CAGR of 11.5%. Growth has been steady throughout the entire period, with a pronounced acceleration in the most recent decade. R&D as a percentage of revenue also increased from 4.5% in 2011 to 7.1% in 2021, a reflection of the growing importance of innovation as both an investment theme and a prerequisite to fundamental strength in the new economy of the 21st century.

Dividends

Perhaps the most impressive change in the fundamental story of these companies was the growth in their cash dividends, from only $6.6 billion to $151.9 billion, an overall growth rate of 2,210.7% and an equivalent CAGR of 18.5%. On a weighted average basis, growth rates were almost identical. A strong growth trend in dividends not only indicates widespread improvements to these companies’ financial health but also signals their managements’ confidence in the future to maintain payouts to shareholders with stable business models. This was simply not the case two decades ago, around the time of the Internet/Tech bubble.

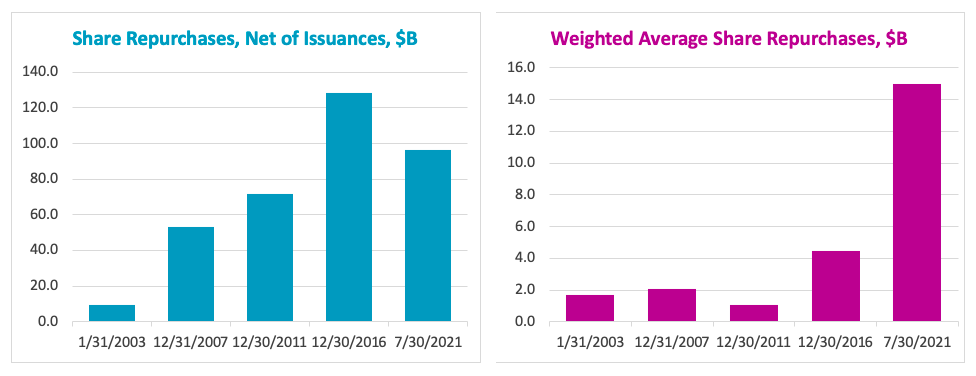

Share Repurchases, Net of Issuances

Dividends are only one part of the aggregate shareholder capital return story, though. Buybacks have also become much more commonplace among Nasdaq-listed companies, with recent years seeing $100 billion or more in share repurchases, net of issuances. The overall growth here was 949.7% or a CAGR of 13.5%. On a weighted average basis, growth was somewhat lower but also occurred in different years. Splitting up the index into quintiles by index weight (20% each) illustrates the disparities between companies in different size buckets.

Quintile 1 represents the largest few companies in the index (top 3 in 2011 & 2016, top 2 in 2021), and its growth rate of net repurchases soared by a factor of 48 from 2011 to 2021. Quintile 2, with 11/10/4 companies in 2011/2016/2021, respectively, saw net repurchases grow by only 44.5% in that time frame. Quintile 3, with 47/34/25 companies in 2011/2016/2021, respectively, saw net repurchases grow by a similar amount, up 57.6%. Quintile 4, with 1755/139/124 companies in 2011/2016/2021, saw growth by a factor of approximately 2. Finally, Quintile 5 – the 20% of Nasdaq Composite index weight with the smallest companies – saw the opposite: substantial growth in net issuance of equity. This group included 2,294 companies in 2011, 2,326 companies in 2016, and 3,210 companies in 2021. Share issuance, net of any repurchases, grew by a factor of 4 times between 2011 and 2016 and then grew again by a factor of 11 times between 2016 and 2021. Thus, even though overall index share repurchases (net of issuances) actually decreased from 2016 to 2021, the weighted average repurchase amount increased dramatically, as the likes of Apple and Microsoft (along with many other large-cap names in Quintiles 2-4) continued to grow their buybacks. Only the smallest companies in the index were diverging from this trend by issuing more shares, and as a group, they have shrunk in size as the biggest companies continue to get bigger.

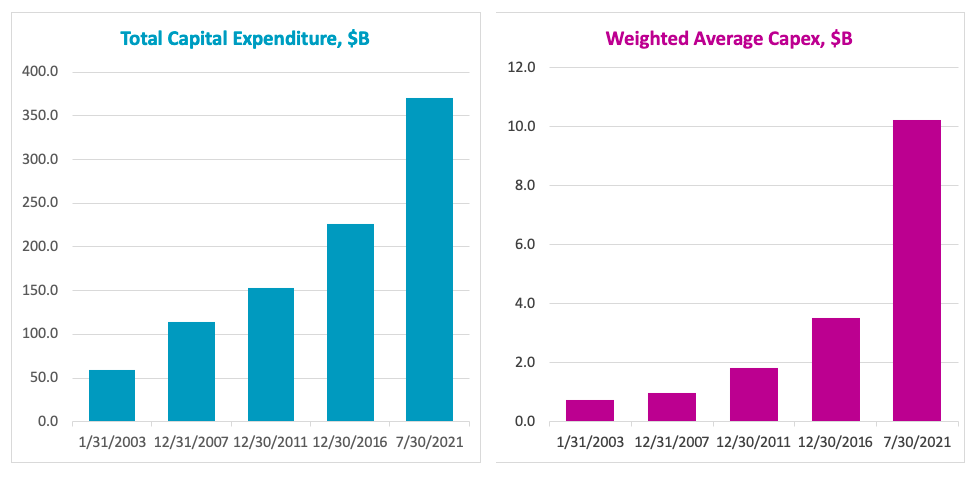

Capital Expenditure (Capex)

Moving beyond the return of capital to shareholders, the next area indicative of fundamental strength and robust growth is capital expenditures. Even though the Nasdaq Composite leans heavily on sectors such as Technology and Consumer Services – which tend to be lighter on tangible assets such as Plant, Property & Equipment, and heavier on intangible assets such as patents and software – the growth in Capex has been impressive, especially in recent years with a threefold increase in the weighted average per company since 2016. The aggregate annual capital expenditure across all companies increased by 529.0%, from $58.9 billion to $370.4 billion as of July 2021, equivalent to a CAGR of 10.45%. On a weighted average basis, companies in the Nasdaq Composite were spending $10.3 billion in annual Capex in 2021, a substantial amount but still lower than the $14.2 billion observed for R&D. Innovation requires both components but ultimately still tilts away from the fixed asset-heavy investment predominant in the 20th century and more in favor of the intangible investment driving economic growth in the 21st century.

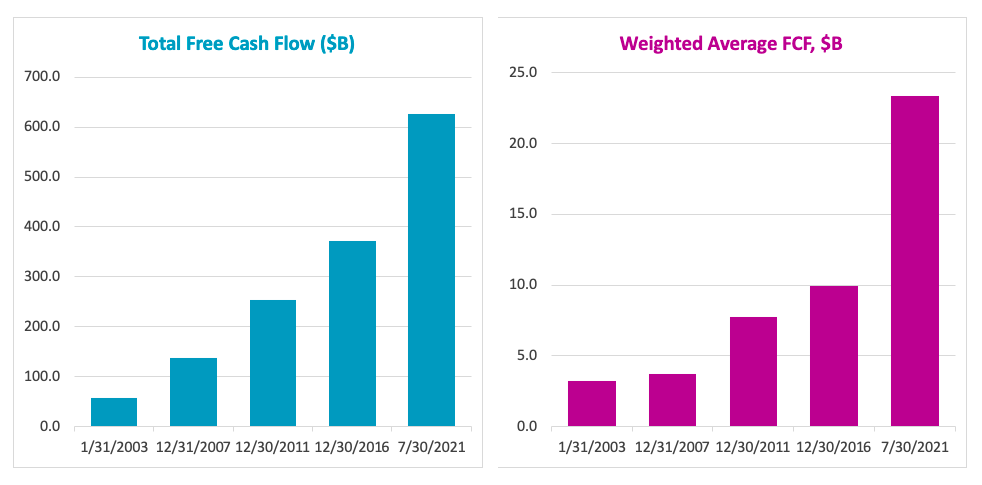

Free Cash Flow (FCF)

Finally, even with all of the growth in dividends, buybacks, capex and R&D, the growth trend of free cash flow (FCF) remained similarly robust with an increase of nearly 1,000% in aggregate, or at a CAGR of 13.8% over the nearly two decade-long period. The ability of this group of companies to grow FCF so dramatically would, on its own, be worthy of praise; in the face of all the various growth metrics analyzed, several of which directly result in a cash drain, it is all the more impressive and indicative of a healthy financial story for the index. As the Nasdaq Composite continues to set new records at a regular pace, market observers and investors should consider the breadth and depth of fundamental strength at the index level whenever encountering the suggestion that the current day is simply version 2.0 of the late-90s Tech/Internet Bubble.

Summary

The Nasdaq Composite Index tracks all Nasdaq-listed companies regardless of size, sector, liquidity, geography, or float. While its performance is strongly correlated with the Nasdaq-100, it nevertheless offers a unique way to access the innovation-driven business models that disproportionately characterize Nasdaq-listed companies. In addition to the largest, most well-known names, COMP includes thousands of smaller companies in sectors such as Health Care and Financials, which are much less prominent or excluded altogether methodologically (Financials) in the Nasdaq-100. Outperformance vs. broader equity market benchmarks has been strong, consistent, and long-running. It has been underpinned by fundamental strength across COMP’s largest constituents, and evident when digging into company financials and aggregating data at the index level to analyze historical trends. Given how much the index has matured over the past two decades, the future does indeed look bright for this unique group of technology-focused companies.

Products currently tracking the Nasdaq Composite Index include the Fidelity Nasdaq Composite Index ETF (Nasdaq: ONEQ) and the Fidelity Nasdaq Composite Index Fund (FNCMX).

Sources: FactSet, Bloomberg, Nasdaq Global Indexes.

1. 1,533 companies representing 71.1% of index weight recorded positive net income for the trailing twelve-month period as of January 31, 2003. The remaining 738 companies representing 9.6% of index weight did not have available data to analyze financial statements from 2002.

Contact Us for More Information

Global Indexes