Nasdaq and Sustainalytics: ESG Meets the Nasdaq Next Generation 100 Index™

Introduction

The Nasdaq Next Generation 100 ESG Index™ (NGXESG™) launched on July 22, 2021, leveraging Morningstar’s industry-leading Sustainalytics ESG data and methodology to ensure all constituents meet specific ESG criteria. While the Nasdaq Next Generation 100 ESG Index is broadly similar to the Nasdaq Next Generation 100 Index in terms of its constituents, sector exposures, and overall return/risk profile, there are several meaningful differences worth analyzing. Let’s first take a deep dive into the Sustainalytics approach to ESG and how Nasdaq employs its data in NGXESG. Thereafter, we will review the Nasdaq Next Generation 100 ESG Index components today, in tandem with how and why the index differs from the Nasdaq Next Generation 100 Index. We will close with competitive positioning against other large-cap and ESG indexes.

What is the Nasdaq Next Generation 100 Index?

The Nasdaq Next Generation 100 Index is comprised of the 100 largest domestic and international non-financial companies listed on The Nasdaq Stock Market that are not in the Nasdaq-100®.

What is ESG?

ESG is a well-documented acronym that stands for Environmental, Social and Governance.

According to the CFA Institute, “Investors are increasingly applying these non-financial factors as part of their analysis process to identify material risks and growth opportunities.

ESG metrics are not commonly part of mandatory financial reporting, though companies are increasingly making disclosures in their annual report or in a standalone sustainability report. Numerous institutions, such as the Sustainability Accounting Standards Board (SASB), the Global Reporting Initiative (GRI), and the Task Force on Climate-related Financial Disclosures (TCFD), are working to form standards and define materiality to facilitate incorporation of these factors into the investment process.”1

ESG Risk Ratings – Methodology Overview

The application of Sustainalytics’ ESG Risk Ratings to the Nasdaq Next Generation 100 Index universe of companies facilitates the construction of the NGXESG index, both in terms of its constituents and their weights. At a high level, these risk ratings measure not only the exposure of a company to various ESG issues at a certain threshold of materiality but also their management of those issues. Thus, it is entirely plausible that a company with above-average exposure to ESG issues may score lower (i.e., better, in terms of its final ESG risk rating) than a company with below-average exposure, assuming it has superior issue management. Per Sustainalytics, the scoring of management takes into consideration a company’s preparedness as well as its track record by evaluating policies, programs, management systems and controversies. Unmanaged risk, therefore, determines the final risk rating after adding across the net impact of each material ESG issue for a given company. For many companies, the Unmanaged Risk will be a combination of systemic risk exposures, as well as a “management gap” – exposure that exists but could be reduced with the appropriate strategy.

This approach allows for a “like-for-like” comparison of companies’ ESG risks across different industries since one unit of risk for one issue is equivalent to one unit of risk for another issue (i.e., a “single currency” to measure risk). In addition to the evaluation of material ESG issues, the risk rating also includes a full-bore assessment of Corporate Governance. Lastly, while they rarely occur, Idiosyncratic ESG issues (with a weight of zero until a highly significant event occurs) are also considered.

Companies with a “Severe” ESG Risk Rating are automatically disqualified from inclusion in NGXESG. A rating of greater than 40 is considered “Severe”; 30-40 is considered “High”; 20-30 is “Medium”; 10-20 is “Low”; and 0-10 is “Negligible.”

Sustainalytics’ ESG Risk Ratings are unique thanks to their:

- Focus on Materiality, with respect to issues only of financial significance;

- Granularity, with respect to model specifications done at the subindustry level, plus company-level refinement via beta factors and company-specific indicator disablements;

- Forward-Looking nature, as a result of explicitly quantifying exposure, as well as offering an “outlook” for every controversy assessed;

- Controversy Discounting Effect applied to management scores that increases with severity (with daily monitoring of controversies via tens of thousands of sources from around the world);

- Strong Foundation, by using the full Corporate Governance rating as a baseline (scoring areas such as Board/Management Quality & Integrity, Board Structure, Ownership & Shareholder Rights, Remuneration, Audit & Financial Reporting, and Stakeholder Governance); and

- Comparability, the “like-for-like” quality described above.

NGXESG Methodology Highlights

The index, at all times, consists of a selection of securities from the Nasdaq Next Generation 100 Index. While the Nasdaq Next Generation 100 Index (NGX™) is annually reconstituted each December, the Nasdaq Next Generation 100 ESG Index is reconstituted on a quarterly basis (in March, June, September, and December), at which time the ESG characteristics of all issuers are reviewed. Securities removed from NGX outside of reconstitution are removed from NGXESG and are not replaced.

NGXESG Exclusions

NGXESG’s screening process considers 15 problematic areas of business activity at the company level, with Sustainalytics assessing the absolute level of involvement via percentage thresholds of revenue derived from each area, as well as the category of involvement (core operations/production vs. sales/distribution vs. ownership level of an asset or business, etc.). The full list of activities can be found in the index methodology. The product breakdown covered can be grouped into four broader themes:

- Energy (Arctic oil & gas, nuclear power, oil & gas, oil sands, shale energy, thermal coal)

- Health & Life (Alcohol, recreational cannabis, tobacco)

- Defense & Military (Controversial weapons, military contracting, riot control, small arms)

- Values-Based (Adult entertainment, gambling)

Nasdaq Next Generation 100 Index companies that are involved in any of these activities are not permitted for inclusion into NGXESG; with some exceptions (e.g., alcoholic beverages), minimal levels of involvement are permissible.

Sustainalytics monitors whether securities violate any of the 10 principles around human rights, labor, environment, and anti-corruption from the United Nations Global Compact.

Securities are excluded from NGXESG that are classified as non-compliant, ensuring that each company in the index is either compliant or on the watch-list with the UN Global Compact framework for following international norms.2

Exclusions will also result from a Category 5 score (the most severe of categorical scores on a scale of 1-5) for any material controversy affecting a company. The controversy rating reflects a company’s level of involvement in and how it manages incidents with negative ESG implications.

Putting it together with the exclusions from “Severe” ESG Risk Rating Score, there are multiple levels of screening to ensure controversial companies with poor performance across any E, S, or G factor will not make it into NGXESG.

NGXESG Weighting

The index is a modified market capitalization-weighted index that considers a company’s ESG Risk Rating Score as an adjustment factor. The process of calculating weights is rather straightforward. The ESG Risk-Adjusted NGX Market Value is calculated for each Index Security as follows:

Initial security weights are calculated by dividing a security’s ESG Risk-Adjusted NGX Market Value by the sum of the ESG Risk-Adjusted NGX Market Values of all Index Securities. Afterward, the same weight adjustment process as exists for NGX is applied to produce final weights on a quarterly basis for NGXESG, wherein any security has a max weight of 4%. Everything else equal, the higher the weight in the Nasdaq Next Generation 100 Index and/or the better ESG risk rating, the higher the weight in the NGXESG Index, and vice versa.

ESG Risk Rating Example – Zebra Technologies (ZBRA)

In the case of Zebra Technologies, Sustainalytics assessed exposures to six material ESG issues, only one of which – Corporate Governance – was considered high. Coupled with the average management of these various exposures, the net risk of Zebra Technologies is considered low, and only one area – Corporate Governance – received an ESG Risk Rating of medium or higher. ZBRA’s momentum has also been trending in the right direction, with a drop in its ESG Risk Rating since 2020, driven by increasing Management Scores across its portfolio of ESG issues. Currently, ZBRA’s ESG Risk Rating Score sits at the low end of the low-risk category (between 10-20), with a score of 12.8.

Data as of 9/30/2021.

ESG Risk Rating Example – Horizon Therapeutics (HZNP)

Unlike Zebra Technologies, which earned a higher weight in NGXESG than in NGX, Horizon Therapeutics saw its weight reduced in proportion to its higher (i.e., worse) ESG Risk Rating. Sustainalytics assessed exposures to eight material ESG issues, three of which were considered to be high for HZNP: Product Governance, Business Ethics, and Corporate Governance. Furthermore, five issues earned weak management ratings, resulting in four “medium” ESG Risk Ratings (compared to ZBRA’s single one), plus one “severe” rating. The Unmanageable Risk portion of the Exposure Score also came in at almost five times the level of Zebra Technologies. HZNP’s momentum has been stagnant, with only a marginal year-over-year improvement in its overall risk rating, driven by a slightly improved Management Score. Currently, Horizon Therapeutics’ ESG Risk Rating Score sits at the high end of the high-risk category (between 30-40) with a score of 37.6.

Data as of 9/30/2021.

Current Composition

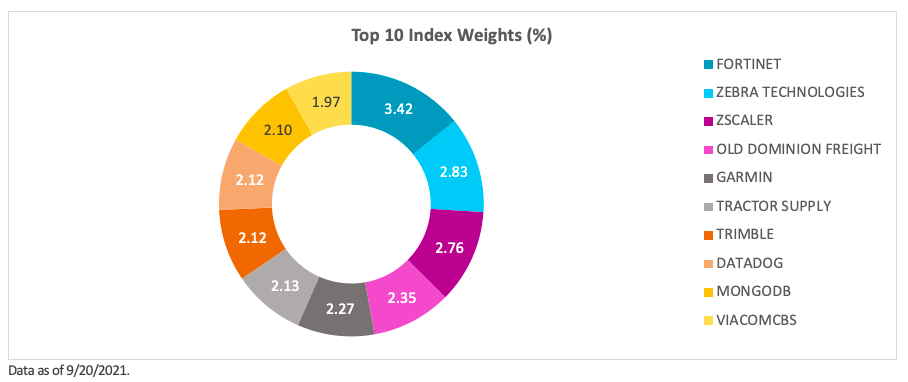

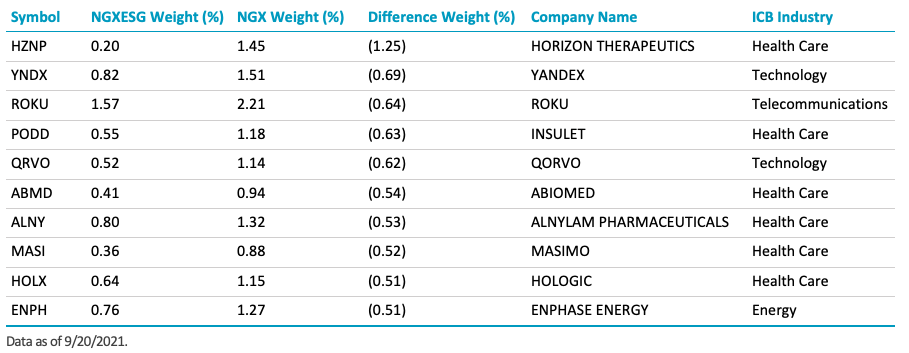

Of the 93 constituents in NGXESG, the top 10 represented 24.1% of the index weight as of September 20, 2021, the effective date of the most recent quarterly reconstitution. The largest of these was Fortinet (FTNT) and Zebra Technologies (ZBRA), whose upsized weightings versus NGX are a function of their lower overall ESG risk exposures and average execution of ESG risk management – at least compared to Horizon Therapeutics (HZNP) and Yandex (YNDX), whose weightings are lower vs. the standard Nasdaq Next Generation 100 Index. Below is an overview of the top 10 most significant overweights vs. NGX:

Below are the top 10 most significant underweights:

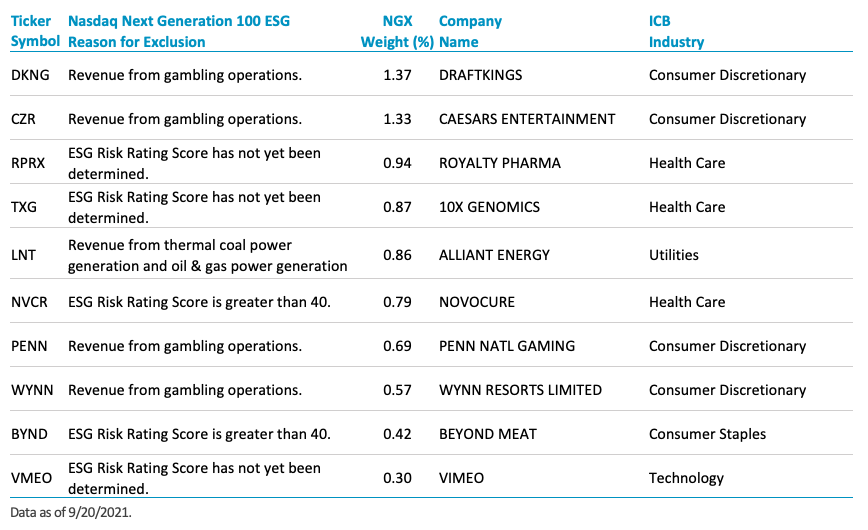

Overall, 58 constituents earned higher index weights in NGXESG vs. NGX with an average weight increase of 0.32%, and 35 constituents earned lower weights with an average decrease of 0.25%. In addition, the following 10 companies were fully disqualified from inclusion in NGXESG, either due to specific controversial exclusion rules – or in the case of Royalty Pharma, 10X Genomics, and Vimeo – insufficient Sustainalytics data:

The resulting weight differences across sectors were most pronounced in Health Care (as defined by the Industry Classification Benchmark), with a decrease of 7.1 percentage points vs. NGX to 12.7%, and in Technology and Industrials, with increases of 4.8 and 4.0 percentage points to 39.7% and 16.0%, respectively. Consumer Staples disappeared entirely as an industry exposure due to the exclusion of Beyond Meat. The remaining industry exposures of any significance were Consumer Discretionary and Telecommunications, with minor residual exposures to Energy, Utilities, and Basic Materials.

Performance Overview

The Nasdaq Next Generation 100 ESG Total Return Index (NGXESG) has marginally outperformed the Nasdaq Next Generation Total Return Index™ (NGXT™), while modestly underperforming the S&P MidCap 400 Total Return Index (SPTRMDCP), the S&P MidCap 400 Sustainability Screened Index (SP4ESUT), and the S&P MidCap 400 ESG Total Return Index (SPMESUT) in the first nine months of 2021, with a gain of 11.9% vs. 9.8%, 15.3%, 16.3%, and 14.4%, respectively (as of September 20, 2021):

On a longer time horizon dating back to the beginning of the NGXESGT backtest in March 2016, it is evident that minor tracking error exists vs. NGXT (2.80% annualized). The significant outperformance of the Nasdaq Next Generation 100 against the broader US midcap equity market, as measured by the S&P MidCap 400 Total Return Index, extends into the ESG universe of benchmarks, including the S&P MidCap 400 ESG Total Return Index (SPMESUT) and the S&P MidCap 400 Sustainability Screened Index (SP4ESUT):

ESG Comparisons

The Nasdaq Next Generation 100 Index by itself has a compelling ESG narrative vs. its S&P Midcap peer. As a result of the screens employed in the Nasdaq Next Generation 100 ESG Index, 11 securities were removed (as of July 30, 2021, shown below). For context, the Nasdaq Next Generation 100 Index has an approximately 11% lower weighted average Sustainalytics ESG Risk Rating Score than the S&P MidCap 400 Index. Furthermore, the Nasdaq Next Generation 100 Index has a lower ESG Risk Rating than two S&P MidCap 400 ESG indexes in the table below.

Now let’s see how the Nasdaq Next Generation 100 ESG Index shapes up versus the competition.

The Nasdaq Next Generation 100 ESG Index benefits from a material drop in its ESG Risk Rating Score, approximately 12% lower than the Nasdaq Next Generation 100 Index. NGXESG is also approximately 20% lower than the two S&P MidCap 400 ESG-focused indexes. Reiterating from above, the Nasdaq Next Generation 100 ESG Index registered an 11% drop in the number of constituents from the Nasdaq Next Generation 100 Index to achieve this new ESG stature, achieving the lowest score among the alternative midcap ESG indexes present in the analysis. By comparison, the S&P MidCap 400 ESG Index dropped 32% of the securities from its parent index to achieve stronger ESG Risk Rating Scores, while the Sustainability-Screened version dropped approximately 7%. Of course, these ESG other indexes may not use Sustainalytics exclusively, and there are different scores and processes associated with these other strategies.

Be that as it may, the results are still quite impressive.

Summary

The Nasdaq Next Generation 100 ESG Index was designed with the following objectives in mind:

- Reduce the degree to which the portfolio’s economic value is at risk because of ESG factors, or more technically, aim to significantly improve the portfolio’s ESG score;

- Exclude enterprises that create reputational risks or violate fundamental values;

- Eliminate business exposures that are off-limits for most ESG-conscious investors; and

- Aim to deliver similar performance to the Nasdaq Next Generation 100 Index (very low tracking error).

The Nasdaq Next Generation 100 ESG Index achieves all of these objectives while handily outpacing the competition from both a performance (over the longer time horizon) and ESG Risk Rating Score perspective.

Sources: Sustainalytics, FactSet, Bloomberg, Nasdaq Global Indexes.

1. https://www.cfainstitute.org/en/research/esg-investing

2. A company is assessed as a watch-list if it is determined to be at risk of contributing to severe or systemic and/or systematic violations of international norms and standards. A company is assessed as a watch-list when it is determined to be:

- Causing or contributing to severe negative impacts (harm) to stakeholders and/or the environment, but for which not all requirements for a Non-Compliant status could be established (e.g., company accountability cannot be confirmed);

- Accountable for negative impacts, but there is insufficient information to determine that the company is violating international norms;

- Linked to a violation of international norms, but the negative impacts are not severe enough to warrant a Non-Compliant status, or the negative impacts are still remediable;

- Improving its policies and programs to prevent a reoccurrence, having been assessed previously as Non-Compliant, and further monitoring is required due to pending resolutions or remediation efforts.

Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED.

© 2021. Nasdaq, Inc. All Rights Reserved.

Copyright © 2021 Sustainalytics. All rights reserved. This report contains information developed by Sustainalytics. Such information and data are proprietary of Sustainalytics and/or its third-party suppliers (Third-Party Data) and are provided for informational purposes only. They do not constitute an endorsement of any product or project, nor an investment advice and are not warranted to be complete, timely, accurate or suitable for a particular purpose. Their use is subject to conditions available at https://www.sustainalytics.com/legal-disclaimers

Global Index Watch (GIW)

Nasdaq’s Web-based Index Delivery Service

Contact Us for More Information

Global Indexes