By Anna V. Haotanto for The New Savvy

As an avid investor, I look at branded bags as a luxury. I often hear of women asking if a particular bag is “worth investing in”. Intrigued, I have always been curious whether buying a bag makes financial sense. With the recent astronomical increase in Chanel prices, I thought that it’ll be interesting to compare buying Exchange Traded Funds (ETFs).

For the purposes of comparison, let’s take the Chanel Medium Classic Flap and 10 years as our time horizon. Why Chanel? I think Chanel bags are desirable to most, a first big splurge for working women and more ubiquitous than Hermes bags.

What is the Nasdaq-100?

Nasdaq has been creating market-leading indexes for over 50 years. The business started with indexes tracking the world’s most innovative companies listed on Nasdaq, including the Nasdaq Composite, Nasdaq-100, and Nasdaq Biotechnology Indexes.

I chose the Nasdaq-100 index as it:

- Includes 100 of the largest domestic and international non-financial companies listed on the Nasdaq stock market based on market capitalization.

- Provides broad sector coverage, such as retail, biotechnology, industrial, technology, health care, and others.

What does this mean? The Nasdaq-100 covers brands that consumers like us are familiar with and love. Brands that we use in our everyday life. For example Starbucks, Apple, Zoom, Tesla, Moderna and more.

Holdings of Nasdaq-100

Here are the top 20 holdings of the Nasdaq-100 by market capitalisation. (As of 5th April 2022)

For the full list, head over to Quotes For NASDAQ-100 Index.

The S&P 100

In comparison, we look at S&P 100 which is a sub-set of the S&P 500. It is designed to measure the performance of large-cap companies in the United States and comprises 100 major blue-chip companies across multiple industry groups. The stocks in the S&P 100 tend to be the largest and most established companies in the S&P 500.

From the graphs below, we note a few differences between the S&P 100 and the Nasdaq-100.

As of 28th February 2022, the S&P 100 has 9.8% of financials in the sector breakdown where financials are not included in the Nasdaq-100.

You can also compare the differences in the holdings for both indexes.

Chanel Bags

Chanel bags need no introduction and for this comparison, I chose the Chanel 2.55 Flap bag, as according to Sotheby’s, it is “arguably the most famous Chanel bag of all time, the 2.55 Flap bag is a timeless icon”.

In 2011, a Chanel Medium Classic will cost you US$3900. It will be interesting to see how the value of the Chanel bag appreciates over the past decade, and when compared to the Nasdaq-100.

Source: Bag Hunter

How have the prices of Chanel changed over the years?

From Bloomberg, “Chanel has raised global prices on some of its classic handbags by almost two-thirds since the end of 2019.

Since November 2019, the price of Chanel’s small classic flap bag in the U.S. has gone up by 60% to $8,200, according to data compiled by Jefferies Group analyst Kathryn Parker. The large version of the handbag known as the 2.55 now costs $9,500 in the U.S. following Chanel’s latest price hike, the brand’s fourth in two years. It cost $7,400 in June, according to Parker.”

Source:Yoogi’s Closet

As you can tell, the Chanel bag prices have indeed appreciated astronomically.

If you have bought a Chanel Medium Classic in 2011 will cost you US$3900. In 2011, it will cost you $7800 on June 25th 2021, after a 14.7% annual price hike. (Pursebob). This is a whopping 200% return, not bad at all, considering most luxury good loses value the moment you buy them.

How has the Nasdaq-100 performed in the past 10 years?

How will the same US$3900 perform if you have invested in the Nasdaq-100 instead, from June 2011 to June 2021?

Source: Google Finance

As you can see, the Nasdaq-100 yielded a 475.48% return in a similar 10 year period. This means that for every $1, you will get back $4.75.

Sure, one can argue that in 2022, the markets have fallen quite drastically. Let’s compare it with today’s prices. (11th March 2022)

Source: Google Finance

The return has dropped to 419.75% if we compare it to March 2022 levels. 55.75% is indeed a big drop. However, your initial US$3900 would still be worth about US$16,370.25 today.

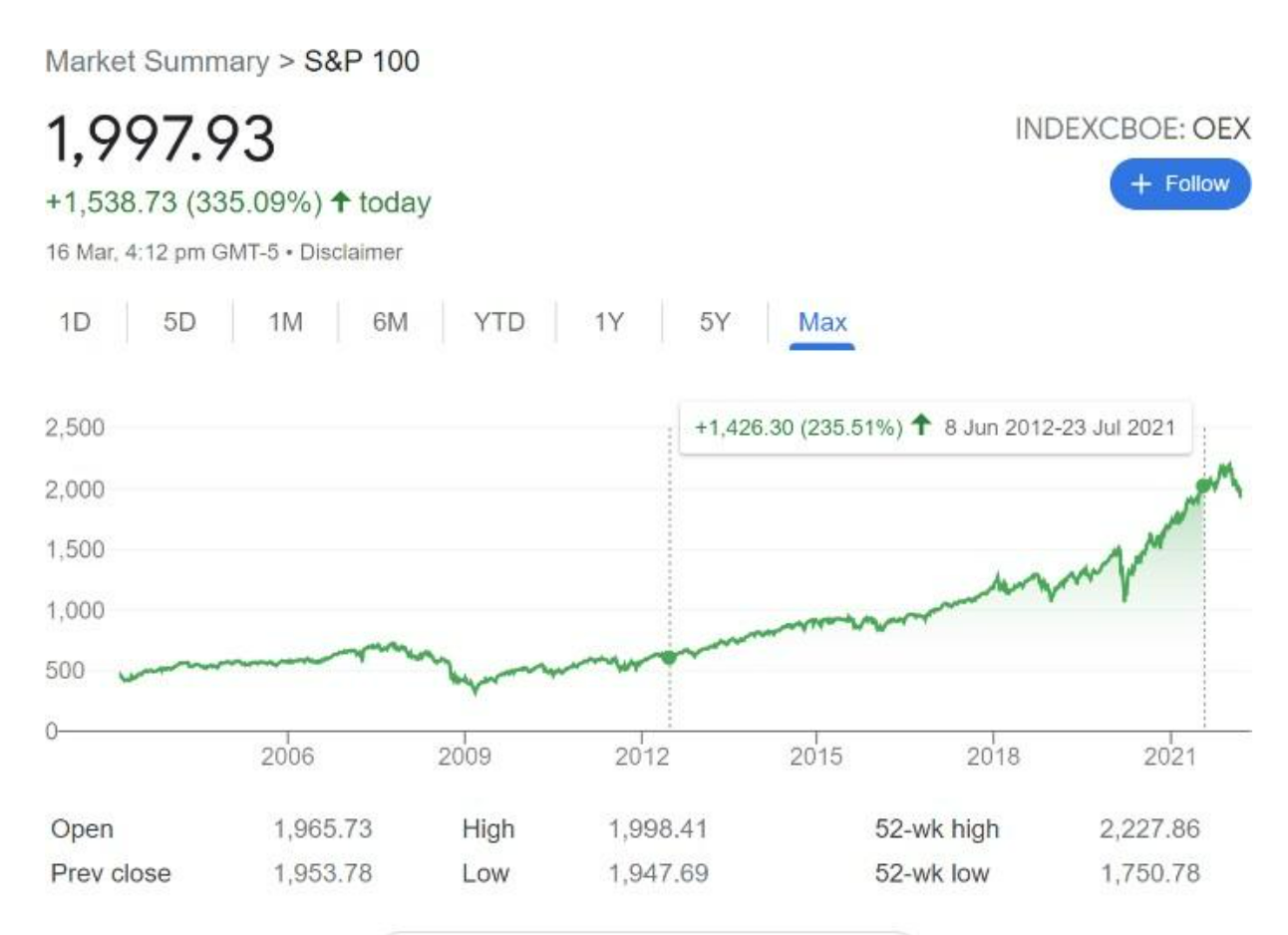

How has the S&P 100 performed in the past 10 years?

In comparison with the S&P 100, if we had invested $1 in 2012, we would have netted 235.51% return for the same period.

Source: Google Finance

Conclusion

Putting funds into a Nasdaq-100 index undoubtedly will give you a bigger monetary return. Of course, this is a simplistic, unemotional look at allocating one’s funds. I understand that we are not factoring in the joy and emotional attachment to rewarding yourself and enjoying the fruits of your labour. A luxury bag is often something one desires and can’t be quantified. This article is by no means trying to preach to make you feel guilty or that you shouldn’t buy any luxury item.

Instead, I hope that the main key takeaway you take from this article is to consider the opportunity costs and other potential investments you can make. Whenever you are buying something, do ask yourself if this is a necessity. If it’s purely a want, do you really need it? What are you sacrificing in return?

After all, delayed gratification, time in the market and being patient can help to reward you further in the long term.

How to Invest in the Nasdaq-100

Investors can check with their local ETF providers if they offer relevant products. If not, here are 2 ETFs available from the U.S. for your reference: QQQ, QQQM

Click https://www.nasdaq.com/global-indexes to understand more about Nasdaq Global Index

This post was written in collaboration with Nasdaq. The New Savvy is financially compensated for this article. Nonetheless, we strive to maintain our editorial integrity and review all investments and products in an objective and unbiased manner. We are committed to ensuring that the information collected and imparted is accurate and timely.

This is not financial advice and should not be considered one. Past performance is not indicative of future results.

Originally published on The new Savvy.

About the author

Anna Haotanto is the Advisor (former CEO) of The New Savvy. She is currently the COO of ABZD Capital and the CMO of Gourmet Food Holdings, an investment firm focusing on opportunities in the global F&B industry. She is part of the founding committee of the Singapore FinTech Association and heads the Women In FinTech and Partnership Committee. Anna is the President of the Singapore Management University Women Alumni. Anna invests and sits on the board of a few startups. Anna is also part of the Singapore Chinese Chamber of Commerce & Industry Career Women’s Group executive committee. Anna’s story is featured on Millionaire Minds on Channel NewsAsia. She hosts TV shows and events, namely for Channel NewsAsia’s “The Millennial Investor” and “Challenge Tomorrow”, a FinTech documentary. Anna was awarded “Her Times Youth Award” at the Rising50 Women Empowerment Gala, organised by the Indonesian Embassy of Singapore. The award was presented by His Excellency Ngurah Swajaya. She was also awarded Founder of the Year for ASEAN Rice Bowl Startup Awards. She was also awarded the Women Empowerment Award by the Asian Business & Social Forum. Anna has been awardedLinkedIn Power Profiles for founders (2018, 2017), Tatler Gen T, The Peak’s Trailblazers under 40 and a nominee for the Women of The Future award by Aviva

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

%20%7C%20Nasdaq&_biz_n=9&rnd=387220&cdn_o=a&_biz_z=1742604240888)

%20Q4%20Earnings%20and%20Revenues%20Beat%20Estimates%20%7C%20Nasdaq&_biz_n=11&rnd=131661&cdn_o=a&_biz_z=1742604240896)