12-month quantitative forecast

Our machine-learning model forecasts that the Nasdaq 100 will have a volatile move down to 11950 by June, a 17% drop from current levels, coinciding with its projected 3-year moving average price. Strong support is expected at that level, enough to propel the price 3.8% above its current position to 15000 by the end of the forecast period (Jan 2023).

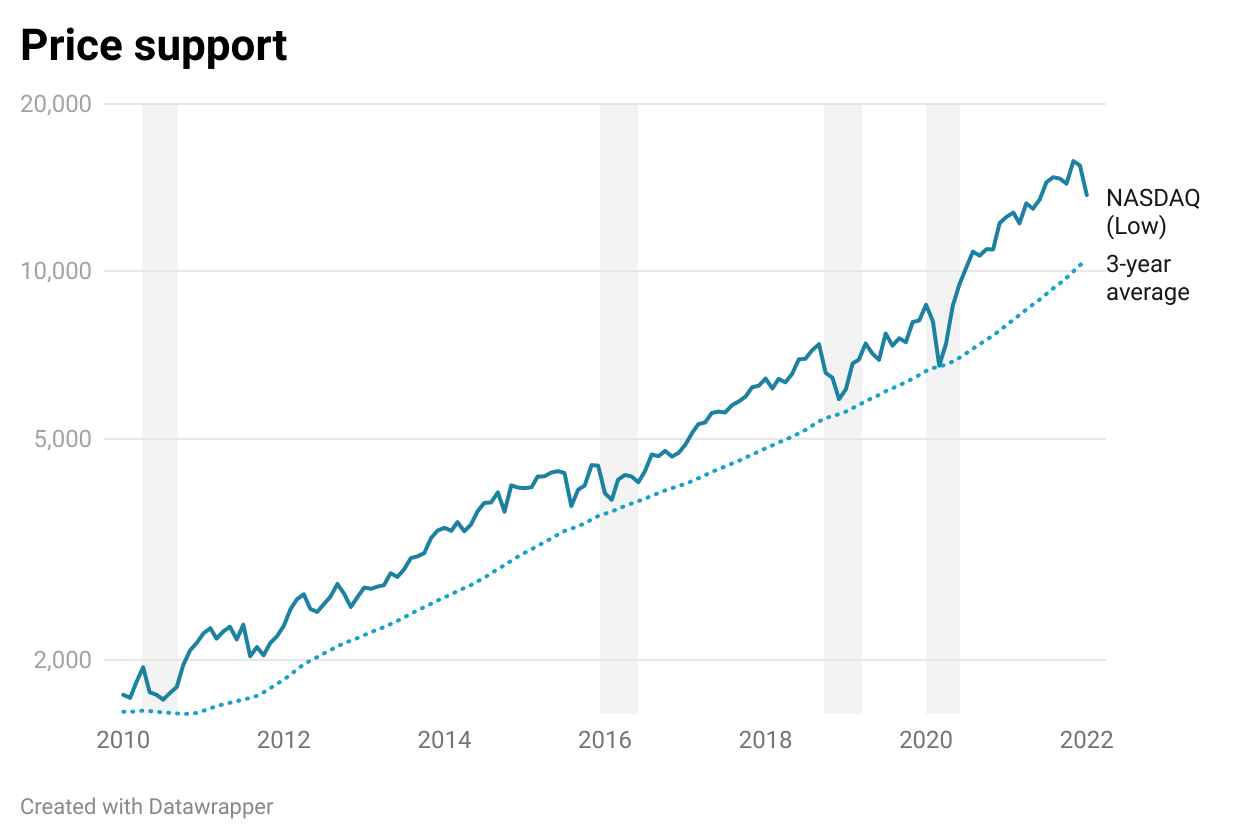

Vital support

The Nasdaq 100 is currently trading at a 20% premium to its 3-year moving average, an area that has provided crucial support for sharp corrections in the past – most notably the Covid crash in early 2020 but also in 2019, 2016, and 2010.

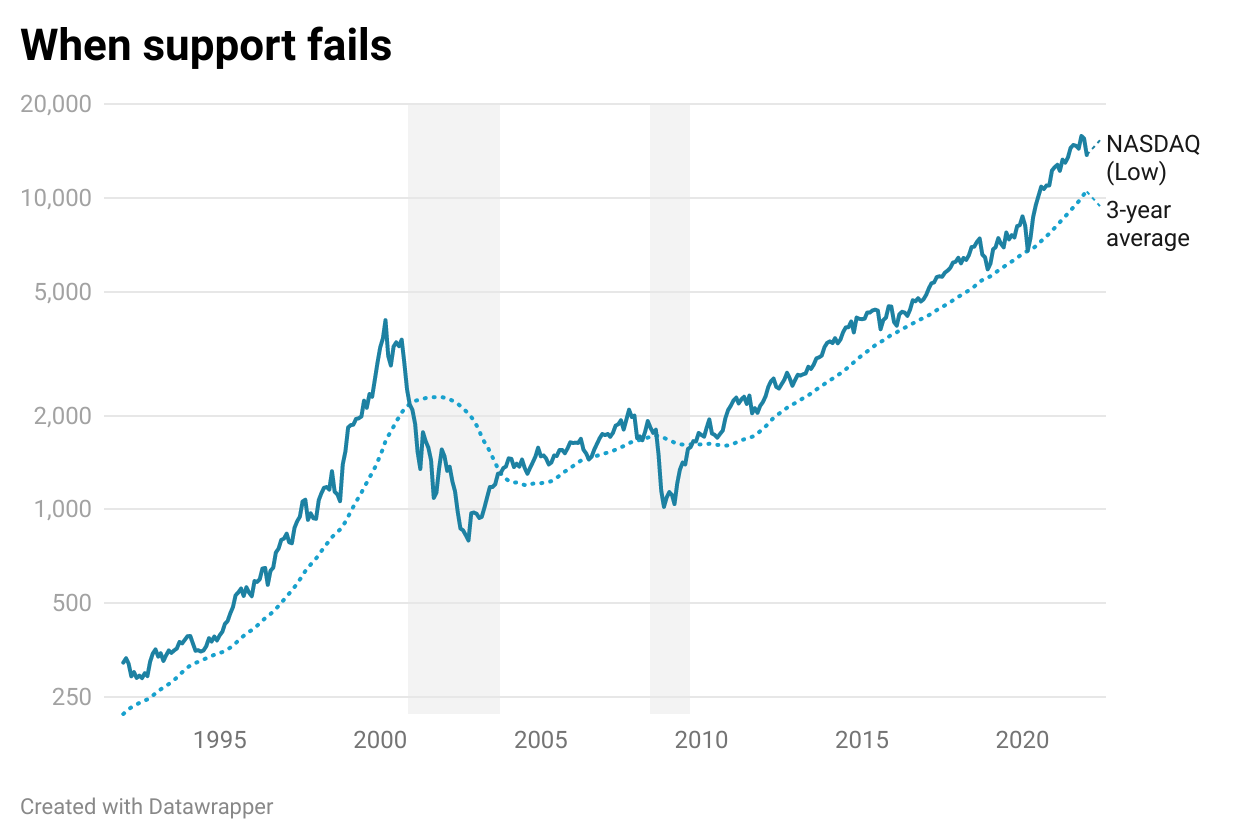

A move down to the projected 3-year average at c12500 – a 25% correction from the highs – is an attractive area for longer-term investors to accumulate as they look to “buy the dip”. However, history suggests that any serious breach of this level could usher in a lengthier bear market, as proven in 2000 and 2008, so tread carefully.

Tech stocks resilience and general outperformance

It is no surprise that technology stocks have fared better than the overall market during Covid as their goods and services are perfectly positioned to benefit from: 1) the shift towards remote working; 2) the accelerated pace of digitalisation; and 3) the increased time spent inside of our homes consuming digital content on all manner of devices.

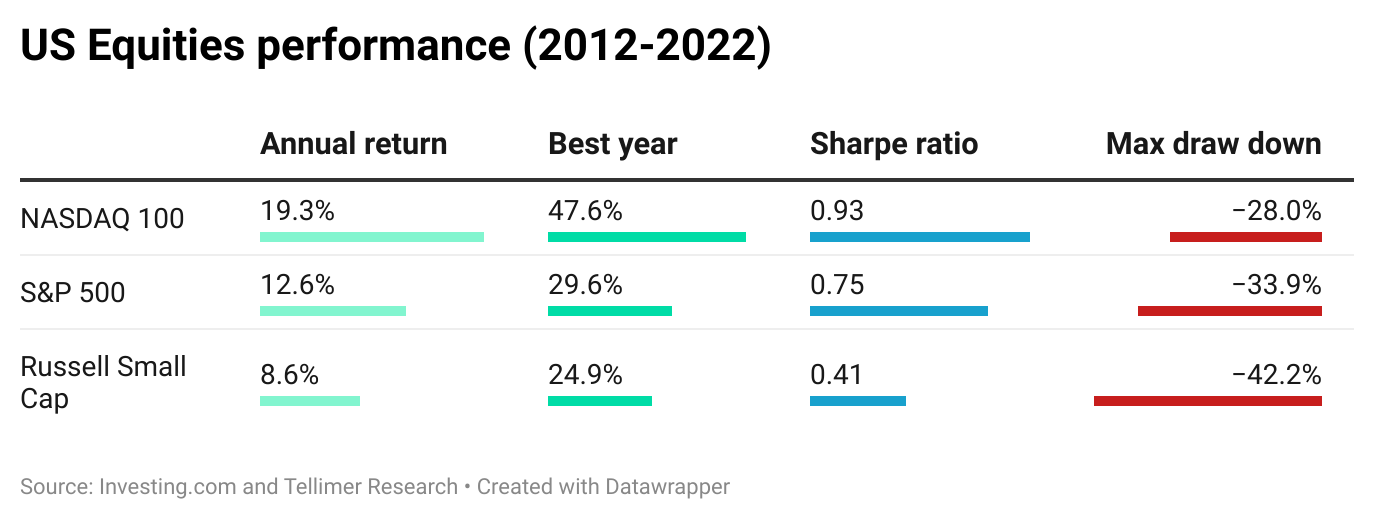

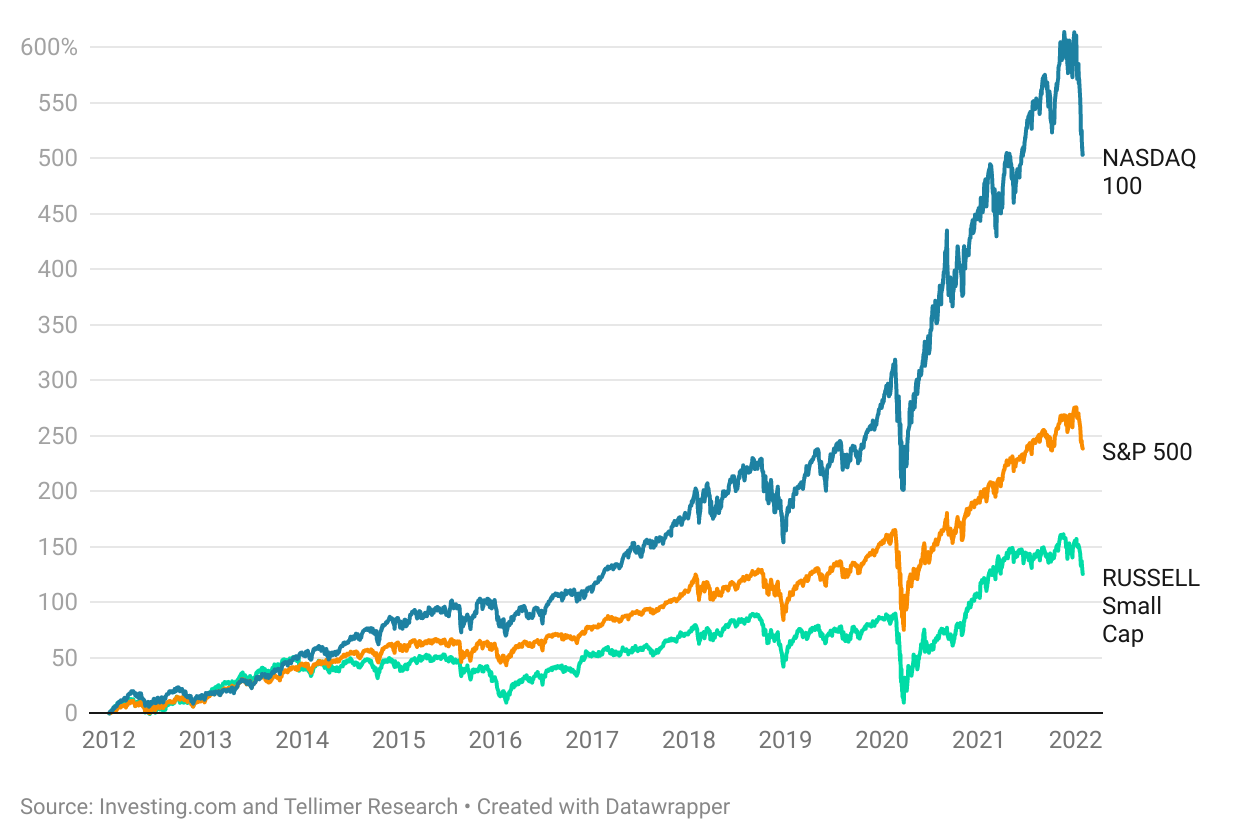

Despite the sell-off this month, the Nasdaq 100 index, which is weighted heavily in favour of big technology companies, has returned 58% since January 2020, while the much broader S&P 500 index has returned 'only' 33%. Small-cap stocks (those between US$300mn and $2bn in market cap) have underperformed, as showcased by the Russell Small Cap index which has risen only 21% during the same period.

Technology stocks have been the darlings of Wall Street for over a decade, while small-cap stocks have remained unloved – this is clearly highlighted by their performance metrics.

The future for technology

Generally, it has been unwise to bet against technology stocks in the long run. The rate of advancement in technology and its ability to compound on breakthroughs made in other areas create perpetual synergistic growth for the entire sector.

In fact, let's have a go a weaving just a single thread through a collection of Nasdaq 100 companies to demonstrate their symbiosis:

Advancements in the manufacturing of computer chips (Intel, Qualcomm, AMD) continue to improve the capabilities of smartphones (Apple, T-Mobile) but also pave the way to more powerful graphics processing units (Nvidia) which allow deeper machine learning models (Google) to engineer better recommendation systems (Netflix, Amazon, Facebook) which conceptually provide the increased intelligence needed for self-driving cars (Telsa) along with a plethora of modern games (Activision Blizzard, Electronic Arts) and immersive Virtual Reality systems (Meta). These same GPU-based machine-learning models also allow for the rapid formation of Covid vaccines and other therapeutics (Moderna) – so much so that Moderna has launched an AI Academy for All Employees.

This symbiotic relationship should continue to drive the sector forward.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.