There have been a few articles talking about the stellar 10-year return of the Nasdaq-100 Index. This return is especially notable versus other broad-market benchmarks such as the S&P 500 and Russell 1000, but it also is outperforming some of the more popular smart beta strategies during this 10-year window. The below chart compares four indexes over the last decade: Nasdaq-100 Total Return Index (XNDX), Nasdaq AlphaDEX Large Cap Core Total Return Index (NQDXUSLCT), FTSE RAFI US 1000 Total Index (FR10XTR), and the S&P 500 Dividend Aristocrat Total Return Index (SPDAUDT).

One analyst’s view is that despite this significant and realized outperformance, the Nasdaq-100 is inherently a riskier index due to its composition:

"Investors shouldn't consider this a core fund, given that more than 50% of its portfolio is invested in technology names," Ben Johnson, Director of Global ETF Research at Morningstar wrote in an email. "By way of comparison, SPDR S&P 500 (SPY), which I would say is a terrific core long-term holding, has 17.5% of its portfolio invested in tech stocks."

QQQ's extreme bets on a few names, especially on the "FANG" stocks, produce more than pronounced sector skews. It results in a top-heavy and volatile portfolio that is more suited to a satellite role in diversified holdings, according to Morningstar.1

The above statement can be debated on two parts: first, that Nasdaq-100 is not a core portfolio holding and second, that the Nasdaq-100 is volatile when compared to the S&P 500.

The second aspect on volatility is easy to breakdown and dispute. Utilizing CBOE’s Volatility Indexes (CBOE Nasdaq-100 Volatility Index and CBOE S&P 500 Volatility Index) which are two noted and long-standing benchmarks of risk measurement, there is very little difference in overall volatility over the past 10 years.

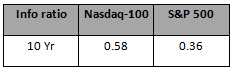

Looking at the full 10-year period, the Nasdaq-100 Volatility has averaged 22% versus 20% for S&P 500. Applying that historical average of implied volatility compared to total return over the same period (information ratio), the Nasdaq-100 has a 158% advantage over the S&P 500.

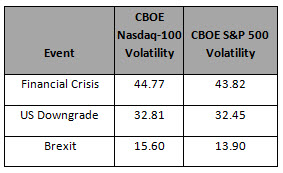

In looking at particular periods of high stress (e.g., Financial Crisis Sept. 2008-Feb. 2009, US Debt Downgrade Aug. 2011, Brexit June 2016), the volatility of the Nasdaq-100 did not move much differently than that of the broader market.

In these periods of strife, it could be assumed the, “extreme bets on a few names, especially on the "FANG" stocks, produce more than pronounced sector skews. It results in a top-heavy and volatile portfolio” highlighted by Ben Johnson of Morningstar would have caused a more dramatic difference in volatility. The reality is quite the contrary.

From a basic portfolio measurement, the Nasdaq-100 has not been a more “volatile portfolio” and the slight difference in volatility has been more than adequately compensated in terms of its significant outperformance.

The core portfolio argument is far more subjective in nature. An argument can be made that the top components of the Nasdaq-100 are the modern industrials and that they are driving the economy forward. This stands for why these companies should, in fact, be overweight. Looking at some technical performance data, below we illustrate the similarities between the Nasdaq-100 and other “core” index holdings.

Correlation

The Nasdaq-100 and S&P 500 have maintained a consistent correlation level historically averaging 92% over the trailing 10 years. This correlation number is lower than other accepted core holdings such as S&P 500 Equal Weight or FTSE RAFI US 1000 though neither index came close to matching the 10-year return.

The lower correlation of the Nasdaq-100 versus the other indexes is largely driven by sector exposure. The Nasdaq-100 excludes financial companies such as banks and exchanges and consistently has a low weight to Oil & Gas. However, the biggest names of the Nasdaq-100 are fully exposed to those sectors. Every financial analyst and bank teller and wildcatter utilizes the products made by companies of the Nasdaq-100 to work and to live. To many people, Facebook and Starbucks are two of the most important companies in everyday social life and it’s important to gauge that in economic value. However without Apple, Cisco, Microsoft, QualCOMM, Intel, Amazon, and Alphabet the economy would simply stop. Every facet of the global economy is completely intertwined with the products created by these companies.

Name Overlap

The reality of that importance is demonstrated in the below fundamental story of the Nasdaq-100 from 2003 forward. The value generated by the Nasdaq-100 companies across earnings, revenue and dividends paid is very compelling when compared to the S&P 500 companies over the past 13 years.

The Nasdaq-100 lacks financials and energy and thus has a different sector exposure than the S&P 500. However, it is impossible to say that lack of sector exposure should send the index to the satellite category when the majority of the companies within the Nasdaq-100 are economically exposed to the growth of those missing sectors.

The index composition overlap between Nasdaq and S&P occurs because the top names of the Nasdaq-100 are the top names of the S&P. These are the economically important names that lead both benchmarks. Apple is the world’s largest company by market capitalization and thus the market capitalization weighted index, as picked by the S&P Index Committee members, has Apple as its largest holding. An ETF tracking the S&P 500 shows a 3.6% weight for Apple followed by Microsoft, another NDX component) with 2.4%2. Four of the top 10 securities and seven of the top 20 within S&P 500 are also in the Nasdaq-100.

Fundamentals

The Nasdaq-100 is also demonstrating significant levels of financial stability with large increases in dividends paid out, earnings growth and top line revenues.

Why is the Nasdaq-100 outperforming and why the Nasdaq-100 is a benchmark worth following is ultimately rooted in the fundamental data. The price performance of the index is strong and the underlying risk metrics are market-neutral because the fundamental data of these 100 companies is beyond compare.

Conclusion

The premise of the Nasdaq-100’s performance over the past 10 years is not debatable. The performance has been significantly greater than other US indexes. The story of the Index being a riskier proposition is definitely debatable. From a realized or even implied volatility perspective, the Nasdaq-100 has not shown significant separation from the S&P 500.

2016 was another solid year for the Nasdaq-100 with a 5.89% annual price return. The Nasdaq-100 has outperformed the S&P 500 in eight out of the past 10 years with the exception of 2008 and 2016 with a strong average annual excess return of 7.18% over the S&P 500 for this ten year period. And 2017 is shaping up to be another strong year with outperformance over S&P 500 by 6.11% through 4/6/2017.

Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED.

© 2017. Nasdaq, Inc. All Rights Reserved.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Credit: Dramatic mountain landscape

Credit: Dramatic mountain landscape