McEwen Mining MUX reported adjusted loss per share of 15 cents per share, missing the Zacks Consensus Estimate of a loss of 13 cents per share. The company had reported earnings per share of $2.90 in the year-ago quarter.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Including one-time items, the loss in the quarter under review was 16 cents per share against the year-ago quarter’s earnings of $2.89 per share.

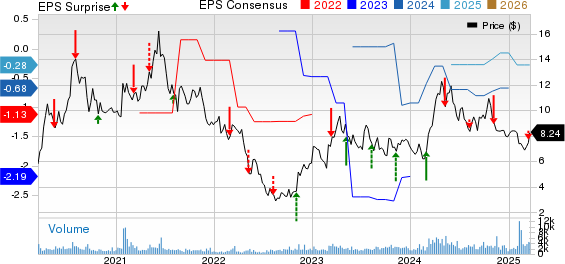

McEwen Mining Inc. Price, Consensus and EPS Surprise

McEwen Mining Inc. price-consensus-eps-surprise-chart | McEwen Mining Inc. Quote

Lower Sales Volume Hurts McEwen Mining’s Q4 Revenues

Revenues from gold and silver sales were $34 million in the quarter, which missed the Zacks Consensus Estimate of $36 million. The figure marked a 42% plunge year over year reflecting lower Gold Equivalent Ounces (GEOs) sold in the quarter, which was somewhat offset by higher prices.

Production plunged 35% year over year to around 32.4 thousand ounces in the fourth quarter of 2024. McEwen Mining sold 31.5 thousand GEOs, which were down 37% from the year-ago quarter. The average realized price increased 35% to $2,648 per GEO.

MUX’s Adjusted EBITDA Improves Substantially in Q4

Production costs declined 37% year over year to $31.5 million. The company reported a gross profit of $0.36 million compared with $13.1 million in the fourth quarter of 2023. The decline was due to the lower number of GEOs produced and sold.

Adjusted EBITDA was a positive $5.2 million against a negative $4.9 million in the year-ago quarter. This excludes the impact of McEwen Copper’s results.

McEwen Mining’s Cash Position at 2024-End

The company used $1.2 million of cash in operating activities in the fourth quarter against inflow of $16.4 million in the prior-year quarter. McEwen Mining reported cash and cash equivalents of $13.7 million as of Dec. 31, 2024, down from $23 million as of Dec. 31, 2023.

MUX’s Performance in 2024

McEwen Mining reported a loss of 86 cents per share in 2024, which missed the Zacks Consensus Estimate of a loss of 72 cents per share. The company reported earnings per share of $1.16 in 2023.

MUX’s 2024 revenues increased 5% year over year to $174 million but fell short of the Zacks Consensus Estimate of $201 million.

Consolidated production in 2024 was 135,884 GEOS, lower than 154,587 GEOs in 2023. The company sold 135,411 GEOs during the year, which marked a 10% decline from the 2023 level. The average realized price was $2,390 per ounce, 24% higher than the $1,927 per ounce in 2023.

McEwen Mining expects consolidated GEO production to increase to 225,000 - 255,000 GEOs as a result of increased production from the Fox Complex.

MUX Stock’s Price Performance

Shares of the company have dipped 6.2% in the past year compared with the industry’s 7.7% decline.

Image Source: Zacks Investment Research

MUX’s Zacks Rank

McEwen Mining currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Performances of Other Gold and Silver Mining Stocks

Fortuna Mining Corp. FSM reported fourth-quarter 2024 adjusted earnings per share of 11 cents, which missed the Zacks Consensus Estimate of 16 cents. The bottom line marked a solid 57% year-over-year improvement. Results were aided by higher gold prices, partially offset by lower gold sales volume.

Fortuna Mining’s revenues improved 13.9% year over year to $302 million. Higher gold prices were partially offset by lower gold sales volume. This was due to lower production at Séguéla, San Jose and Lindero.

Avino Silver & Gold Mines Ltd. ASM reported earnings per share of seven cents for fourth-quarter 2024, which surpassed the Zacks Consensus Estimate of three cents. The company posted earnings of two cents per share in the year-ago quarter.

ASM’s revenues surged 95% year over year to $24 million. The top line beat the Zacks Consensus Estimate of $18 million. The upside was driven by higher production and realized silver and gold prices.

Hecla Mining Company HL reported fourth-quarter 2024 adjusted earnings per share of four cents, in line with the Zacks Consensus Estimate. HL incurred a loss per share of four cents in the year-ago quarter.

The company’s revenues increased 55.4% year over year to $250 million aided by higher production and prices for both gold and silver. The top line beat the Zacks Consensus Estimate of $229 million.

Zacks Names #1 Semiconductor Stock

It's only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>Hecla Mining Company (HL) : Free Stock Analysis Report

McEwen Mining Inc. (MUX) : Free Stock Analysis Report

Fortuna Mining Corp. (FSM) : Free Stock Analysis Report

Avino Silver (ASM) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.