The Mosaic Company MOS reported net income of $372 million or 97 cents per share in third-quarter 2021 against a loss of $6.2 million or 2 cents in the year-ago quarter. The fertilizer maker’s third-quarter results were strongest in more than a decade, gaining from higher prices and its transformation efforts in the quarter.

Barring one-time items, adjusted earnings per share were $1.35, which missed the Zacks Consensus Estimate of $1.59.

Revenues rose around 44% year over year to $3,418.6 million in the quarter but missed the Zacks Consensus Estimate of $3,802.9 million. Sales were driven by higher prices that more than offset reduced volumes.

Segment Highlights

Net sales in the Phosphates segment rose around 75% year over year to $1,300 million in the quarter, driven by increased prices. Sales volumes in the segment slipped approximately 11% to 1.8 million tons. The segment’s gross margin per ton improved significantly to $198 from $11 in the year-ago quarter as better pricing more than offset reduced volumes and higher raw material costs.

Potash division’s net sales climbed around 27% year over year to $589 million driven by higher prices. Sales volumes in the segment declined roughly 22% to 1.8 million tons. Gross margin per ton in the quarter shot up to $131, increasing more than two times year over year.

Net sales in the Mosaic Fertilizantes segment were $1.8 billion, up around 64% driven by higher year-over-year prices. Sales volume fell roughly 6% to 3.4 million tons. Gross margin per ton in the quarter was $99, shooting up 102% year over year.

Financials

At the end of the quarter, Mosaic had cash and cash equivalents of $843 million, up around 32% year over year. Long-term debt fell roughly 12.7% to $3,947.7 million.

Net cash provided by operating activities increased roughly 19.4% year over year to $422.7 million in the reported quarter.

The company’s board also approved a 50% increase in the targeted annual dividend to 45 cents per share, effective with the next declaration, which is expected in December 2021. It also repurchased 956,404 shares at an average price of $35.72 per share through Oct 31, 2021.

Outlook

Moving ahead, the company noted that it expects strong agricultural commodity pricing trends to continue through the fourth quarter of 2021, driving demand for fertilizers. Farmer economics remain attractive in most global growing regions on strong crop demand, affordable inputs, and favorable weather, the company noted.

Going forward, the company expects upward pricing momentum to continue, with about 90% of fourth-quarter sales committed and priced, and some commitments are as far as the second quarter of 2022 being requested by certain customers. Average realized prices for phosphate in the fourth quarter are expected to be $55-$65 per ton higher than the prior quarter. Fourth-quarter phosphate raw material costs per finished ton are expected to be $5-$10 higher than the prior quarter. Potash’s average realized prices are expected to be $110-$130 per ton higher than the third quarter.

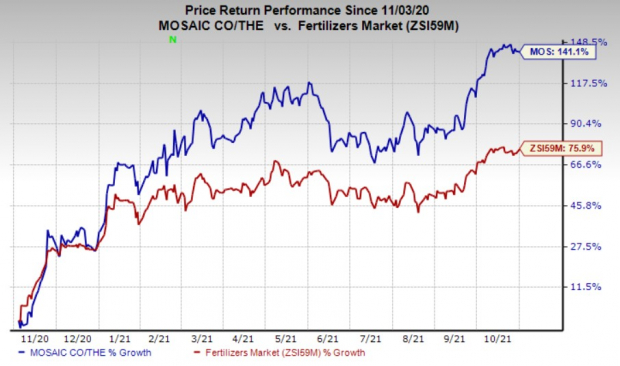

Price Performance

Mosaic’s shares have surged 141.1% in the past year compared with the industry’s 75.9% growth.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Currently, Mosaic carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the basic materials space include Methanex Corporation MEOH, Olin Corporation OLN, and Arkema S.A. ARKAY, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Methanex has a projected earnings growth rate of 429% for the current year. The company’s shares have jumped 51.7% over a year.

Olin has a projected earnings growth rate of 740% for the current year. The company’s shares have grown 229.3% over a year.

Arkema has a projected earnings growth rate of 88.7% for the current year. The company’s shares have surged 110.3% over a year.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Methanex Corporation (MEOH): Free Stock Analysis Report

The Mosaic Company (MOS): Free Stock Analysis Report

Arkema SA (ARKAY): Free Stock Analysis Report

Olin Corporation (OLN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.