The Mosaic Company MOS recently announced sales volumes and revenues for Aug 2021 by business unit.

The Potash segment recorded sales volume of 610,000 tons in August, down 17.7% from 741,000 tons in the year-ago period. Sales revenues were $196 million, up around 27% from $154 million in the prior-year period.

The Mosaic Fertilizantes segment’s sales volume fell 10.4% to 1,134,000 tons from 1,266,000 tons last year. Sales revenues increased around 53% to $602 million from $393 million recorded last year.

The Phosphates segment recorded sales volume of 666,000 tons, down around 10.4% from 743,000 tons a year ago. Sales revenues in the segment were $465 million, up around 78% year over year from $261 million a year ago.

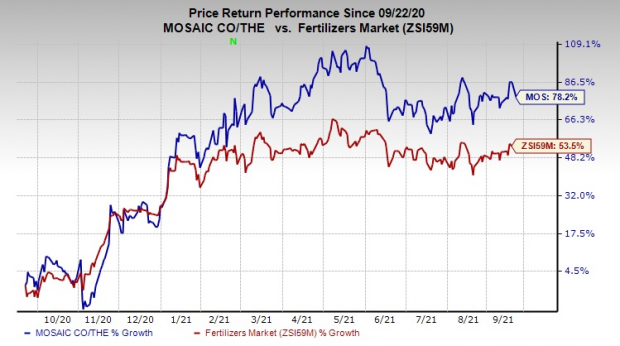

Shares of Mosaic have gained 78.2% in the past year compared with 53.5% rise of the industry.

Image Source: Zacks Investment Research

The company, in its lastearnings call stated that it expects strong agricultural trends to continue through the second half of 2021, driving demand for fertilizers. Grower economics remain attractive in most global regions on strong crop demand, affordable inputs and favorable weather, the company noted.

The company forecasts $90-$100 per ton improvement in average realized price in the Phosphates segment, sequentially, in the third quarter. For the Potash segment, the company expects $25-$35 per ton improvement in average realized prices in the third quarter.

The Mosaic Company Price and Consensus

The Mosaic Company price-consensus-chart | The Mosaic Company Quote

Zacks Rank & Other Key Picks

Mosaic currently flaunts a Zacks Rank #1 (Strong Buy).

Some other top-ranked stocks in the basic materials space are Nucor Corporation NUE, The Chemours Company CC and Olin Corporation OLN.

Nucor has a projected earnings growth rate of around 508% for the current year. The company’s shares have soared 112.1% in a year. It currently sports a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Chemours has an expected earnings growth rate of around 86.4% for the current year. The company’s shares have gained 38.6% in the past year. It currently carries a Zacks Rank #2 (Buy).

Olin has an expected earnings growth rate of around 639.3% for the current fiscal. The company’s shares have surged 265.3% in the past year. It currently carries a Zacks Rank #1.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nucor Corporation (NUE): Free Stock Analysis Report

The Mosaic Company (MOS): Free Stock Analysis Report

Olin Corporation (OLN): Free Stock Analysis Report

The Chemours Company (CC): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.