Morgan Stanley announced that its board has approved a $10 billion share buy-back program, which is set to start in January, after the Federal Reserve eased some restrictions imposed on banks during the coronavirus pandemic. Shares climbed 5.2% in Friday’s after-market trading.

Morgan Stanley (MS) said that the repurchases of outstanding common stock of up to $10 billion in 2021 was authorized in recognition of the bank’s “significant capital buffer.”

The move comes after the Federal Reserve Board on Friday released a second round of bank stress test results this year, which concluded that large banks had strong capital levels, despite setting aside about $100 billion in loan loss reserves. In response to the pandemic-led economic crisis, the Fed had earlier this year put several restrictions in place to ensure that banks would preserve capital, including suspending share repurchases and limiting dividends.

“The results announced today allow us to restart our share repurchase program in January, and we expect to continue the program throughout the coming year,” Morgan Stanley CEO James P. Gorman. “With over 400bps of excess capital, we are in a position to continue to invest in our businesses while returning capital to shareholders and absorbing market volatility.”

The repurchases will be subject to market conditions and the investment bank’s financial performance. Repurchases under the program in any period will be consistent with Morgan Stanley’s stress capital buffer (SCB) requirement and other regulatory capital standards.

The Fed determined that for the first quarter of 2021, both dividends and share repurchases will be limited to an amount based on income over the past year. If a firm does not earn income, it will not be able to pay a dividend or make repurchases.

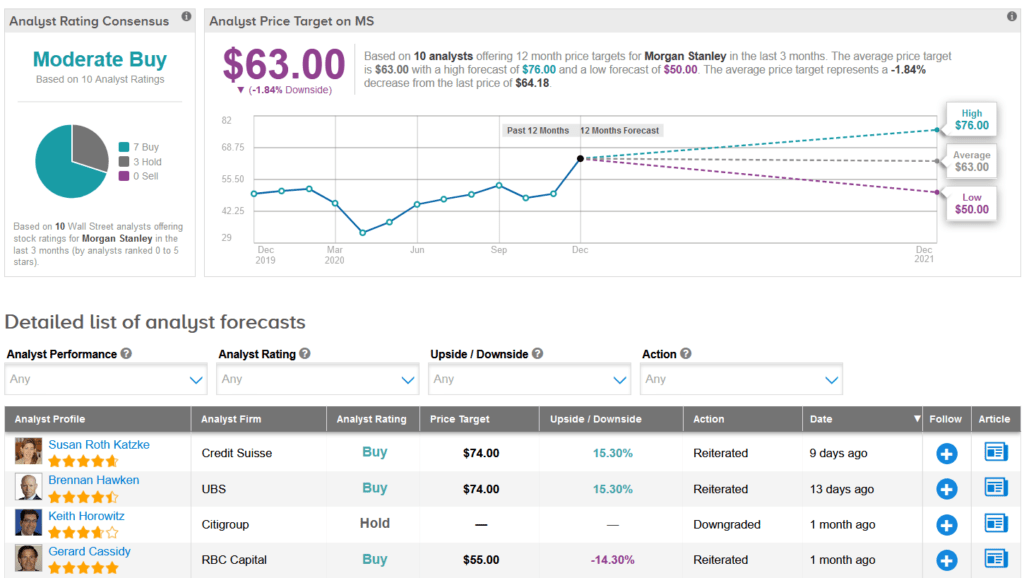

MS shares have gained 25% so far this year and the stock scores a cautiously optimistic Moderate Buy analyst consensus. That’s based on 7 Buy ratings versus 3 Hold ratings assigned in the last three months. (See Morgan Stanley stock analysis on TipRanks)

Looking ahead, the average analyst price target of $63 suggests shares are more than fully priced at current levels and could see some downward correction of 1.8%.

Meanwhile, Credit Suisse analyst Susan Roth Katzke this month raised the stock's price target to $74 from $60 and reiterated a Buy rating.

Katzke argues that with the prospect of a COVID-19 vaccine on the horizon and a shift in risks, there is "more upside and less downside" around base case estimates in the US large cap bank sector.

Related News:

BNY Mellon To Resume Stock Buybacks; Shares Rise 5%

U.S. Steel Dips 6% On Higher-Than-Feared Loss Outlook, Street Sees 47% Downside

Accenture Gains 7% On Blowout 1Q Results; RBC Lifts PT

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.