More than eight in ten asset managers said that ESG is one of their company’s top priorities, according to data from the Index Industry Association’s (IIA) 2021 International Survey Of Asset Managers report, “Measurable Impact: Asset Managers On The Challenges And Opportunities Of ESG Investment.”

The survey consisted of 300 interviews across the industry and included chief investment officers, chief financial officers, and portfolio managers in four countries: the United Kingdom, the United States, France, and Germany.

Of those surveyed, 85% said that ESG is one of the top priorities for their company’s investment strategy or portfolios. This drive is carried across different asset classes and fund sizes, as well as active and passive funds.

87% of those surveyed by the IIA believe that ESG will become a bigger priority to their company within the next three years. In addition, respondents believed that the proportion of ESG assets carried in portfolios would increase from 26.7% within the next 12 months to 43.6% within the next five years.

Flows into Global Sustainable Fund Flows Hit Record

The survey also cited Morningstar research into the growth of ESG inflows globally. In the first quarter of 2021, sustainable fund investment inflows reached a record high of $185 billion, with Europe comprising 79% of those inflows.

During that same time period, global assets in sustainable funds reached $1.94 trillion, nearly double from the same period in 2020 and an all-time high to boot.

ESG continues to see growing interest because of both societal and financial goals, the IIA says. The primary areas behind ESG investment are “client demand (54%), desire for increased return (44%), portfolio diversification (42%), investment policy (40%), concern for ESG factors (40%), and reputation or regulatory risk (36%),” reported the IIA.

Investing in ESG with State Street’s CNRG

There are many ESG ETF offerings available, including pure plays based on the clean energy sector.

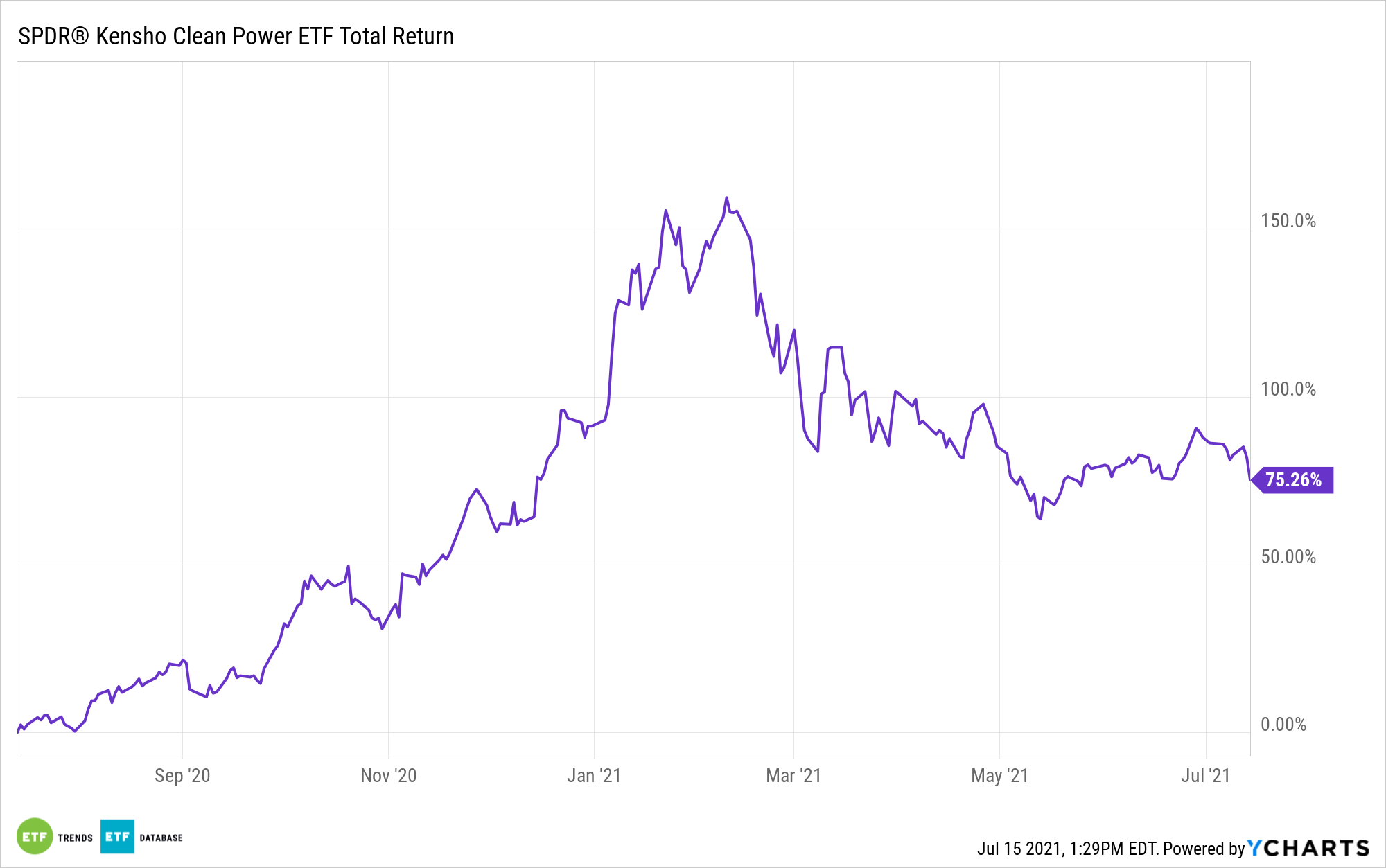

One such ETF is the SPDR S&P Kensho Clean Power ETF (CNRG), which tracks the performance of the S&P Kensho Clean Power Index.

This benchmark combines artificial intelligence with a quantitative weighting methodology to invest in global stocks that are driving innovation in the clean energy sector, both with products and services. This includes firms manufacturing technology used for renewable energy, and companies that have services and products related to the generation and transmission of renewable energy, as well as supply chain companies.

CNRG allocates 19.15% of its portfolio to electrical components & equipment companies; 15.34% to semiconductors companies; 14.63% to electric utilities; and 10.69% to renewable electricity firms.

CNRG has an expense ratio of 0.45% and AUM of $400 million.

For more news, information, and strategy, visit the ESG Channel.

Read more on ETFtrends.com.The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.