Welcome back to the Canadian Monthly Market Wrap from YCharts! Here, we break down the most important market trends for Canada-based advisors and their clients every month. As always, feel free to download and share any visuals with clients and colleagues, or on social media.

Nearly three-fourths of Canadians are fully vaccinated against the coronavirus. Though cases per day have spiked again, hospitalizations are lower than during the “dark winter” wave in January, and even more so compared to the initial onset of COVID-19 when hospital beds were in short supply.

In the U.S, where only 57% of the population is fully vaccinated, policy focused on fully inoculating certain segments of the population instead of rolling out the first dose to everyone. While the U.S. has received criticism for relatively lax COVID-19 prevention measures, Canada’s process left most people only partially vaccinated for months and could have been the key differentiator between Canada’s wave of hospitalizations and the U.S.’s lower levels in April.

Here are the same stats for the United States:

In any case, it appears the vaccines are doing their job at lowering hospitalizations compared to the pre-vaccine days of the pandemic, no matter which side of the border you live on.

As snow replaces the leaves and ice rinks freeze to usher in hockey season, glide over these key developments from October:

• Major Index Returns: Equities Rebound, Bonds Stay Flat

• Sector Movement: 6 of 7 Positive, Energy Leads Again

• Hot Stocks of the Month: Commodities and Railways Power Returns

• Laggards & Losers: Board Room Drama Weighs on Big Telcos

• Economic Data: Unemployment Nearing Normal Levels

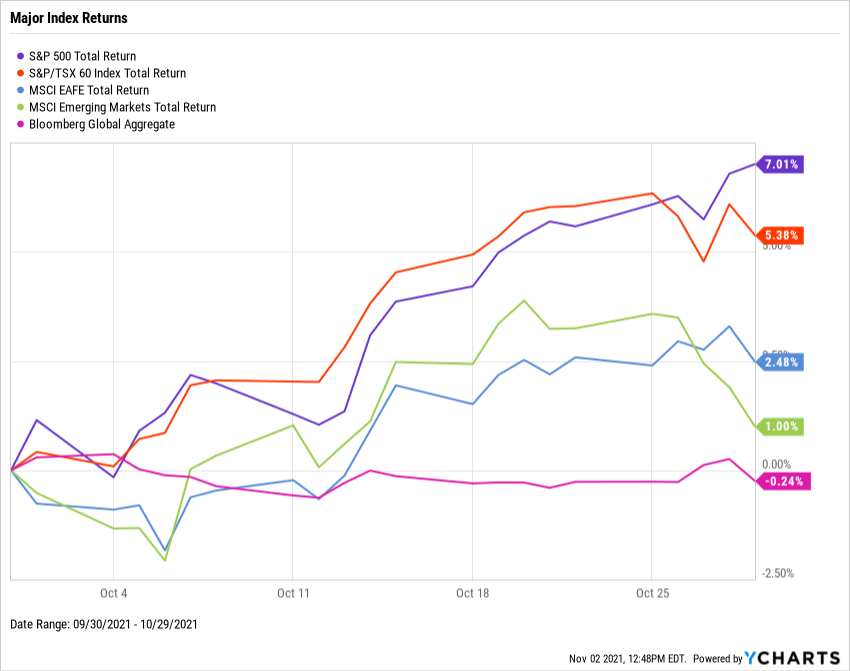

Major Index Returns: Equities Rebound, Bonds Stay Flat

Equities rebounded in October from a down September with the S&P 500 and TSX 60 finishing the month 7.0% and 5.4% higher, respectively. Equity indices around the world overcame the “September Effect” as well, with International Developed Markets rising 2.5% and MSCI Emerging Markets tacking on 1%. Fixed income proved to be an uninspiring source of returns once again, with the Global Aggregate Bond Index slipping 0.2% as central banks around the world continued cutting rates.

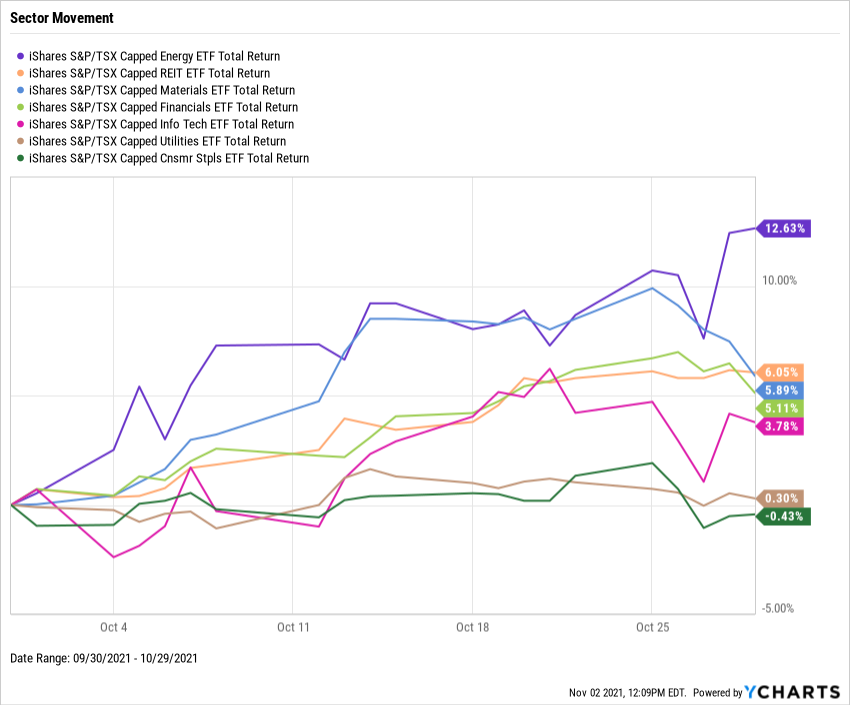

Sector Movement: 6 of 7 Positive, Energy Leads Again

Energy jumped another 12.6% in October, following a September in which it soared 18.8% as the only positive sector that month. WTI crude oil neared $85 USD per barrel at the end of October, while Brent oil reached that level just days earlier. In second place was the REIT sector, adding 6.1% as Canadian home prices and rentsreached all-time highs. The only down sector in October was Consumer Staples, which lost 0.4% as supply chain backlogs took a toll on consumer goods companies.

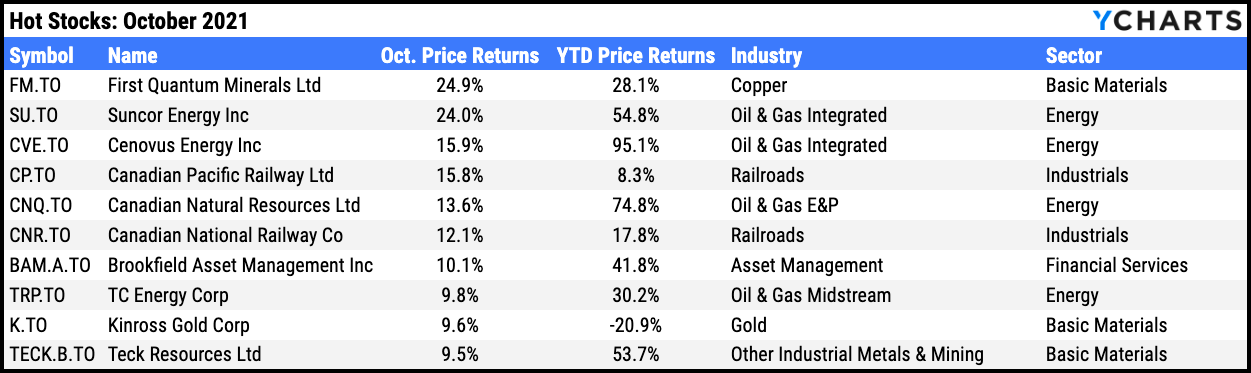

Hot Stocks of the Month: Commodities and Railways Power Returns

If your favorite stock starts with the word “Canadian”, then October was a good month for you. Shares of Canadian Pacific Railway (CP.TO), Canadian Natural Resources (CNQ.TO), and Canadian National Railway (CNR.TO) were all up at least 12% as further economic reopenings translated into strong demand for commodities. Oil & gas companies Suncor Energy (SU.TO), Cenovus Energy (CVE.TO), and TC Energy Corp (TRP.TO) all got lifts in October as Crude Oil roared 12.5% higher.

First Quantum Minerals (FM.TO), Brookfield Asset Management (BAM.A.TO), Kinross Gold (K.TO), and Teck Resources (TECK.B.TO) also made the cut for October’s ten best performers.

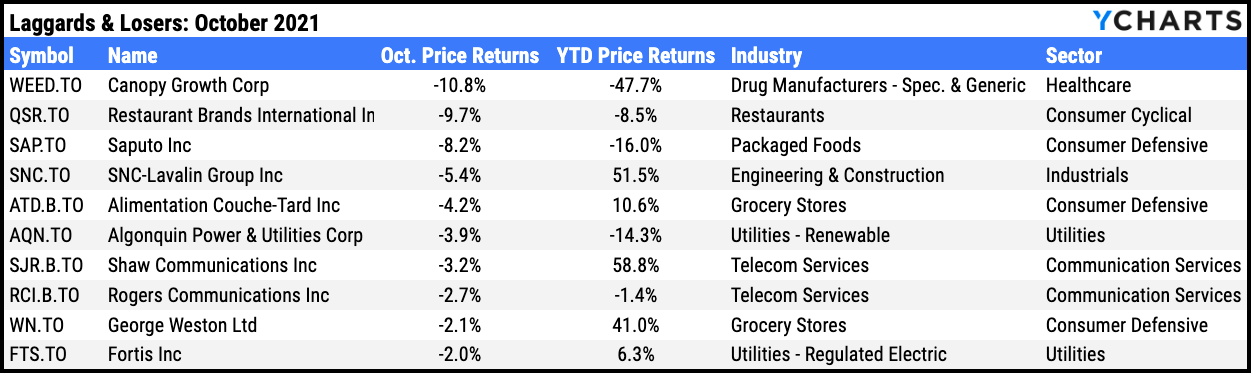

Laggards & Losers: Board Room Drama Weighs on Big Telcos

Restaurant Brands International (QSR.TO), the parent of fast food chains Tim Hortons, Burger King, and Popeye’s plummeted 9.7% in October as the company missed Q3 revenue expectations. RBI blamed labor and supply chain pressures, challenges that also impacted dairy producer Saputo (SAP.TO), grocer George Weston (WN.TO), and convenience store chain Alimentation Couche-Tard (ATD.B.TO). Shaw Communications (SJR.B.TO) and Rogers Communications (RCI.B.TO) each lost around 3% in October on news that Rogers’s planned acquisition of Shaw could be in jeopardy. Infighting among the Rogers family—whose trust owns 97 percent of voting shares—over appointments to the C-Suite has distracted efforts to finalize the merger for presentation to regulators, where it is expected to face even more challenges.

Rounding out October’s Laggards & Losers list is SNC-Lavalin Group (SNC.TO), Algonquin Power & Utilities Corp (AQN.TO), and Fortis Inc (FTS.TO), along with Canopy Growth (WEED.TO) who returns for the fourth consecutive month.

Featured Market & Advisor News

Smallest Increase in EPS Estimates for S&P 500 Companies for Q4 Over the Past Five Quarters (FactSet)

10 Stock Market Trends for the End of 2021 (YCharts)

Canadian stocks add $191B of value in longest rally ever (BNN)

How Wholesalers Gain an Edge with YCharts SMA, Portfolio Data (YCharts)

Canadian wage inflation looms as ‘perfect storm’ hits labour market (Financial Post)

mYCharts: Overvalued Markets, Big Decisions & Cherry-Picking with Nick Maggiulli (YCharts)

Economic Data: Unemployment Nearing Normal Levels

Unemployment: September’s Canadian unemployment rate clocked in below 7% for the first time since February 2020, at 6.9%. The Canada Ivey Employment index, however, slumped 3.2 points to 63.7, and Canada Part-time Employment recorded a loss of 36,000 part-time workers in September.

Housing: A month after posting its first sub-20,000 reading since February, Canada Housing Starts rebounded to 20,202 in September, a MoM increase of 3.4%. Housing price growth remained relatively steady, as the Canada New Housing Price Index rose just 0.4% in September.

Consumers: The Canada Consumer Price Index rose another 0.4% in September, while the Canada Inflation Rate climbed for the fourth straight month to 4.4%, which is its highest level since March 2003.

Manufacturing: The Canada Ivey PMI rose 4.4 points in September to 70.40, a level it has tested but failed to break through in both March and June.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.