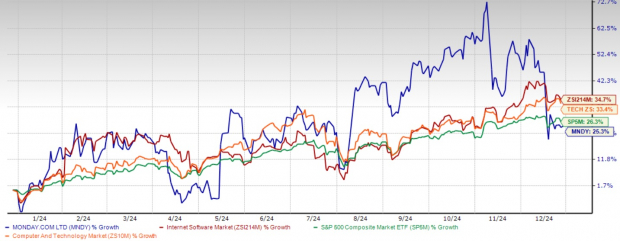

Monday.com MNDY has emerged as a standout performer in the work management software sector, delivering a remarkable 25.3% stock price appreciation in 2024. As we look ahead to 2025, several key indicators suggest this growth trajectory is poised to continue, making the stock an attractive investment opportunity for the coming year.

1-Year Performance

Image Source: Zacks Investment Research

Strong Financial Foundation

The company achieved a significant milestone by surpassing $1 billion in annual recurring revenues (ARR), marking a pivotal moment in its growth journey. This achievement is particularly impressive considering it comes just eight years after reaching $1 million in ARR. Monday.com's third-quarter 2024 results further underscore its robust financial health, with revenues growing 33% year over year to $251 million. The company maintains an impressive gross margin of 90% and has demonstrated strong profitability with a 13% non-GAAP operating margin.

The Zacks Consensus Estimate for 2025 revenues is pegged at $1.21 billion, suggesting 25.62% year-over-year growth. The consensus mark for earnings is pegged at $3.57 per share, implying an 11.72% year-over-year increase.

Image Source: Zacks Investment Research

Find the latest earnings estimates and surprises on Zacks Earnings Calendar.

Expanding Market Opportunity

With a total addressable market exceeding $100 billion and growing at 14% annually across work management, CRM, service management and software development segments, Monday.com is well-positioned to capture substantial market share. The company's enterprise customer base continues to expand, with a 40% increase in customers generating more than $50,000 in ARR, reaching 2,907 enterprises. Even more impressive is the 44% growth in customers with more than $100,000 in ARR, now totaling 1,080.

Innovation and Product Development

Monday.com's commitment to innovation is evident in its expanding product portfolio. The company's AI initiatives have shown exceptional adoption, with AI actions increasing more than 250% quarter-over-quarter. The upcoming launch of monday service by the end of 2024 promises to add another growth vector, with strong initial cross-sell opportunities already evident in the beta phase. The successful rollout of mondayDB 2.0 to enterprise customers demonstrates the platform's increasing scalability, supporting boards with up to 100,000 items and dashboards with 500,000 items.

Enterprise Success and Customer Retention

The platform's enterprise appeal is exemplified by the company's second-largest customer expanding from 25,000 to 60,000 seats, representing a remarkable validation of the product's scalability. The net dollar retention rate remains strong at 111% overall, with even higher rates of 115% for customers with more than $100,000 in ARR, indicating strong customer satisfaction and expanding usage within existing accounts.

Growth Catalysts for 2025

While facing competition from tech giants like Asana ASAN, Microsoft MSFT, with Microsoft Teams and Planner, and Atlassian TEAM, with Jira and Confluence, several factors position Monday.com for continued success in 2025. The company's pricing optimization initiative, expected to be fully implemented by July 2025, is projected to generate approximately $80 million in additional revenues through 2026. The expanding partner ecosystem, now including 254 active channel partners and 738 new referral partners, provides a strong foundation for market expansion. The company's focus on R&D investment and product development, particularly in AI capabilities, positions it to maintain its competitive edge. The company's strong balance sheet, with $1.34 billion in cash and cash equivalents, provides ample resources for strategic investments and innovation.

Its 3-year forward 12-month price-to-sales ratio of 9.37, though above the Zacks Internet - Software industry average of 3.01, reflects the market's confidence in MNDY's growth potential.

MNDY’s P/S F-12M Ratio Depicts Stretched Valuation

Image Source: Zacks Investment Research

Investment Case for 2025

For investors looking ahead to 2025, Monday.com presents a compelling opportunity. The combination of strong financial performance, product innovation and enterprise customer growth creates a solid foundation for sustained expansion. The company's demonstrated ability to scale while maintaining profitability, coupled with its innovative product roadmap and strong customer retention, makes it an attractive investment option.

With its robust cash position, high gross margins and expanding market opportunities, Monday.com is well-positioned to continue its upward trajectory. As digital transformation continues to accelerate globally, Monday.com's comprehensive work operating system stands to capture an increasing share of the expanding market opportunity. For investors seeking exposure to the growing work management software sector, Monday.com's strong execution and clear growth strategy make it a compelling investment choice for 2025. The stock currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Only $1 to See All Zacks' Buys and Sells

We're not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not - they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 228 positions with double- and triple-digit gains in 2023 alone.

See Stocks Now >>Microsoft Corporation (MSFT) : Free Stock Analysis Report

Atlassian Corporation PLC (TEAM) : Free Stock Analysis Report

Asana, Inc. (ASAN) : Free Stock Analysis Report

monday.com Ltd. (MNDY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.