By Stjepan Kalinic

This article first appeared on Simply Wall St News .

M&A activity is undoubtedly heating up as Microsoft Corporation ( NASDAQ: MSFT ) is pursuing its most significant acquisition so far. A US$69b buyout of Activision Blizzard will make it one of the largest gaming companies.

Yet, the move of this magnitude is not without concerns, as the cross-platform competition draws scrutiny from the regulators.

See our latest analysis for Microsoft .

The M&A Madness of the (Late) Bull Market

According to Howard Marks, the bull market has 3 stages:

- When only a few perceptive people believe things will get better

- When most investors realize things are getting better

- When everyone concludes, things will get better forever

Over a decade into the longest bull market in history, after buying the dips in 2015, 2018, and 2020 – the jury is on whether we are in stage 3.

The decline of market breadth in 2021, which burdened the market performance on the biggest, almost reminds us of the K-shaped pandemic recovery scenario. The performance of those doing well is of such magnitude that it's blocking the view of the larger part of the market that it is not doing so great.

You don't need to look further than Cathie Wood's flagship ARK Innovation ETF (ARKK), which just put in an 18-month low, with every single of its 44 holdings closing in the red yesterday. So far, the actively managed ETF that focuses on disruptive technology is down 19.9% year-to-date — one percent for every day of the year.

An Affordable Deal

Currently, Microsoft was in a prime position for such an acquisition. First of all, Activision Blizzard ( NASDAQ: ATVI ) was in a crisis – falling as low as 45% from the highs, with a series of internal conflicts and erosion of brand value.

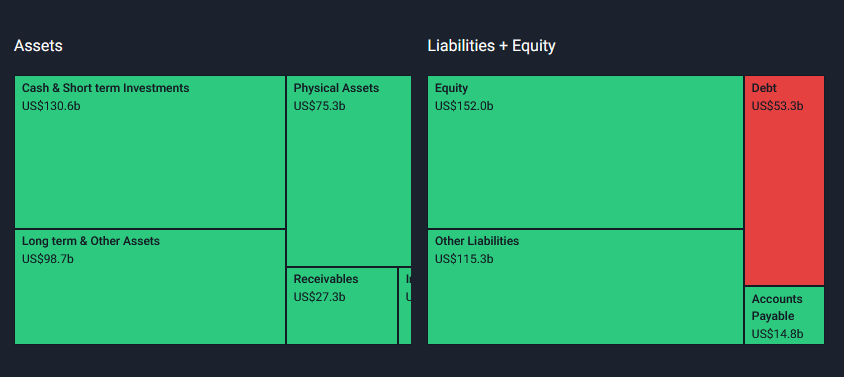

Even though this acquisition is the largest one in the tech space, Microsoft can easily absorb this cost, with its strong balance sheet, as seen from the following depiction.

Secondly, Microsoft is not under the same scrutiny as the other players in the tech space like Apple, Google, or Facebook(Meta) – who have been a subject of the various antitrust-related conversations.

Yet, regulatory concerns extend beyond the jurisdiction of the US Congress. Microsoft's acquisition of ATVI will bring even more popular franchises under its control. Now its broad portfolio has:

- Call of Duty

- Warcraft

- Starcraft

- Diablo

- Candy Crush

- Overwatch

- The Elder Scrolls

and many, many others.

The consolidation of this magnitude raises the question of product competition. It puts Microsoft in a position to pressure their biggest rival in the console market, Sony, which dropped 13% (the largest drop since The Great Recession) on the news.

Conclusion

Microsoft's acquisition of ATVI is positioning them among the royalty of the gaming market. However, the competitive pressures this deal is creating are likely going to draw the attention of the regulators so that we wouldn't write it as a done deal just yet. So far, it looks like Wall Street gives it roughly a 60% chance .

If the deal does get through, for the ATVI fans, it will be a sign of relief. Their beloved franchises will get a boost as synergy between the corporations drives the progress forward under the watchful eye of Microsoft Gaming.

The near future should bring more quality gaming and less corporate politics and scandals that are, hopefully, in the rear-view mirror.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

%20Gigantic%20Acquisition%20is%20Fueling%20the%20K-shaped%20Tech%20Performance%20%7C%20Nasdaq&_biz_n=0&rnd=450531&cdn_o=a&_biz_z=1740820048698)

%20Gigantic%20Acquisition%20is%20Fueling%20the%20K-shaped%20Tech%20Performance%20%7C%20Nasdaq&rnd=659006&cdn_o=a&_biz_z=1740820048702)