Microsoft's MSFT announcement of a $3 billion investment in India's cloud and AI infrastructure over the next two years marks a significant strategic move in the company's global AI expansion strategy. The investment, which includes new data center establishments and ambitious skilling initiatives, aligns with India's vision of becoming an AI-first nation by 2047. The company's commitment to training 10 million Indians in AI skills by 2030, following its successful ADVANTA(I)GE program which has already trained 2.4 million individuals, demonstrates a comprehensive approach to market development.

Enterprise Partnerships and Market Penetration

The depth of Microsoft's commitment is evident in its strategic partnerships with major Indian enterprises. The collaboration with RailTel aims to transform the public sector through an AI Center of Excellence, while partnerships with Apollo Hospitals for healthcare innovation and Bajaj Finserv for financial services showcase the broad-based adoption potential. Notably, Bajaj Finance's transformation into a FinAI company targeting 200 million customers and projected annual cost savings of INR 150 crore by 2026 provides early validation of the investment thesis.

The partnership with Mahindra Group spans automotive, farm and financial services sectors, with plans to develop AI projects, including agentic and multimodal scenarios. This diversified approach, combined with Mahindra's establishment of a dedicated AI Division, demonstrates the potential for deep integration of Microsoft's AI technologies across traditional industries.

Innovation and Sustainability Focus

Microsoft's research and innovation ecosystem development through Microsoft Research's AI Innovation Network creates a robust foundation for sustainable growth. The collaboration with Physics Wallah for math reasoning and SaaSBoomi for startup ecosystem development aims to impact more than 5,000 startups and 10,000 entrepreneurs while helping attract $1.5 billion in venture capital funding. This positions Microsoft to capture value across the entire AI value chain in one of the world's fastest-growing digital economies.

The company's commitment to sustainable AI infrastructure development includes zero-water cooling data centers and renewable energy partnerships with Amplus and ReNew. The allocation of $15 million toward community environmental initiatives through the ReNew partnership demonstrates a balanced approach to growth and sustainability that could prove crucial for long-term success in the Indian market.

Market Position and Growth Trajectory

Microsoft's existing presence in India, with three operational data center regions and a fourth planned for 2026, provides a strong foundation for execution. This established infrastructure, combined with the company's global success with Copilot (evidenced by 70% Fortune 500 adoption and rising daily usage), suggests similar potential in the Indian market. The collaboration with India AI, a division of Digital India Corporation, to advance AI and emerging technologies further strengthens Microsoft's position in the market.

The scale of Microsoft's commitment includes plans to skill 500,000 individuals by 2026 through various programs and establish AI Productivity Labs in 20 National Skill Training Institutes across 10 states. This comprehensive approach to market development could create a sustainable competitive advantage in the rapidly growing Indian technology sector.

The Zacks Consensus Estimate for Microsoft’s fiscal 2025 revenues is pegged at $277.69 billion, suggesting 13.29% year-over-year growth. The consensus mark for earnings is pegged at $12.92 per share, indicating a 9.49% year-over-year increase.

Image Source: Zacks Investment Research

Investment Outlook for 2025

For investors considering Microsoft stock in 2025, several factors warrant attention. The two-year investment period suggests gradual revenue recognition, with significant infrastructure development phases ahead. Key metrics to monitor include enterprise partnership conversion rates, data center deployment progress, AI skills program adoption and startup ecosystem growth indicators.

Given MSFT's recent global AI momentum, including Copilot's success and strong enterprise adoption, the India investment could provide additional growth catalysts. However, investors might benefit from watching for clear execution metrics throughout 2025 before making significant position changes. The combination of Microsoft's global AI leadership, strong existing presence in India and comprehensive market development approach suggests this initiative could meaningfully impact the company's long-term growth trajectory.

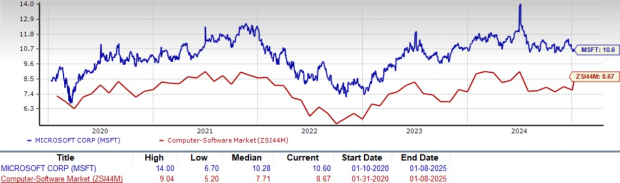

Microsoft's current valuation presents a premium scenario, with its forward 12-month P/S ratio of 10.6X exceeding both the Zacks Computer - Software industry average of 8.67X and its historical median of 10.28X. This elevated pricing reflects strong investor confidence in Microsoft's future growth, particularly in cloud computing and AI. However, it also raises questions about potential limitations and whether the company's performance can justify this premium in the long term.

MSFT’s P/S F12M Ratio Depicts Stretched Valuation

Image Source: Zacks Investment Research

Investors should carefully weigh the current valuation against future growth prospects, given the stock's 13% appreciation in the past year.

1-Year Performance

Image Source: Zacks Investment Research

Conclusion

As Microsoft executes its India strategy throughout 2025, investors should closely monitor the development of enterprise partnerships, infrastructure deployment and ecosystem growth. While the long-term potential appears promising, the gradual nature of enterprise technology adoption and infrastructure development suggests maintaining a watchful stance on the stock through 2025, looking for clear signs of successful execution before making major investment decisions. Microsoft currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Just Released: Zacks Top 10 Stocks for 2025

Hurry – you can still get in early on our 10 top tickers for 2025. Handpicked by Zacks Director of Research Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2024, the Zacks Top 10 Stocks gained +2,112.6%, more than QUADRUPLING the S&P 500’s +475.6%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2025. You can still be among the first to see these just-released stocks with enormous potential.

Microsoft Corporation (MSFT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.