As many have become aware, artificial intelligence (AI) has been one of the hottest market topics of 2023.

After all, it’s easy to understand why, as the technology allows us to achieve digital feats that otherwise felt impossible.

And, of course, several big-tech players, including Microsoft MSFT and Alphabet GOOGL, have been scurrying to become the leader.

Microsoft has gained widespread attention following announcements of its new AI-powered Bing search engine and Edge browser.

The new search engine and Edge browser are expected to deliver enhanced search results, complete answers, a new chat experience, and an overall much easier experience when exploring the web.

On the flip side, Alphabet has recently unveiled its new conversational AI service, Bard, powered by the company’s next-generation LaMDA (language model for dialogue applications).

Bard is expected to deliver high-quality responses drawn from the web, pairing the globe’s knowledge with the power of Alphabet’s LaMDA.

It raises a valid question: with each company going head-to-head, which one’s shares look like a more attractive option? Let’s take a closer look.

Share Performance

We can take a look at each company’s price action across several timeframes to better understand which stock buyers have preferred.

Over the last six months, MSFT’s 11% decline handily beats out GOOGL’s 22% pullback.

Image Source: Zacks Investment Research

When shrinking the timeframe to encompass the year-to-date price action, MSFT’s 7.5% return again edges out GOOGL’s 6.6% climb.

Image Source: Zacks Investment Research

As we can see, buyers have favored MSFT shares over the last six months and in 2023.

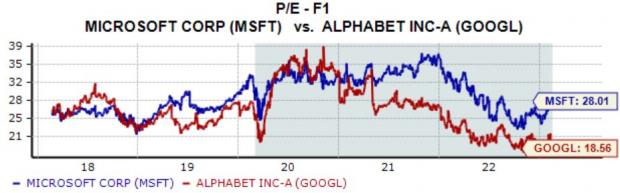

Valuation

Of course, a critical aspect of any investment decision revolves around valuation, as many investors steer clear of companies trading at high multiples.

Currently, Alphabet shares trade at an 18.6X forward earnings multiple, well beneath the 26.2X five-year median.

On the flip side, Microsoft’s current 28.1X forward earnings multiple resides nearly precisely in line with its five-year median.

Image Source: Zacks Investment Research

In addition, Alphabet shares presently trade at a 4.9X forward price-to-sales ratio, again beneath the 6.9X five-year median by a fair margin.

Pivoting to Microsoft, the company’s 9.4X forward P/S ratio sits above its 8.9X five-year median.

Image Source: Zacks Investment Research

This round, GOOGL shares appear to be the better option regarding value, with the company’s forward P/S and forward P/E ratios sitting beneath their respective five-year medians.

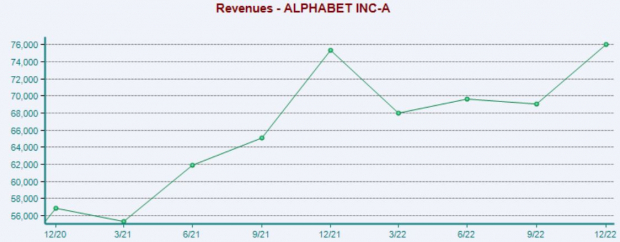

Quarterly Performance

Of course, it’s always important to see which company has delivered more robust quarterly results, indicating an ability to exceed analysts’ expectations.

Alphabet has struggled to exceed quarterly estimates as of late, falling short of top and bottom line estimates in each of its last four quarters. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

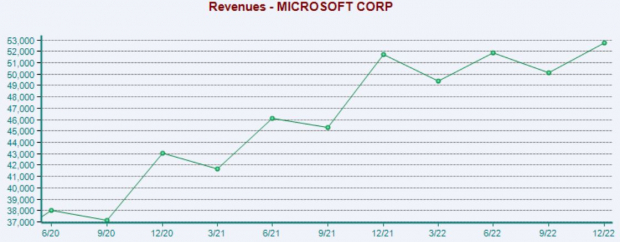

Microsoft has delivered a much stronger earnings performance, exceeding the Zacks Consensus EPS Estimate in three of its last four quarters. Top line results have also been more robust, with MSFT exceeding sales expectations in two of its previous four releases.

Image Source: Zacks Investment Research

This round, the victory goes to Microsoft.

Putting Everything Together

With these two tech heavyweights going head-to-head in an artificial intelligence race, investors may wonder which stock looks like a better option.

Buyers have favored Microsoft shares across several timeframes, and the company has delivered much better quarterly results.

On the flip side, Alphabet shares are notably cheaper, with the company’s forward P/S and P/E ratios sitting nowhere near their five-year medians.

However, a big difference between the two is Microsoft’s dividend; MSFT’s annual dividend currently yields 1%, whereas Alphabet doesn’t pay dividends.

The decision can come down to preference alone, with value investors most likely gravitating toward Alphabet GOOGL and income investors finding Microsoft MSFT shares more attractive.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>Microsoft Corporation (MSFT) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.