Microsoft's MSFT first-quarter fiscal 2025 results revealed robust adoption of its AI-powered Copilot services across multiple business segments. The company reported that nearly 70% of Fortune 500 companies now utilize Microsoft 365 Copilot, with daily users more than doubling quarter over quarter. A commissioned Forrester study projects compelling ROI ranges of 132% to 353% over three years for small and medium businesses, suggesting a strong value proposition for customers.

Microsoft's comprehensive approach could position it as a leader in the global healthcare AI market, which was valued at $19.27 billion in 2023 and is expected to witness a CAGR of 38.5% from 2024 to 2030, per a Grand View Research report.

The Zacks Consensus Estimate for Microsoft’s fiscal 2025 revenues is pegged at $277.66 billion, which suggests 13.27% year-over-year growth. The consensus mark for earnings is pegged at $12.94 per share, which indicates a 9.66% year-over-year increase.

Image Source: Zacks Investment Research

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Enterprise Implementation Shows Promising Results

Major enterprise deployments highlight growing confidence in Copilot's capabilities. Vodafone's decision to roll out the service to 68,000 employees following trials that demonstrated average time savings of three hours per person per week represents a significant vote of confidence. Similarly, UBS' commitment to deploy 50,000 seats, marking Microsoft's largest financial services deal to date, indicates strong traction in the crucial banking sector.

Developer Tools and Platform Expansion

The GitHub ecosystem continues to show impressive momentum, with Copilot Enterprise customers increasing 55% quarter over quarter. The launch of GitHub Copilot Workspace and Autofix features, which help developers fix vulnerabilities three times faster, demonstrates Microsoft's commitment to innovation in the developer tools market. The introduction of GitHub Spark further expands the platform's reach by enabling natural language app development.

Healthcare and Industry-Specific Solutions Drive Growth

Microsoft's vertical integration strategy is showing particular success in healthcare, where DAX Copilot now processes over 1.3 million physician-patient encounters monthly across more than 500 healthcare organizations. The service's revenue growth is outpacing GitHub Copilot's first-year performance, suggesting strong potential in industry-specific applications.

Security and Infrastructure Investment

The company's commitment to security remains paramount, with the Secure Future Initiative engaging 34,000 full-time equivalent engineers. This substantial investment, while necessary, impacts near-term profitability. Microsoft's Defender has helped secure over 750,000 GenAI app instances, while Purview has audited more than a billion Copilot interactions.

Business Applications and LinkedIn Show Strong Momentum

Dynamics 365 continues to gain market share, with monthly active users of Copilot across CRM and ERP solutions increasing more than 60% quarter over quarter. LinkedIn's performance remains strong, with double-digit growth in key markets like India and Brazil, and a 6x quarter-over-quarter increase in weekly immersive video views.

Enterprise Integration Shows Promise

Enterprise customers are showing strong confidence in Copilot's capabilities, as evidenced by major deployments like Vodafone's 68,000-employee rollout and UBS' 50,000-seat implementation — the largest in the financial services sector to date. Notable efficiency gains, such as Vodafone's reported three hours saved per employee per week, demonstrate tangible business value that could drive further adoption.

Developer Tools and Platform Growth

GitHub Copilot's momentum continues with a 55% quarter-over-quarter increase in Enterprise customers. The introduction of GitHub Copilot Workspace and Autofix features, along with the new GitHub Spark platform, positions Microsoft strongly in the developer tools market. The company reports that Copilot Autofix helps developers fix vulnerabilities three times faster than traditional methods.

Healthcare and Industry-Specific Applications Show Promise

DAX Copilot's rapid adoption in healthcare, now processing more than 1.3 million physician-patient encounters monthly across 500+ organizations, demonstrates Microsoft's successful vertical integration strategy. The service is reportedly growing faster than GitHub Copilot did in its first year, suggesting potential for sustained growth in industry-specific applications.

Investment Perspective: Patience May Be Rewarded

While Microsoft's AI initiatives demonstrate impressive growth and adoption metrics, several factors suggest investors might benefit from waiting for better entry points. Management expects H2 revenue growth to remain relatively stable compared with the second quarter, with M365 Copilot seat revenues projected to grow gradually over time. The significant allocation of resources to security and infrastructure development may impact near-term margins.

The AI landscape is becoming increasingly competitive, with tech giants like Alphabet GOOGL-owned Google, Nvidia NVDA and Oracle ORCL making significant investments and advancements in the field. Microsoft's success will hinge on its ability to maintain a competitive edge and effectively monetize its AI technologies. Additionally, looming regulatory scrutiny adds an element of uncertainty to the AI-driven growth prospects of the industry.

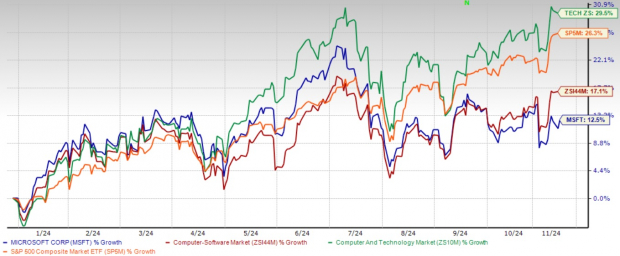

With a 12.5% year-to-date gain, Microsoft has underperformed both the Zacks Computer & Technology sector and the S&P 500 index’s return of 29.5% and 26.3%, respectively. This raises a crucial question of whether MSFT's AI advancements will provide the needed boost to its stock performance.

Year-to-date Performance

Image Source: Zacks Investment Research

Current stock prices may already reflect much of the near-term growth potential from AI initiatives. Microsoft's current valuation presents a premium scenario, with its forward 12-month P/S ratio of 10.78X exceeding both the Zacks Computer - Software industry average of 7.93X and its own historical median of 10.15X. This elevated pricing reflects strong investor confidence in Microsoft's future growth, particularly in cloud computing and AI. However, it also raises questions about potential limitations and whether the company's performance can justify this premium in the long term.

As Microsoft navigates these challenges, investors will be closely watching its ability to translate AI innovations into tangible financial results and market outperformance.

MSFT’s P/S F12M Ratio Depicts Stretched Valuation

Image Source: Zacks Investment Research

Conclusion

For current shareholders, the strong adoption metrics and enterprise customer wins suggest holding positions could be rewarding over the long term. However, new investors might benefit from waiting for more attractive entry points, particularly given the general market volatility and the possibility of short-term fluctuations as the company continues to invest heavily in AI infrastructure and security measures. Microsoft currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +23.7% per year. So be sure to give these hand picked 7 your immediate attention.

See them now >>Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Oracle Corporation (ORCL) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.