Earnings season continues to capture the spotlight, with several big tech companies slated to take center stage this week. The period has primarily been positive so far, again helping us elude an ‘earnings meltdown’ many had feared.

Regarding this week’s docket, we have both Alphabet GOOGL and Microsoft MSFT scheduled to reveal their quarterly prints. Both companies report on Tuesday, October 24th, after the market’s close.

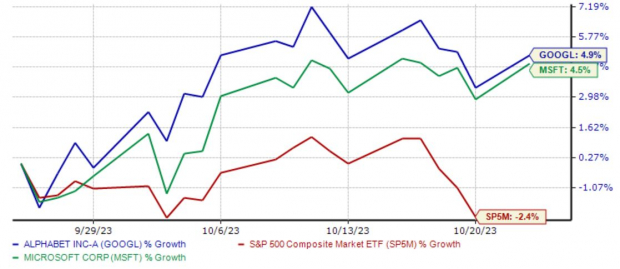

Both stocks have enjoyed positive price action over the last month, outperforming the S&P 500 as buyers continue to favor mega-cap tech. This is illustrated below.

Image Source: Zacks Investment Research

But what should investors expect heading into the release, particularly regarding some key metrics? Let’s take a closer look.

Microsoft

Analysts have moved their quarterly expectations slightly higher since July, with the $2.65 Zacks Consensus EPS Estimate up 0.4% and the $54.4 billion consensus revenue estimate 0.1% higher in the same period.

The estimated figures reflect year-over-year growth rates of 13% and 8.5%, respectively. The technology sector as a whole is expected to benefit from more effective cost controls that have aided margins.

MSFT’s shares faced pressure following their latest earnings release, breaking the trend of positive reactions in prior quarters throughout 2023.

Image Source: Zacks Investment Research

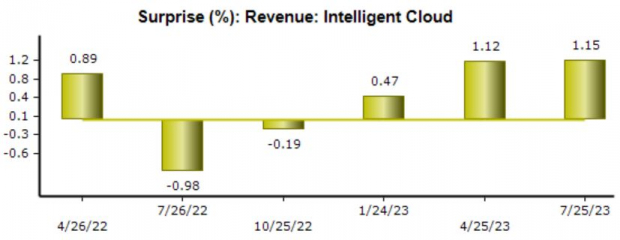

Many will be fixated on cloud computing results, an area that’s significantly aided MSFT’s growth over recent years. The company’s Intelligent Cloud segment consists of public, private, and hybrid server products and cloud services.

For the quarter to be reported, the Zacks Consensus Estimate for Intelligent Cloud revenue sits at $23.5 billion, reflecting a year-over-year climb of 15.8% and a sequential 2% decrease. As we can see below, the company has consistently exceeded consensus Intelligent Cloud revenue expectations in 2023, snapping a streak of back-to-back negative surprises in 2022.

Image Source: Zacks Investment Research

Alphabet

Analysts have shown slight positivity for Alphabet’s upcoming release, with the $1.45 Zacks Consensus EPS Estimate 1.4% higher since July and reflecting a year-over-year improvement of 36%.

Top line expectations have also moved higher, with the $63.1 billion quarterly revenue estimate up a fractional 0.5% since July and suggesting an improvement of 10% from year-ago sales of $57.3 billion.

Shares have reacted positively to the company’s quarterly results in back-to-back releases, as shown below.

Image Source: Zacks Investment Research

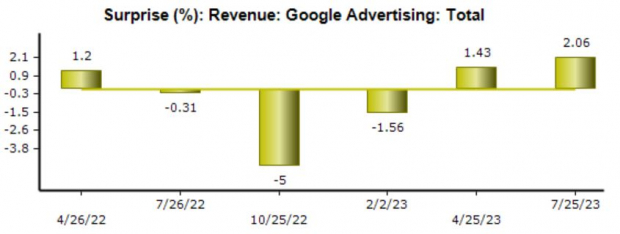

Alphabet’s advertising business makes up a large chunk of its total revenue. For the quarter, the Zacks Consensus Estimate for advertising revenue stands at $58.9 billion, reflecting an 8% change year-over-year.

The company has positively surprised on this metric in back-to-back quarters, as shown below. Advertising results will likely be closely watched among investors, as ad spending is a common business item that gets reduced during fears of a potential economic slowdown.

Image Source: Zacks Investment Research

Like MSFT, Alphabet’s cloud computing business has become a source of growth for the company, which will bring it under heavy attention. For the quarter, the Zacks Consensus Estimate for Google Cloud revenue stands at $8.5 billion, suggesting a 23% year-over-year climb.

Bottom Line

Earnings season continues to chug along, with big tech names such as Microsoft MSFT and Alphabet GOOGL stealing the spotlight this week.

The quarterly releases will undoubtedly have significant implications regarding sentiment, particularly following investors' flight to safety within mega-cap tech in 2023.

Cloud computing results will be closely watched following several years of rapid growth, whereas investors will also focus on Alphabet’s advertising business as well.

Top 5 ChatGPT Stocks Revealed

Zacks Senior Stock Strategist, Kevin Cook names 5 hand-picked stocks with sky-high growth potential in a brilliant sector of Artificial Intelligence. By 2030, the AI industry is predicted to have an internet and iPhone-scale economic impact of $15.7 Trillion.

Today you can invest in the wave of the future, an automation that answers follow-up questions … admits mistakes … challenges incorrect premises … rejects inappropriate requests. As one of the selected companies puts it, “Automation frees people from the mundane so they can accomplish the miraculous.”

Download Free ChatGPT Stock Report Right Now >>Microsoft Corporation (MSFT) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.