Ramping up its essential memory and storage solutions, Micron Technology’s MU stock hit record highs today after posting strong results for its fiscal second quarter on Wednesday.

Strong revenue forecast driven by soaring demand for its artificial intelligence memory cells led to Micron’s stock popping +18% in this morning's trading session.

Of course, investors may be wondering if it's time to get in on the rally with it being noteworthy that Micron’s Zacks Semiconductor Memory Industry is currently in the top 1% of over 250 Zacks industries.

Image Source: Zacks Investment Research

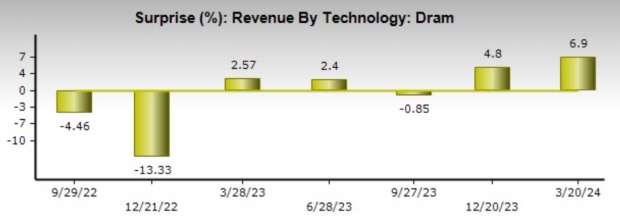

Not Your Average Dram

Micron has assertively entered the AI revolution as the company’s HBM3E memory cells are far more advanced than traditional dynamic random-access memory (DRAM) cells that are used in computers to store data. Unlike a traditional Dram, the HBM3E is applied for more specific applications such as graphics processing, high-performance computing, and servers.

Designed to provide higher bandwidth and lower power consumption the HBM3E is being used in the production of Nvidia’s NVDA H200 AI GPU which has been crucial to continuing the development of large language models (LLMs) and other artificial intelligence tasks.

HBM3E Demand

Attributed to its partnership with Nvidia and high demand for the HBM3E, Micron’s Dram segment sales soared 52% year over year to $4.15 billion compared to $2.72 billion in Q2 2023. Furthermore, this impressively topped Zacks estimates of $3.89 billion by 7%.

Image Source: Zacks Investment Research

Total quarterly sales of $5.82 billion climbed 58% YoY and beat estimates of $5.33 billion by 9%. More impressive, Micron was able to post a surprise profit of $0.42 a share versus estimates that called for an adjusted loss of -$0.27 a share. Curtailed by the high inflationary environment in recent years, Micron’s Q2 EPS reassuringly rose from an adjusted loss of -$1.91 a share in the comparative quarter. Notably, Micron has exceeded earnings expectations in each of its last four quarterly reports.

Image Source: Zacks Investment Research

Impressive Revenue Guidance

For its fiscal third quarter, Micron expects sales of $6.6 billion which came in above the current Zacks Consensus of $5.89 billion (Current Qtr.) Based on Zacks estimates, Micron’s total sales are projected to climb 46% in fiscal 2024 to $22.67 billion compared to $15.54 billion last year. Even better, FY25 sales are forecasted to soar another 48% to $33.57 billion.

Image Source: Zacks Investment Research

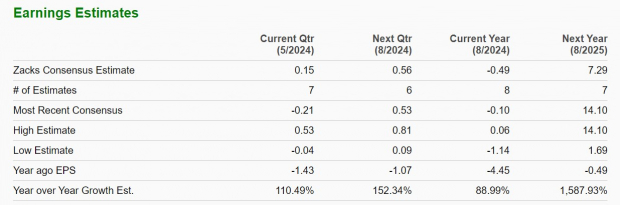

Earnings Estimates

Micron is currently expected to post an adjusted loss of -$0.49 a share in FY24 which would be a vast improvement from -$4.45 a share in 2023. Optimistically, Micron’s annual earnings are anticipated to soar to $7.29 per share in FY25 with the company appearing to be ahead of its projected return to probability.

Image Source: Zacks Investment Research

Plus, over the last 30 days, FY24 earnings estimates have remained unchanged but FY25 EPS revisions have risen 4%.

Image Source: Zacks Investment Research

Takeaway

Micron has been one of the overlooked contributors to the advancement of artificial intelligence and its stock currently sports a Zacks Rank #2 (Buy). To that point, earnings estimates are likely to move higher in the coming weeks for Micron’s FY24 and FY25 with many analysts starting to raise their price targets after the memory chip giants' impressive Q2 results.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Micron Technology, Inc. (MU) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.