MGM Resorts International MGM recently reached an agreement with Hard Rock International to sell the operations of The Mirage Hotel & Casino (“The Mirage”). The deal, which is valued at $1.075 billion in cash, is contingent on customary working capital adjustments. The deal is likely to be completed in the second half of 2022, subject to regulatory approvals.

The Mirage, which was opened in 1989, was acquired by MGM Resorts in 2000. Per the agreement, MGM Resorts will retain “The Mirage name and brand, licensing it to Hard Rock royalty-free for a maximum period of three years while it finalizes its plans to rebrand the property.”

MGM Resorts anticipates net cash proceeds following taxes and estimated fees to be nearly $815 million. Paul Salem, chairman of the board of directors, MGM Resorts International said “The monetization of our entire real property portfolio, together with the addition of CityCenter and our agreement to acquire The Cosmopolitan of Las Vegas, will position the Company with a fortress balance sheet, premier portfolio, and significant financial resources to pursue our strategic objectives.”

Focus on Asset Light Strategy

Instead of being a capital-intensive, brick & mortar real estate business, the company intends to be a developer, manager and operator of major gaming, hospitality and entertainment properties. The company intends to focus on sports and live entertainment. It is committed to the asset-light strategy.

Previously, MGM Resorts announced that it has signed a definitive agreement to sell its Las Vegas Properties. To this end, in July, 2021, the company announced two separate deals with Infinity World Development Corp and Blackstone. In May 2021, it announced an agreement to sell and lease back MGM Springfield, an underlying real estate, to MGM Growth Properties.

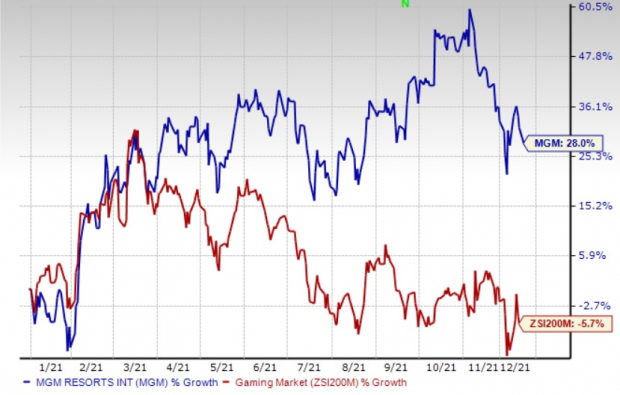

Price Performance

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

So far this year, shares of the Zacks Rank #3 (Hold) company have gained 28%, against the industry’s decline of 5.7%. The company is benefiting from increased visitation in the Las Vegas market and solid long-term prospects of the Macau business. Despite the pandemic, the company is confident about prospects in Macau and will continue to invest in the same. Sports betting and iGaming continues to be major growth driver for the company. MGM Resorts is optimistic regarding BetMGM operations as it anticipates revenue contributions of more than $1 billion in 2022.

Key Picks

Some better-ranked stocks in the Consumer Discretionary sector include Hilton Grand Vacations Inc. HGV, Bluegreen Vacations Holding Corporation BVH and Camping World Holdings, Inc. CWH.

Hilton Grand Vacations sports a Zacks Rank #1 (Strong Buy). The company has a trailing four-quarter earnings surprise of 411.1%, on average. Shares of the company have jumped 14% in the past three months. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Hilton Grand Vacations’ current financial year sales and earnings per share suggests growth of 222.1% and 170.8%, respectively, from the year-ago period.

Bluegreen Vacations flaunts a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 695%, on average. Shares of the company have surged 35.5% in the past three months.

The Zacks Consensus Estimate for Bluegreen Vacations current financial year sales and earnings per share indicates growth of 27.5% and 199.3%, respectively, from the year-ago period.

Camping World carries a Zacks Rank #2 (Buy). The company has been benefiting from the launch of a new peer-to-peer RV rental marketplace and a mobile service marketplace. It has been investing heavily in product development.

Camping World has a trailing four-quarter earnings surprise of 70.9%, on average. Shares of the company have appreciated 5.4% in the past three months. The Zacks Consensus Estimate for CWH’s current financial year sales and earnings per share suggests growth of 25.9% and 77.6%, respectively, from the year-ago period.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MGM Resorts International (MGM): Free Stock Analysis Report

Camping World (CWH): Free Stock Analysis Report

Hilton Grand Vacations Inc. (HGV): Free Stock Analysis Report

Bluegreen Vacations Holding Corporation (BVH): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.