Merck MRK announced that the European Commission has approved its blockbuster drug Keytruda for treating certain patients with adjuvant renal cell carcinoma (RCC) in the European Union (EU).

The EC has approved Keytruda, a PD-1 inhibitor, as an adjuvant treatment for adult patients with RCC at intermediate-high or high risk of recurrence, following nephrectomy or following nephrectomy and resection of metastatic lesions.

Following the EC approval, Keytruda became the first immunotherapy approved as an adjuvant therapy in Europe for such patients with RCC.

The approval for Keytruda is based on data from the phase III KEYNOTE-564 study that evaluated Keytruda against placebo as an adjuvant therapy in 994 patients having intermediate-high or high risk of recurrence of RCC. Data from the study demonstrated that Keytruda achieved statistically significant improvement in disease-free survival (DFS), reducing the risk of disease recurrence or death by 32% compared to placebo.

Last November, Merck received approval for Keytruda in a similar indication in RCC in the United States.

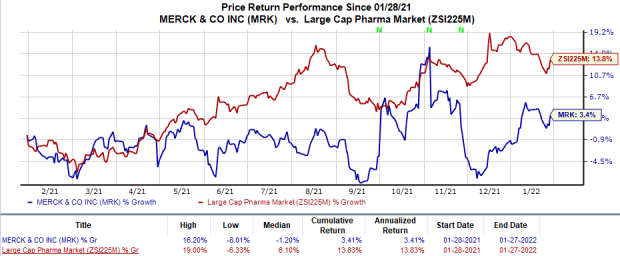

Merck’s stock has risen 3.4% this year so far in comparison with the industry’s 13.8% rise.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

RCC is the most common form of kidney cancer. Per Merck, RCC accounts for the majority of kidney cancer diagnosis.

Keytruda is already approved in both the United States and EU as a first-line treatment of adult patients with advanced RCC, in combination with Pfizer’s PFE axitinib.

Axitinib is marketed by Pfizer under the trade name Inlyta. Inlyta is also approved as monotherapy in both the United States and the EU for treating advanced RCC in adult patients who have failed a previous treatment regimen.

Pfizer’s Inlyta delivered a strong performance, driven by continued adoption in the United States and Europe. During the third quarter, Pfizer recorded $256 million in revenues from Inlyta sales.

Keytruda, which is the key revenue generator for Merck, is already approved for the treatment of many cancers globally. During third-quarter 2021, Merck recorded $4.5 billion in sales from Keytruda. Sales of the drug are gaining from its usage for the treatment of lung cancer and increasing use in other cancer indications. Keytruda is continuously growing and expanding into new indications and markets globally.

Merck is also evaluating Keytruda across a wide number of indications that are progressing well. In fact, Keytruda is being studied for more than 30 types of cancer indications in more than 1700 studies, including combination studies. Label expansions for new cancer indications, if approved, can further boost sales.

Bristol Myers BMY markets its own immuno-oncology drug, Opdivo, which is approved for various oncology indications and poses stiff competition to Keytruda in many targeted indications. In fact, Bristol Myers’ Opdivo is approved as both monotherapy and in combination with marketed drugs Yervoy and Cabometyx for the treatment of adults with advanced RCC.

For the third quarter, Bristol Myers recorded $1.9 billion in revenues from sales of Opdivo.

Merck & Co., Inc. Price

Merck & Co., Inc. price | Merck & Co., Inc. Quote

Zacks Rank & Stock to Consider

Merck currently carries a Zacks Rank #3 (Hold). A better-ranked stock in the same sector is Eli Lilly LLY, which carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Eli Lilly’s earnings per share estimates for 2022 have increased from $8.42 to $8.45 in the past 30 days. Shares of Eli Lilly have risen 12.7% in the past year.

Earnings of Eli Lilly missed estimates in three of the last four quarters while beating the mark in one, delivering a surprise of 0.5%, on average.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bristol Myers Squibb Company (BMY): Free Stock Analysis Report

Pfizer Inc. (PFE): Free Stock Analysis Report

Merck & Co., Inc. (MRK): Free Stock Analysis Report

Eli Lilly and Company (LLY): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.