Medtronic plc MDT recently received CE Mark approval for its Inceptiv closed-loop rechargeable spinal cord stimulator (SCS). The Inceptiv SCS system won't be sold or distributed in the United States but will be commercially available in Europe in the upcoming months.

The latest approval will fortify Medtronic’s Neuromodulation business, part of the Neuroscience Portfolio.

More on Inceptiv SCS System

Inceptiv SCS System is the first Medtronic SCS device to offer a closed-loop feature that senses each person's unique biological signals and adjusts stimulation moment to moment to keep therapy in sync with the motions of daily life.

The Inceptiv device uses a closed-loop ECAP (Evoked Compound Action Potential) capacity, the result of years of research and development by Medtronic, to provide the ability to hear and react to signals throughout the spinal cord. The device can respond to patient movements in real time thanks to ECAPs, which directly measure how much neural tissue in the spinal cord is active in response to electrical stimulation.

Benefits of Inceptiv SCS System

The distance between the spinal cord and the implanted epidural leads can change due to patient movements, which are not considered by fixed-output spinal cord stimulation today. The Inceptiv closed-loop function will enable more optimal and consistent therapy delivery and less manual programming adjustment on the part of the patient. This most recent generation of rechargeable neurostimulators represents a substantial advancement in SCS therapy and a turning point in contemporary neuromodulation.

More than 50 years ago, Medtronic invented SCS for pain management and continues to produce innovative breakthroughs that personalize care and enhance patient pain relief. With this permission, a new era of pain management that uses sensing technologies to account for each patient's particular biological signals has officially begun.

Industry Prospects

Per a report by Grand View Research, the global spinal cord stimulation devices market size was valued at $1.83 billion in 2018 and is anticipated to expand at a CAGR of 8.7% by 2026. The rise in the number of patients suffering from failed back syndrome, chronic pain, and Complex Regional Pain Syndrome (CRPS) is the key factor boosting the market growth.

Recent Developments

In June 2023, Medtronic presented a robust collection of new clinical and real-world data on its MiniMed 780G insulin pump system. The results were demonstrated at the 83rd American Diabetes Association (“ADA”) Scientific Sessions in San Diego, CA.

The latest data sets showed that the proprietary Meal Detection technology of MiniMed 780G supported Time in Range outcomes, which exceeded consensus guidelines of 70%. Additionally, the system helps to reduce the percentage of time spent in hyperglycemia in children and adults.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

In May 2023, Medtronic entered into a definitive agreement to acquire EOFlow Co. Ltd., the manufacturer of the EOPatch device. The acquisition will expand the company's ability to serve more people living with diabetes worldwide within one seamless Medtronic ecosystem of support.

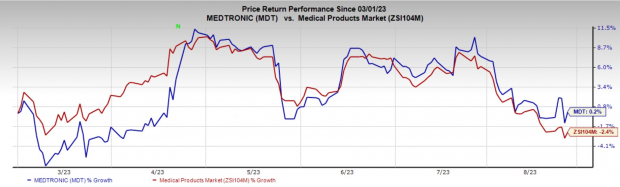

Price Performance

In the past six months, MDT shares have increased 0.2% against the industry’s fall of 2.4%.

Zacks Rank and Key Picks

Medtronic currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Elevance Health, Inc. ELV, Integer Holdings Corporation ITGR and Patterson Companies, Inc. PDCO.

Elevance Health reported second-quarter 2023 adjusted EPS of $9.04, beating the Zacks Consensus Estimate by 2.5%. Revenues of $43.38 billion surpassed the Zacks Consensus Estimate by 4.5%. It currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Elevance Health has a long-term estimated growth rate of 12.1%. ELV’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 2.8%.

Integer Holdings reported second-quarter 2023 adjusted EPS of $1.14, beating the Zacks Consensus Estimate by 15.2%. Revenues of $400 million surpassed the Zacks Consensus Estimate by 8.9%. It currently carries a Zacks Rank #2.

Integer Holdings has a long-term estimated growth rate of 12.1%. ITGR’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 8.4%.

Patterson Companies has an Earnings ESP of +5.66% and a Zacks Rank of 1. PDCO has an estimated long-term growth rate of 9.2%.

Patterson Companies’ earnings surpassed estimates in three of the trailing four quarters and missed once, with the average surprise being 4.5%.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>Medtronic PLC (MDT) : Free Stock Analysis Report

Patterson Companies, Inc. (PDCO) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report

Elevance Health, Inc. (ELV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.