The subsidiaries of MDU Resources Group, Inc. MDU, namely Montana-Dakota Utilities Co. and WBI Energy, Inc. are planning to expand the natural gas pipeline project in the Eastern North Dakota. This new project will assist the company to provide more natural gas to its existing customers in Wahpeton along with introducing its services to Kindred.

Montana-Dakota Utilities has contracts, which need 10 million cubic feet (MMcf) per day of service in Wahpeton, which is more than the company’s existing capacity. WBI Energy plans to expand a 60-mile, 12-inch natural gas pipeline and ancillary facilities to meet rising demand via capacity growth by 20 MMcf per day. The expected cost is $75 million and following all regulatory approvals, the company plans to begin construction in early 2024 and place it in service later that year.

Prior to this, WBI Energy started building the North Bakken Expansion project in Northwestern North Dakota after receiving an approval from the Federal Energy Regulatory Commission on Jul 8. The unit has plans to make $508 million worth investment in the pipeline business over the next five years and strengthen its core operations.

Company’s Capex Plans

After spending $648 million in 2020, the utility spent $107.2 million in the first quarter of 2021. However, it reduced its investment plans to $810.5 million from $826 million in the ongoing year. It expects to invest $3,032 million during the 2021-2025 period. These investments will increase the reliability of its services and enable it to serve an expanding customer base effectively. The company expects to see a 5% CAGR for its rate base over the next five years.

During the 2021-2025 time frame, it expects to invest $606 million and $970 million in electric and natural gas distribution business, respectively. Also, the company is likely to witness 1-2% customer growth in these segments, annually.

Other gas distribution utilities are also expanding their operations on the back of strategic capital investment plans. These include National Fuel Gas Company NFG, ONEOK Inc. OKE and Atmos Energy Corporation ATO. National Fuel Gas Company plans to invest in the range of $720-$830 million during fiscal 2021. ONEOK expects growth and maintenance capital expenditures in the band of $335-$465 million and $190-$210 million, respectively, in 2021. Atmos Energy remains on track to spend in the $2-$2.2 billion band during fiscal 2021.

Zacks Rank & Price Performance

MDU Resources currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

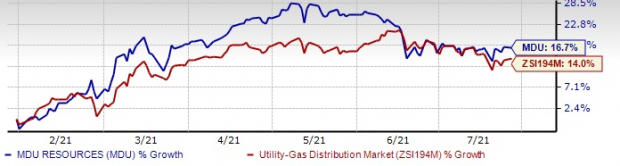

In the past six months, shares of the utility have rallied 16.7%, outperforming the industry’s 14% growth.

Six Months Price Performance

Image Source: Zacks Investment Research

+1,500% Growth: One of 2021’s Most Exciting Investment Opportunities

In addition to the stocks you read about above, would you like to see Zacks’ top picks to capitalize on the Internet of Things (IoT)? It is one of the fastest-growing technologies in history, with an estimated 77 billion devices to be connected by 2025. That works out to 127 new devices per second.

Zacks has released a special report to help you capitalize on the Internet of Things’s exponential growth. It reveals 4 under-the-radar stocks that could be some of the most profitable holdings in your portfolio in 2021 and beyond.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ONEOK, Inc. (OKE): Free Stock Analysis Report

Atmos Energy Corporation (ATO): Free Stock Analysis Report

MDU Resources Group, Inc. (MDU): Free Stock Analysis Report

National Fuel Gas Company (NFG): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.