MDU Resources MDU announced a $3.5 billion capital expenditure plan for the next five years, from 2023 through 2027. The strategic capital investments are expected to provide organic growth across its two-platform business model, while the company is working toward creating two pure-play public companies.

Details of the Expenditure

MDU Resources has a two-platform business model with a regulated energy delivery platform as well as a construction materials and services platform that includes different operating segments. Expenditures are properly distributed among the two platforms.

In regulated energy delivery, after expected spending of $2,159 million in the 2018-2022 time frame (including $463 million forecast for 2022), the company will invest $2,547 million in the 2023-2027 time frame, up nearly 18% from the previous five-year plan.

In the construction materials and services platform, after spending $3,673 million in the 2018-2022 time frame (including $699 million forecast for 2022), it will invest $3,529 million in the 2023-2027 time frame, down 3.9% from the previous five-year plan.

Benefits From Spending

MDU Resources anticipates that the electric and natural gas utility will grow its rate base by 6%-7% annually over the next five years on a compound basis. The company’s operations are spread across eight states and its customer base is expected to expand 1-2% annually. These strategic investments will increase the reliability of its services and enable it to serve an increasingly large customer base effectively.

Investment in pipelines will primarily support organic ventures like the recently announced Jamestown-to-Ellendale 345-kilovolt transmission project in North Dakota and the Wahpeton Expansion project in North Dakota, all these projects will further strengthen MDU’s electric and natural gas transmission capabilities.

Two Separate Entities

On Aug 4, 2022, MDU Resources announced its intent to separate its construction materials subsidiary, Knife River Corporation, into a standalone publicly traded company, and for that reason it is reporting adjusted earnings that exclude costs attributable to the separation transaction. In addition, on Nov 3, the company announced a strategic review process for MDU Construction Services Group, Inc. and is expected to share more detail on the separation next month.

Price Performance

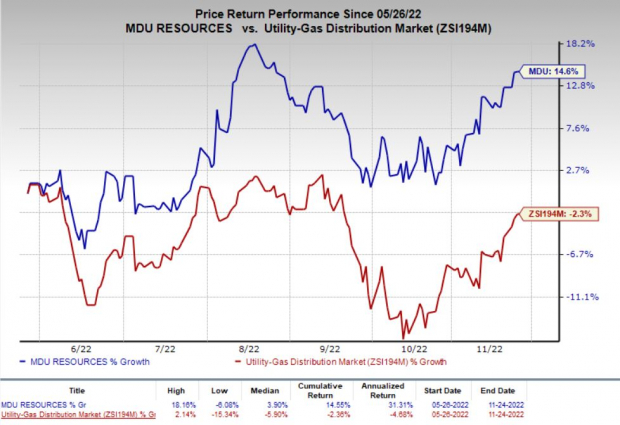

In the past six months, shares of MDU Resources have gained 14.6%, against the industry’s 2.3% decline.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

MDU Resources currently has a Zacks Rank #3 (Hold). Some better-ranked stocks in the same sector include NiSource Inc. NI, NRG Energy NRG and ALLETE Inc. ALE, each currently holding a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

NiSource, NRG Energy and ALLETE’s long-term (three- to five-year) earnings growth are currently pegged at 6.8%, 12.1%, and 9.3%, respectively.

The Zacks Consensus Estimate for 2022 earnings for NiSource, NRG Energy and ALLETE has moved up 0.7%, 24.7%, and 0.3%, respectively, in the past 60 days.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>NiSource, Inc (NI) : Free Stock Analysis Report

NRG Energy, Inc. (NRG) : Free Stock Analysis Report

Allete, Inc. (ALE) : Free Stock Analysis Report

MDU Resources Group, Inc. (MDU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.