McKesson Corporation MCK, on Tuesday, announced the completion of its earlier-announced divestiture of Canada-based Rexall and Well.ca businesses on Dec. 30, 2024. In September 2024, MCK announced its plans to sell its Canada-based businesses to Canadian private equity firm, Birch Hill Equity Partners.

It is worth noting that McKesson’s Canada retail business included approximately 400 owned pharmacies under the Rexall brand, where the company provided patients with greater choice and access, integrated pharmacy care and enhanced service levels. McKesson Canada also owned and operated Well.ca, a Canadian online health and wellness retailer.

The latest divestiture is expected to enable McKesson to focus on capital deployment and prioritize investments in expanding its strategic oncology and biopharma growth platforms.

Likely Trend of MCK Stock Following the News

Following the announcement yesterday, shares of the company lost nearly 1.2% till Dec. 31, 2024’s closing.

Historically, the company has gained a top-line boost from its products being selected for distribution as part of various partnerships. Although the announcement of the close of the latest divestiture is likely to be beneficial for MCK’s top-line growth going forward, the stock declined overall.

McKesson currently has a market capitalization of $72.34 billion. It has a sales/assets ratio of 4.8, higher than the industry’s 0.8. In the last reported quarter, MCK delivered an earnings surprise of 2.6%.

Rationale Behind McKesson’s Divestiture

Per McKesson, the transaction is expected to mark a significant milestone aligned with its enterprise strategy, advancing its strategic priorities, further streamlining its business and prioritizing investment in the growth areas of oncology and biopharma services. However, as McKesson Canada continues to see value in Rexall and Well.ca, management intends to remain a wholesale distribution supplier to each business.

Industry Prospects in Favor of MCK

Per a report by Precedence Research, the global oncology market accounted for $225.01 billion in 2024 and is anticipated to reach $668.26 billion by 2034 at a CAGR of 11.5%. Factors like the rising technological advancements in the diagnostics of various cancers and the increasing prevalence of cancer are likely to drive the market.

Given the market potential, the latest divestiture is expected to provide a significant boost to McKesson’s business.

McKesson’s Notable Agreements in Oncology

In November 2024, McKesson’s oncology technology and insights business, Ontada, announced a strategic collaboration with Datavant, a health data platform, to include Ontada’s data in their health ecosystem. The collaboration aims to help life science companies access Ontada’s real-world data, accelerating the discovery of critical insights that drive oncology innovation and improve the lives of cancer patients.

In October, McKesson’s Ontada announced its collaboration with Microsoft to utilize Azure AI, including Azure OpenAI Service, to help efficiently process more than 150 million unstructured oncology document components. The collaboration is expected to significantly improve Ontada's ability to extract crucial clinical information.

MCK’s Share Price Performance

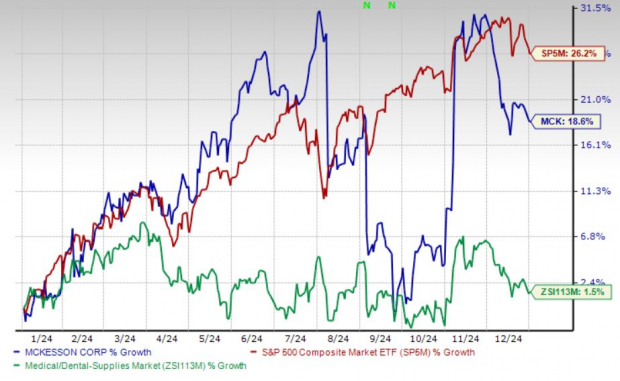

Shares of the company have gained 18.7% in the past year compared with the industry’s 1.5% rise and the S&P 500's 26.2% growth.

Image Source: Zacks Investment Research

McKesson’s Zacks Rank & Other Key Picks

Currently, MCK sports a Zacks Rank #1 (Strong Buy).

A few other top-ranked stocks in the broader medical space are Cardinal Health, Inc. CAH, ResMed Inc. RMD and Boston Scientific Corporation BSX.

Cardinal Health, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 10.2%. CAH’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 11.2%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Cardinal Health’s shares have gained 12.9% compared with the industry’s 1.5% rise in the past year.

ResMed, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 14.8%. RMD’s earnings surpassed estimates in each of the trailing four quarters, with the average being 6.4%.

ResMed has gained 37.9% compared with the industry’s 10.7% rise in the past year.

Boston Scientific, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 13.8%. BSX’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 8.3%.

Boston Scientific’s shares have rallied 55.1% compared with the industry’s 10.7% rise in the past year.

Just Released: Zacks Top 10 Stocks for 2024

Hurry – you can still get in early on our 10 top tickers for 2025. Handpicked by Zacks Director of Research Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2024, the Zacks Top 10 Stocks gained +2,112.6%, more than QUADRUPLING the S&P 500’s +475.6%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2025. You can still be among the first to see these just-released stocks with enormous potential.

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

McKesson Corporation (MCK) : Free Stock Analysis Report

ResMed Inc. (RMD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.