In a shareholder-friendly move, McDonald's Corporation MCD announced a hike in its dividend payout. The company also announced the resumption of its share repurchase program.

The company raised its quarterly dividend by 7% to $1.38 per share. The new dividend will be paid out on Dec 15 to its shareholders on record as of Dec 1. The total fourth-quarter dividend payout will amount to more than $1 billion.

Notably, the company has a history of increasing dividend every year since the inception of its dividend payout policy in 1976. McDonald’s has increased dividend for 45 consecutive years.

We appreciate McDonald's’ consistent efforts to enhance shareholder returns, despite the coronavirus pandemic affecting most of the industries. These initiatives reflect on the company’s business strength and sustainability of its cash flows.

Considering the above-mentioned positives, we believe that McDonald's is an attractive option for income-seeking investors at the moment. It is to be noted that an income-generating and dividend-paying stock is always a preferred investment option. People looking for regular income from stocks are most likely to be inclined toward companies that have a track record of consistent and incremental dividend payments.

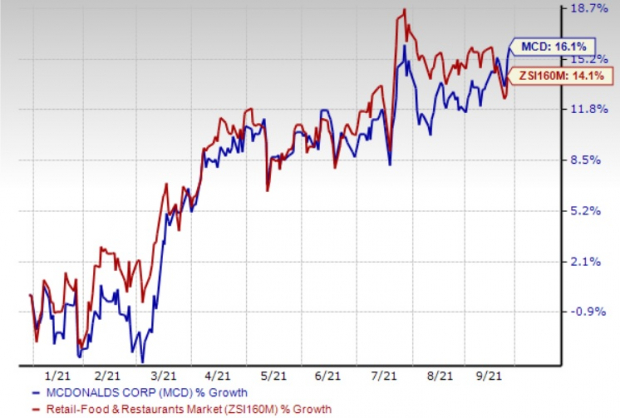

Image Source: Zacks Investment Research

Price Performance

So far this year, this Zacks Rank #3 (Hold) stock has gained 16.1% compared with the industry’s 14.1% rally. The company's focus on drive-thru, delivery & take-away bodes well. McDonald’s launched its first-ever loyalty program in the United States. More than 80% of the company’s restaurants across 100 markets globally provide delivery. It has been pursuing every effort to drive growth in the international markets.

Despite the pandemic, the company opened about 500 restaurants across the market in 2020. In 2021, the company is planning to open more than 1,300 restaurants globally. In China, the company surpassed the 4,000 restaurants mark in June and is on track to open 500 new restaurants in the country this year.

Solid Restaurant Bets

Some better-ranked stocks in the Zacks Retail - Restaurants industry include Jack in the Box Inc. JACK, Chipotle Mexican Grill, Inc. CMG and The Wendy's Company WEN, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Jack in the Box has a trailing four-quarter earnings surprise of 26.4%, on average.

Chipotle’s earnings for 2021 are expected to rise 137.5%.

Wendy's earnings for 2021 are anticipated to increase 42.1%.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Janus Henderson Sustainable & Impact Core Bond ETF (JACK): Free Stock Analysis Report

McDonalds Corporation (MCD): Free Stock Analysis Report

Chipotle Mexican Grill, Inc. (CMG): Free Stock Analysis Report

The Wendys Company (WEN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.