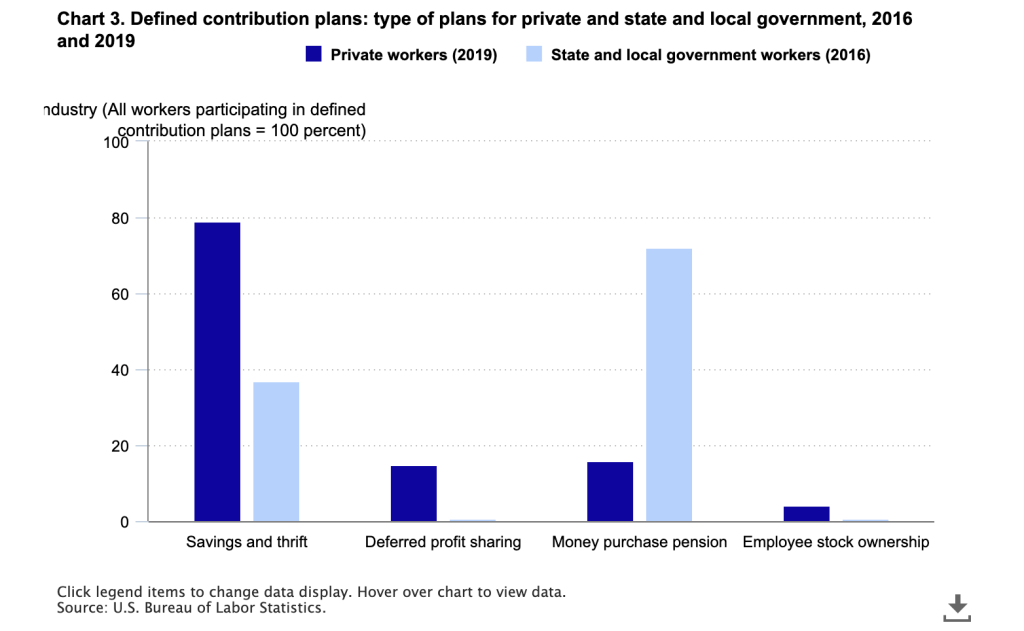

Retirement is no longer a sure thing for many people as defined-benefit pension plans are steadily declining. As of March 2022, 12% of private industry workers and 34 % of state and local government workers had access to both defined benefits and defined contribution plans. Conversely, only 3% of private industry workers have access to defined benefit plans, while 53 % of state and local government workers do. Meanwhile, 54 % of private industry workers had only defined contribution plans, and 5 % of state and local government workers had only defined contribution plans.

This is why it’s so important for workers to contribute to their own retirement plans. After all, although Social Security is a valuable resource, most people won’t be able to live as they did before retirement.

When you’re retired, the savings and investments you make now will likely play a big role. That’s why it’s better to get started early. However, it’s all about being realistic and making a plan that works.

Defining your retirement goals and putting aside a certain amount each month is the first step. It wouldn’t hurt to work with a financial planner or use a retirement calculator to figure out how much you should be saving.

After that, you’ll have to decide where to put your savings.

People usually have two kinds of accounts:

- Workplace retirement accounts, like 401(k)s and 403(b)s

- Individual retirement accounts, such as traditional and Roth IRAs

Using one or more account types will depend on your employment status, your employer’s plan, your income, and how much you can save. However, retirement is a significant investment, and many financial experts recommend maximizing your retirement savings in order to address financial obstacles like living longer and higher healthcare costs.

Contribution limits for 401(k)s.

To make the most of your 401(k), working backward is one of the most effective ways to get started. If that’s the case, divide your maximum annual contribution by the number of pay periods in a year and see what you’re left with.

For 2023, employees who participate in 401(k), 403(b), most 457 plans, and the federal government’s Thrift Savings Plan can contribute up to $22,500. For people over 50, there’s also a $7,500 catch-up contribution.

Some employers contribute to 401(k)s, but not all do. Combined contribution limits (your own and your company’s) are $66,000 for 2023 or $73,500 with the catch-up.

Roth 401(k) vs. 401(k)

Roth 401(k)s and traditional 401(k)s are two options your employer might offer. The difference? Roth 401(k)s and Roth IRAs use after-tax dollars to fund, but the limits are the same.

You get a tax break right away with a traditional 401(k). By paying into your account, you reduce your gross income. Taxes will only be due when you withdraw the money.

A Roth IRA collects income tax right away. On the flip-side, if you withdraw money, whether it’s your money or profits, you won’t pay more taxes.

Both 401(k) plans are great ways to save for retirement. During your working years, the traditional option gives you a tax break. With a Roth, however, you can save for retirement tax-free.

Don’t forget to max out your 401(k).

Are you able to save the maximum? As long as you make the best investment decisions you can with the plan’s options, there’s not much more you can do to boost your savings.

If you can’t make the maximum contribution, what should you do? Decide what you can realistically contribute to. Remember, you’ve got to pay for things like mortgages, rent, and utilities. Therefore, it doesn’t make sense to put aside so much that you have to get credit card debt just to get by.

You might be able to supplement your contribution with a bonus or profit-sharing payment if you can’t make the maximum. There are lots of companies that let you have these amounts deposited directly into your 401(k). It’s a good idea to automate deposits because well- intentions can turn south once the bonus check comes.

Most importantly, save consistently. Unless you need to change it, set a specific amount per paycheck. If you’re worried about the economy or politics, don’t cut your contributions.

You should save at least 15% of your gross pay. Coupled with reasonable investment returns, this amount should be enough to supplement Social Security down the road.

Make sure your employer contributes to your 401k.

Depending on your employer, you may be able to get a match, but there are usually rules to follow. Employers may match only up to a certain amount, or they may require a minimum contribution. Those two requirements might even be combined. The rules for matching contributions will vary from company to company, so check your company’s policy.

As an example, let’s say your company matches your contributions up to 3%. Basically, it works like this. if you put 4% in your 401(k), your employer will put 4% in too. As a result, you’re saving 8% instead of only 4%. You just doubled your contribution with the employer match.

Suffice it to say, your employer’s matching program is an excellent way to boost your retirement savings. If you’re saving for retirement, every penny counts, so don’t miss out on this “free money”.

Your employer (or HR department, or plan administrator) may be able to up your matching contribution if you’re not already maxing it out.

Required Minimum Distributions (RMDs).

Like some other retirement savings plans, 401(k)s require minimum distributions.

Owners of 401(k)s will have to start taking RMDs at age 73 starting on Jan. 1, 2023. The IRS takes this seriously. If you don’t withdraw the correct amount, there’s a 25% penalty — down from 50% previously.

When an employee still works for the same employer, RMDs don’t apply. Don’t forget you can roll over the Roth 401(k) funds to a Roth IRA, which doesn’t require minimum distributions during your lifetime.

Vesting in 401(k)s.

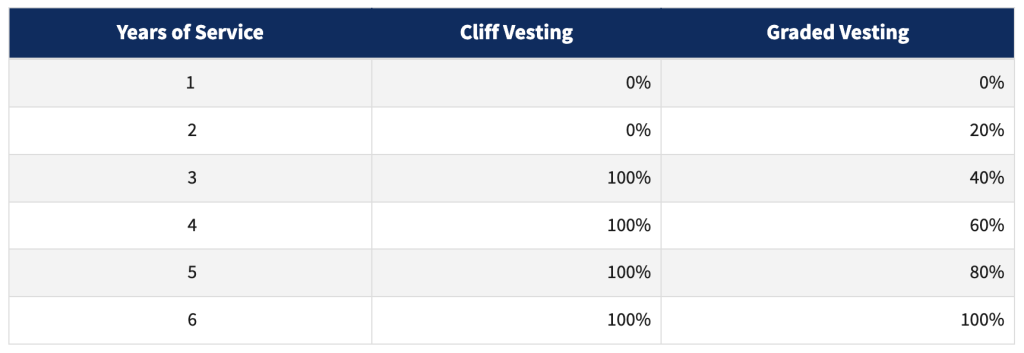

A certain number of years of service may be required before the employer matches the employee’s contributions. That’s a vesting schedule. Generally, there are two kinds of vesting schedules for 401(k)s:

- Cliff vesting. After a certain amount of time, the employee goes from owning 0% to 100%.

- Graduated vesting. The employee starts with a small portion of the matching contributions and eventually gets them all.

In order to maximize your 401(k) and employer match, you should understand a plan’s vesting schedule. The U.S. Department of Labor requires full vesting after six years of service. If you leave before you’re vested, the company will take back some or all matching contributions.

Traditional IRA vs. Roth IRA.

Traditional or Roth IRAs help you save for retirement if you don’t have access to an employer-sponsored plan like a 401(k) or if you’re already contributing the maximum amount. For 2023, the annual contribution limit is $6,500, or $7,500 if you’re over 50.

There is a difference between the two IRAs in how and when your money will be taxed:

- Your modified adjusted gross income determines the amount you can contribute to a traditional IRA on a pre-tax basis. Generally, contributions are tax-deductible, and you are not taxed until you withdraw the funds.

- If you have held the Roth IRA for at least five years and are over age 59 ½, your qualified withdrawals in retirement are tax-free. Roth IRA contributions are made after tax, so you don’t qualify for a tax deduction in the year of the contribution. Roth IRAs are only available to people with incomes below certain thresholds.

Is it better to open a traditional IRA or a Roth IRA?

You may benefit more from a traditional IRA if you expect to be in the same or a lower income tax bracket in retirement. It might make more sense to invest in a Roth IRA if you expect to be in a higher tax bracket, as it offers other advantages over 401(k)s and traditional IRAs.

As well as not being subject to annual required minimum distributions (RMDs), Roth IRAs aren’t subject to taxes. The advantage here is that your savings will be able to grow tax-free through the retirement years. In addition, your heirs could benefit from income tax-free withdrawals after your passing. However, beneficiaries may be required to take RMDs on inherited Roth IRAs.

Lastly, Roth IRAs give you more flexibility to plan your income and taxes in retirement—having accounts with both pre-tax and post-tax funds gives you more flexibility.

401k or IRA maxed out? What’s next?

Establish an emergency fund.

Before contributing to a retirement plan, experts recommend setting up an emergency fund with at least six months of living expenses. Maybe you have already done that. However, it wouldn’t hurt to update the account if it’s been a while. As your living expenses increase, you should make sure your emergency fund grows as well. In case of unforeseen medical expenses, replacing your tires, or repairing your roof, this will cover you financially.

Liquidity is essential for an emergency fund, as it needs to be accessible immediately. The FDIC will also protect your funds if the bank or financial institution goes under.

Invest in health care.

In retirement, you should save separately for health care costs. If your health plan is eligible for an HSA, consider using it. When you contribute to an HSA, your contributions can often be split between invested money (which can be used for long-term healthcare savings in retirement) and cash (to pay for qualified medical expenses directly from the account). For contributions,

- You can get three tax benefits: contributions are deductible.

- Earning potential that is tax-free.

- You can withdraw the money tax-free if you use it for qualified medical expenses.

Determine how much you are able to contribute, and if you can, try to reach that limit (for 2023, the limit is $3,850 for individuals and $7,750 for families). Your money will grow over time when you invest it. Don’t forget to do so once your money is in your account.

Create a brokerage account.

You may also want to consider opening a brokerage account after you max out your 401(k). and/or IRA. There are numerous types of brokerage accounts offered by brokerage firms, each with different fees and services. In addition to offering financial services, full-service brokerages may also offer securities trading.

For most brokerage firms, you must have enough cash to cover trading fees and commissions to open an account. Interest and dividends earned from the account are taxed, regardless of how much you contribute. In other words, if you make a profit or sell an asset, you must pay capital gains tax. Losses on stock sales, however, are capital losses. As a result, your taxable income may be reduced through the transaction.

You may want to consider an annuity.

It is important to note, though, that it’s often advised to avoid variable annuities since they have high costs and are subject to a multitude of risks.

In any case, you should invest only money that is absolutely intended for retirement in annuities. As with a 401(k), when you invest in an annuity, you get tax-deferred growth.

The money cannot be accessed until age 59 ½, which means you will have to pay surrender charges or tax penalties. If you decide to purchase an annuity, you should do so with money you won’t need until almost your 60s.

Additionally, annuities come in a variety of forms. Among these options is the fixed annuity, which is probably the most appealing. The return you earn from a fixed annuity will never change.

Index annuities, on the other hand, offer returns based on a specific index, such as the S&P 500. Having said that, you should always read the fine print when it comes to these types of accounts.

An IRA contribution that is not deductible.

It’s possible to make a nondeductible (after-tax) contribution to a traditional IRA. Yes. This is true even if you’re covered by an employer plan and above the income limits for a Roth IRA and deductible contributions to a traditional IRA.

If you withdraw earnings, they will be taxed as ordinary income, since you won’t get an up-front deduction. A Roth IRA can also be created by making a contribution to a nondeductible IRA and then converting it into a Roth IRA. The conversion rules can be complicated, so be sure to consult a financial professional before converting. It may be more efficient to have a regular brokerage account with tax-efficient investments.

Among the benefits of tax deferral is the potential for tax-deferred compounding. The other option is to invest tax-efficiently and not trade actively in taxable brokerage accounts to delay or defer taxes.

FAQs

1. What is the minimum amount you need to save for retirement?

Depending on an individual’s current lifestyle, desired retirement lifestyle, expenses, health, and dependents, the amount of retirement savings will differ. A simple rule of thumb is to divide the amount of income you intend to receive in retirement by 4%. Taking this example, if you need $75,000 in income each year, you need $1.75 million in retirement savings.

2. What is the best retirement plan?

Retirement plans such as 401(k)s are one of the best options for saving for retirement. However, not all employees have access to 401(k)s, as they must be provided by their employers. In spite of that, 401(k)s offer high contribution limits, are tax-advantaged, and many employers will match employee contributions.

3. Is it possible for me to contribute to both a 401(k) and an IRA at the same time?

IRAs and 401(k)s can both be contributed to in the same year. However, an IRA contribution may have its tax benefits reduced or eliminated depending on your income.

4. What happens to my 401(k) savings if I switch jobs?

There are several options available to you:

- If you have a balance above a certain amount, you can leave your savings alone (if there is a balance above that amount).

- In your new plan, you can transfer the balance of your 401(k) savings. It is important not to touch that money! Let your plan administrator handle the transfer, or you could owe a lot of taxes.)

- IRA rollovers give you control over the money you save at work. They are offered by almost all banks and brokerages.

- Your plan can be cashed out, but that isn’t a good idea. It is likely that you will have to pay taxes and a penalty if you are under the age of 59 ½. Furthermore, you will lose your retirement savings.

5. Is it possible to roll over funds from a traditional 401(k) to a Roth IRA?

The answer is yes. In that year, you will be required to pay income taxes on the amount you roll over. The reason for that is that you got an upfront tax deduction on your contributions with the understanding that you would have to pay the taxes in the future.

In contrast, Roth IRA withdrawals will not be taxed in the future. In order to protect your savings, it’s important to fully understand the rules about rollovers.

The post Maximizing Your Retirement Savings with 401(k)s and IRAs appeared first on Due.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.