Maximize Your Index Exposure with Index Options

Investors seeking exposure to a broad-based index such as the Nasdaq-100 Index can trade both Index options or ETF options. In this post, we will explore how Index options can provide investors with access to deep liquidity and unique advantages around settlement and expiration, tax, and sizing. Despite providing exposure to the same index, the characteristics of Index and ETF options are very different. Moreover, with the launch of XND, the Nasdaq-100 Micro Index Option, investors can now access the full benefits of Index options in a retail-friendly size. XND’s 1/100th value of the full Nasdaq-100 Index merges Index options' advantages with the sizing flexibility typically provided only by ETF options.

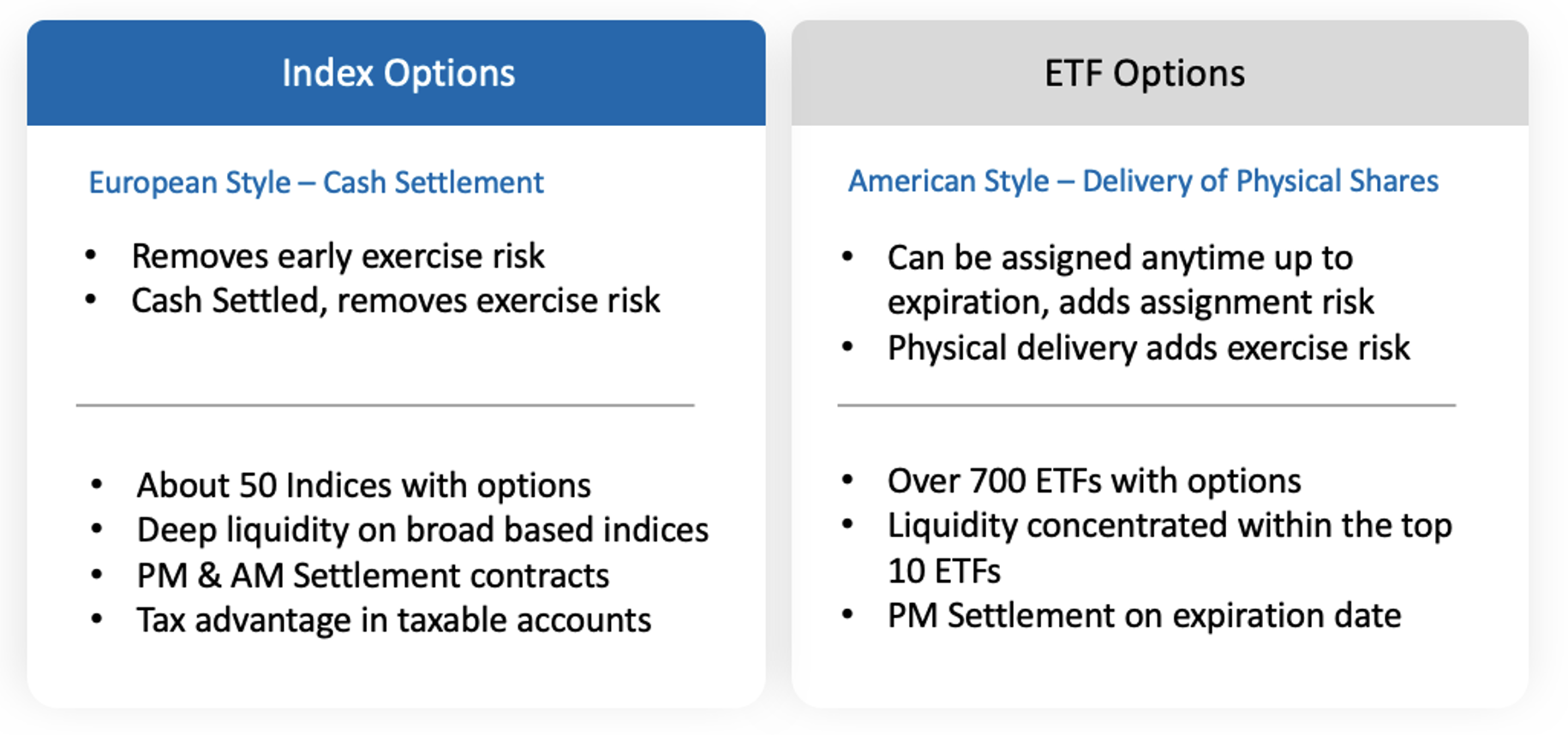

Index vs. ETF Options

Source: OptionsPlay

Settlement and Expiration Risk

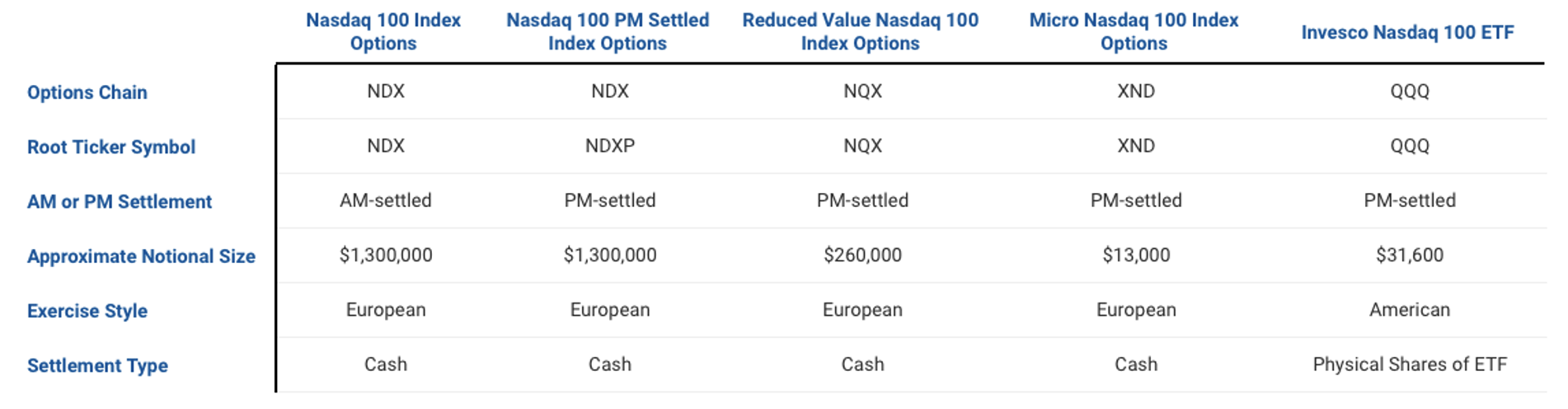

Both Index and ETF Options on the Nasdaq-100 track the same underlying index; however, they have very different characteristics. One of the most significant differences is that index options do not have an underlying security, only a calculated index, whereas ETF options are listed on a tradable security. Index options are cash-settled European style, while ETF options are for physical delivery and American style. Therefore, index options cannot be exercised early, which remove assignment risk entirely. Additionally, index options' cash settlement provides investors with protections against exercise risk, whereas ETF options leave investors exposed. For investors seeking to reduce risk, Index options offer a distinct advantage by eliminating both assignment and exercise risk.

Tax Advantage

For investors trading in a taxable account, index options are unique for investors seeking equity exposure through an option. Index options are a Section 1256 Contract taxed at 60% Longer-Term Capital gains and 40% Short Term capital gains. Since most options contracts are held for less than one year, investors seeking exposure to the same underlying index will likely see a smaller tax bill for an index option over a similar ETF option.

Sizing Advantage

Position sizing and flexibility are paramount for investors trading accounts under $100,000. One historical advantage that ETF options such as QQQ provided over Index options have been on sizing. Investors seeking precise exposure to the index will benefit from smaller contract sizes by controlling the number of contracts traded. While a single contract of QQQ is smaller than NDX, a $33,000/contract as of April 9th, 2021, may no longer provide the flexibility necessary for retail traders. The new XND contract with a notional value of only $13,000 a contract will provide investors with better flexibility and control over their risks. With the full suite of NDX, NDXP, NQX, and XND products, investors have a wide range of flexibility for all account sizes to access the benefits of Index Options on the Nasdaq-100 Index.

Nasdaq-100 Index and ETF Listed Options

Source: Nasdaq

Historically, Index Options were out of reach for most investors except for high net worth and institutional investors. ETF options did provide investors with a simple PM settled, weekly and monthly expirations in a smaller package for retail investors. However, with the introduction of Nasdaq-100 Micro Index Options (XND), you can now explore the benefits of trading index options with even more control over the size and maximize its many advantages.

To learn more about the launch of XND, don’t miss our Introduction to Trading Index Options webinar. Watch the event replay here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.