MasTec, Inc. MTZ inked a deal with Infrastructure and Energy Alternatives, Inc. (IEA) to acquire all of latter’s outstanding shares in a cash-and-stock transaction. The transaction is valued at $14.00 per IEA share and is subject to IEA stockholder approval, regulatory approvals and other customary closing conditions.

Shares of the company fell more than 6% on Jul 25.

Deal Highlights

Per the deal, IEA stockholders will get $10.50 per share in cash and 0.0483 of a MasTec share, with a value of $3.50 per share (based on the closing share price on Jul 22). This marks a 34% premium to IEA's closing stock price on Jul 22. The transaction is expected to close late in fourth-quarter 2022.

Image Source: Zacks Investment Research

MasTec expects to issue approximately 2.8 million shares to fund transaction consideration of approximately $1.1 billion.

IEA expects to generate revenue between $2.3 billion and $2.5 billion, net income within $45-$51 million, and adjusted EBITDA of $140-$150 million for 2022. Meanwhile, MasTec believes IEA will generate revenues between $2.6 billion and $2.7 billion and adjusted EBITDA within $160-$170 million in 2023, exclusive of any post-transaction synergies.

Additionally, it anticipates annual cost savings of approximately $10 million, owing to the combination of reduced IEA public company reporting and other costs. It expects IEA will generate $45-$50 million of adjusted net income in 2023.

Updated Views

Considering higher costs during the second half of 2022, MTZ updated its guidance. For the second half, revenues are expected to be $5 billion, GAAP net income is likely to be approximately $114 million, adjusted net income of $180 million and adjusted EBITDA is anticipated of nearly $471 million or 9.4% of revenue. Adjusted earnings per share are likely to be $2.39.

For the full year, it continues to expect revenues of approximately $9.2 billion. GAAP net income and earnings per share are expected to be $95 million and $1.24, respectively. Full-year adjusted EBITDA is expected to be approximately $750 million (8.1% of revenues) and adjusted earnings per share are likely to be $3.09.

Jose Mas, MasTec's chief executive officer, stated, "While our expected second half 2022 performance represents a 280-basis point improvement in adjusted EBITDA margin rate versus first half 2022 results, our current expectation reflects higher expected project costs, inefficiencies and delays including the impact of higher fuel, labor and material costs from sustained levels of inflation. We believe that these impacts will be largely mitigated in 2023 as new projects and contractual cost escalators take effect. We continue to expect MasTec legacy operations in 2023 will generate strong revenue and adjusted EBITDA growth and look forward to the expected incremental contribution in 2023 of the IEA acquisition."

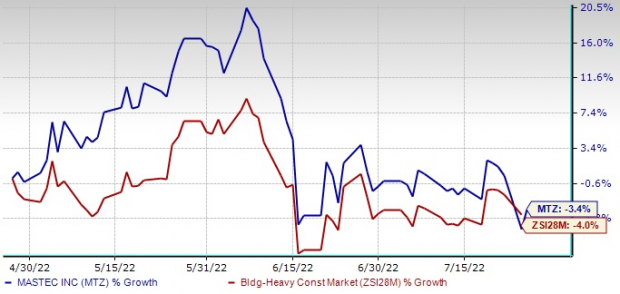

Price Performance

Shares of MasTec have declined 3.4% in the past three months, almost in line with the Zacks Building Products - Heavy Construction industry’s 4% fall. The company has been making the most of the country’s diligent focus on carbon neutrality. Furthermore, MTZ’s substantial presence in the telecommunications market and recent expansion into heavy infrastructure will prove conducive to its growth profile.

Zacks Rank

MasTec currently carries a Zacks Rank #4 (Sell). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some Better-Ranked Stocks in the Construction Sector

KBR, Inc. KBR, currently carrying a Zacks Rank #1, provides scientific, technology and engineering solutions to governments and commercial customers. Its mission-critical government services, high-end and differentiated government business work, strong margin performance, proprietary technology solutions and a significant increase in backlog (particularly in Government Solution) are expected to boost 2022 earnings.

KBR’s 2022 earnings are likely to rise 7.9%. The company’s earnings estimates have remained stable over the past 60 days.

Primoris Services Corporation PRIM, currently carrying a Zacks Rank #1, provides a wide range of construction, fabrication, maintenance, replacement and engineering services.

PRIM’s 2022 earnings are likely to rise 21.7%. The company’s earnings estimates have increased to $2.64 from $2.59 per share over the past seven days.

Toll Brothers Inc. TOL, currently carrying a Zacks Rank #2 (Buy), mostly offers luxury homes and its communities are located in prosperous suburban areas with easy access to major cities.

TOL’s expected earnings growth rate for fiscal 2022 is 53.2%. The consensus mark for its fiscal 2022 earnings has moved up to $10.16 from $9.87 per share in the past 60 days.

This Little-Known Semiconductor Stock Could Lead to Big Gains for Your Portfolio

The significance of semiconductors can't be overstated. Your smartphone couldn't function without it. Your personal computer would crash in minutes. Digital cameras, washing machines, refrigerators, ovens. You wouldn't be able to use any of them without semiconductors.

Disruptions in the supply chain have given semiconductors tremendous pricing power. That's why they present such a tremendous opportunity for investors.

And today, in a new free report, Zacks' leading stock strategist is revealing the one semiconductor stock that stands to gain the most. It's yours free and with no obligation.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

KBR, Inc. (KBR): Free Stock Analysis Report

Toll Brothers Inc. (TOL): Free Stock Analysis Report

Primoris Services Corporation (PRIM): Free Stock Analysis Report

MasTec, Inc. (MTZ): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.