March 2020 Review and Outlook

Executive Summary:

- Asset classes experienced historic price swings on par with any era since the early 1900s.

- The Dow Industrials had its top 3 largest drawdown (MoM) since the start of the 20th.

- Long rates made record lows while the short end (1M – 12M) temporarily went negative in late March.

- The Fed, Treasury, Regulators, and Congress responded with massive coordinated intervention.

- Crude had its worst quarter on record with WTI falling below $20 per barrel.

March was a historic month for virtually all asset classes, and with it marked the end of the longest running bull market for U.S. equities. In less than two months the COVID-19 pandemic spread outside of China’s borders and quickly became the largest global health crisis since the Spanish flu in 1918. Global confirmed cases and deaths escalated from roughly 11,500 and 360 at the end of January, to 832,000 and 41,000 by the end of March. The United States (178k), Italy (106k), Spain (95K) China (83k), and Germany (68k) have the highest number of confirmed cases, while the state of New York (75K) alone ranks 4th amongst all countries. The global “virus policy response” was initially staggered, but most of the world is currently adhering to a strategy of containment, social distancing, and economic stoppage with the essential goal of flattening the virus curve. From an economic perspective, the cure may be as bad as the disease. In turn, policy makers and regulators have had no choice but to inject massive amounts of liquidity and stimulus. The Fed has led the response in part by lowering overnight rates to zero, providing unlimited QE, backing private credit, opening trillions in REPO facilities, and expanding USD swap lines to 14 countries. Over the last four weeks the Fed’s balance sheet has already expanded by more than $1T, or 26%, to $5.25T, and it could be set to reach $9T in 2H 2020. Congress has done its part with a $2.8T fiscal stimulus package (13% of GDP).

With containment, global economic activity has slowed dramatically. However, open capital markets keep us abreast of price, and recent price action has been historic. The immediate performance numbers are on par with the darkest periods since the early 1900’s, let alone the bursting of the DOTCOM and Housing bubbles. To start, equities crashed into a bear market from all-time highs in the fastest time on record. From its February high to March low, the Dow Jones Industrials declined 38.3%. This measures its third largest MoM decline on record, trailing only The Great Depression (Q4’29) and Black Monday (Q4’87). The Dow also had its third largest single-session decline (-13%), its single worst Q1 (-23.2%), and its 7th worst quarter ever. For the quarter, the Russell 2000 had one of the largest drawdowns (-44%) while bottoming within 3% of its 2016 lows. Its relative underperformance was due largely to its outsized exposure to Financials, and relatively low exposure to Technology. Conversely the Nasdaq 100 (-30%) was the relative outperformer on all three measures (YTD %, March %, and 2020 max drawdown).

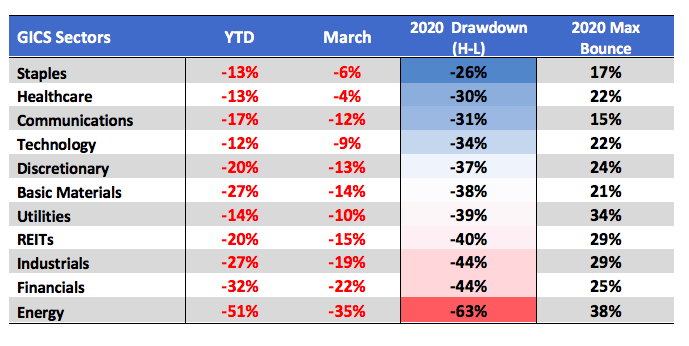

On an absolute basis all sectors faced steep declines, however from 2020 highs the defensive Staples (-26%) and Healthcare (-30%) sectors had the least drawdowns. At the other end, Energy (-63%) took the biggest hit due not only to collapsing demand, but also increasing production after talks between Saudi Arabia and Russia broke down. Financials (-44%) came within 10% of its 2016 lows as the Fed cut the overnight FFR to the zero bound and maturities out to 12 months went negative.

Rates, Commodities, and the Dollar:

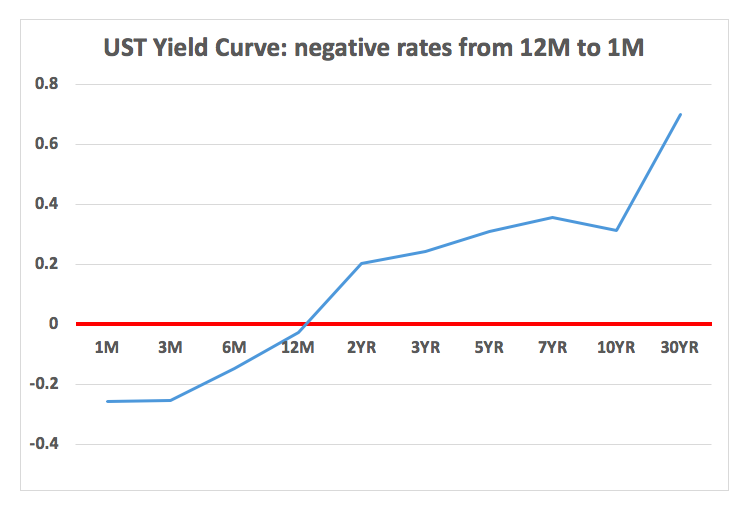

Treasury yields plummeted for the third consecutive month, and after two emergency rate cuts the Federal Reserve lowered the overnight FFR to the zero bound. The UST 10YR Yield declined as much as 137bps from its February high (1.68%) to March low (31bps), marking (1) its largest net decline (MoM) since December 2008, and (2) single largest MoM percentage decline since at least the early 1960’s. Before the 2nd rate cut to the zero bound, every single maturity out to the 30YR yield was below the overnight FFR (1% - 1.25%). At different times throughout the last week of March, the 1M, 3M, 6M, and 12M maturities were each in negative territory.

The 1M and 3M UST yields remained negative at the end of March. Currently the UST 2YR yield is riding near term support at 24bps-25bps level. Failure to hold this minor support risks a move down towards the zero bound, based on the size of the recent 2.5 week range (30bps).

Crude oil registered its worst quarterly performance on record (since 1983). The double whammy of falling demand (economic standstill) and increasing supply (global price war) drove the price of WTI down below $20 per barrel, and Brent crude below $22, levels not seen since 2002. After OPEC and allies failed to reach an agreement on production cuts, Saudi Arabia went the other way by slashing prices. Both Saudi Arabia and Russia plan to ramp up production on April 1.

On March 9th spot gold was +12% YTD and reached a seven year high, $1,704, but then quickly reversed giving back nearly 15% over the ensuing five sessions as real rates bounced off lows and oil plunged. Higher real rates make gold relatively less attractive, while falling crude decreases gold’s production costs. The broad Bloomberg Commodity Index (BCOM) lost 12.9% in March for its third worst monthly decline since 1980, behind October 2008 (Lehman) and September 2011 (US Credit downgrade).

The US dollar index (DXY) gained a modest 0.9% and finished the quarter +2.8% YTD. The DXY came within 1% of breaking out to an 18 year high. The greenback’s strength reflects, in part, the fierce global demand for dollars, and a reason the Fed expanded existing USD swap lines from five nations to 14.

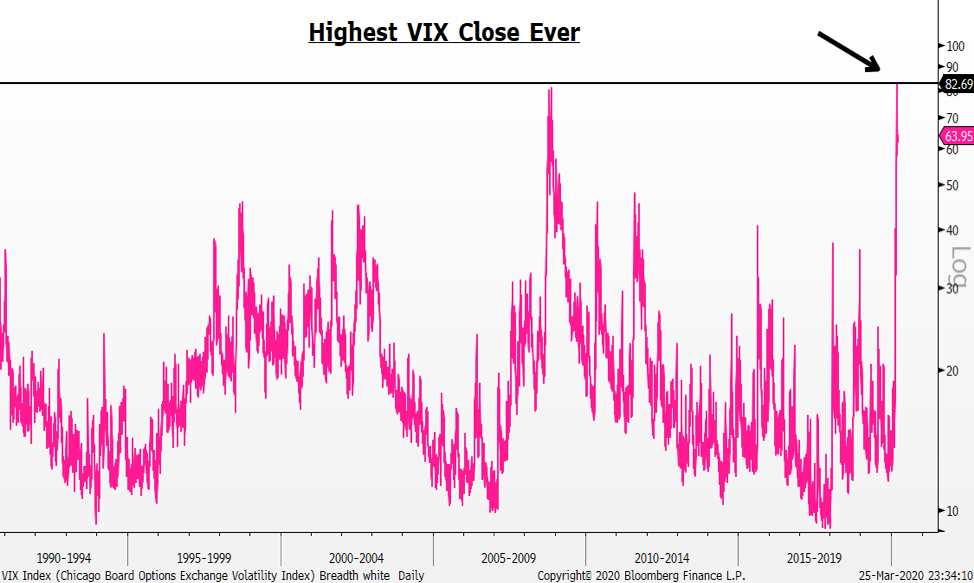

The VIX Index registered is highest daily close ever.

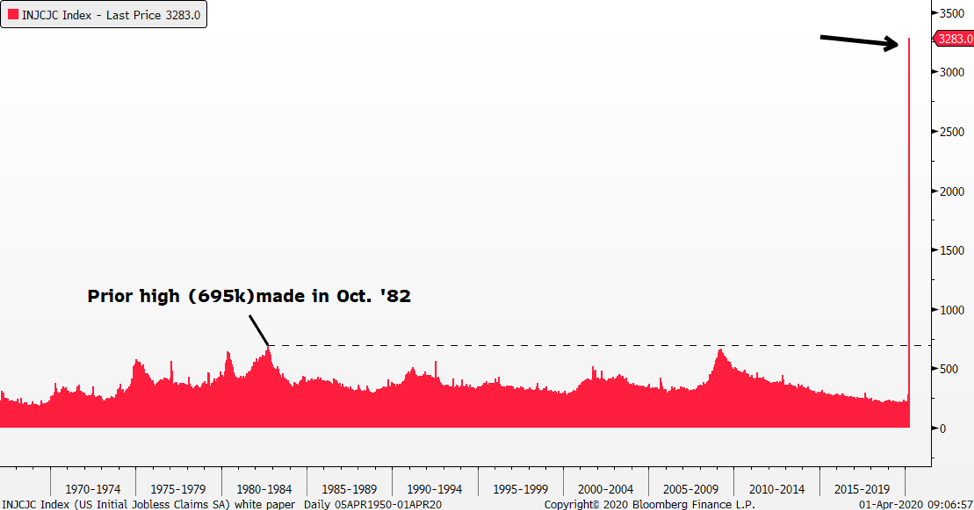

There is little economic data capturing the “economic stoppage,” however, the final weekly jobless claims report in March offered a glimpse into the level of economic carnage coming down the pipeline.

Looking Ahead:

COVID-19

During normal times, offices would be bustling with March Madness excitement and the start of baseball season, but these indeed are not normal times. Instead, the key numbers to watch will be COVID-19 infections, deaths, recoveries, and locations. Former FDA Commissioner Dr. Scott Gottlieb believes the pandemic could peak in New York City over the next week or two, but we could begin to see outbreaks in other cities throughout the country if drastic steps are not taken. Will states like Florida, which was likely heavily seeded during February and March, see large outbreaks similar to New York? Will the attempts to flatten the curve payoff? As testing capabilities continue to ramp up, nationwide infection numbers should continue to climb as well. Identifying as many cases as quickly as possible will be essential in curbing the spread of the virus, and we should observing countries like China and South Korea as they begin to transition back to “normal” life following their respective battles with COVID-19. Not much is known yet about re-infection rates and immunities, so if countries that have already gone through their peak and decline phase start seeing another uptick in infections, we could see shelter-in-place orders extended much longer than originally anticipated.

The S&P 500 bottomed back on March 23rd and has since rallied ~21%. Over the last four sessions in March, the SP ran into stiff resistance at the 38.2% retracement, 2,651, an area to expect increased overhead supply. During the recovery oversold momentum readings have normalized with the daily RSI now at 45, up from lows of 19 and 25 in February and March. An upside breakout from here opens up the potential for a move to the 50% (2,793) and 61.8% (2,935) retracements. While a V-shape recovery is a possibility, the more probable path is a retest of the March lows.

Source: Bloomberg LP

The information contained herein is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. All information contained herein is obtained by Nasdaq from sources believed by Nasdaq to be accurate and reliable. However, all information is provided “as is” without warranty of any kind. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.