Are These The Best SPAC Stocks To Buy Right Now?

The special purpose acquisition company (SPAC) might have been around since the 1980s. But it is only gaining more traction in 2021. SPAC stocks were among 2020’s biggest trends. And it seems that the trend has extended into 2021. Over the years, the popularity of SPACs has ebbed and flowed, and right now, it’s flowing. For those who are new to SPAC, it is a company with no commercial operations. It is structured strictly to raise funds through an initial public offering (IPO). Some also refer to them as blank cheque companies. With the capital raised, a SPAC then identifies a private company to merge with. This essentially provides a faster way for a private company to go public, without the traditional, more lengthy IPO process.

Hot off the press, Sunlight Financial, a premier U.S. residential solar financing platform, will be going public through Spartan Acquisition Corp. II (NYSE: SPRQ), a SPAC managed by an affiliate of Apollo Global Management. Upon announcement of such exciting news, the stocks have skyrocketed over 35% as of 9:36 a.m. ET. Such spectacular gains are not uncommon among the best SPAC stocks.

Why Are SPAC Stocks So Hot In The Stock Market Today?

A possible reason they are getting popular again in 2020 could be to do with the electric vehicle (EV) revolution we are experiencing in the stock market today. If you have only gotten to know SPACs this year, chances are the ones that you know are in the EV space. Recall that Tesla’s (NASDAQ: TSLA) stock was on every investor’s radar last year. And it was during that time that has led to a number of EV SPACs cashing in the red hot market. While most EV SPACs have brought good returns to shareholders in recent months, we don’t know if the party can go on forever.

You see, it’s almost like a perfect recipe for success when you combine an electric vehicle company with a SPAC. You will also see the incredible bias of SPACs toward exciting businesses. For instance, space travel company Virgin Galactic (NYSE: SPCE) is really cool. And it has been bringing great returns to shareholders. Now, there may come a day when space travel is no longer a dream. Perhaps it would just be a luxury vacation. Until then, the company remains a speculative bet. With all that in mind, let’s take a closer look at trending SPAC stocks in the stock market today.

Read More

- Top 5 Things To Watch In The Stock Market This Week

- Looking For The Top EV Stocks To Buy Ahead Of February? 1 Reporting Earnings This Week.

Top SPAC Stocks To Watch Right Now:

- Churchill Capital Corp IV (NYSE: CCIV)

- Foley Trasimene Acquisition II (NYSE: BFT)

- Ftac Olympus Acquisition (NASDAQ: FTOC)

Churchill Capital Corp IV (Lucid Motors)

Hopes of a merger with Lucid Motors had investors on edge last week. And it didn’t end there, Churchill Capital Corp IV’s stock is skyrocketing in its pre-market trading. As of 9:36 a.m. ET, CCIV stock price is up by 14%. Investors seem to be responding to an article from Los Angeles Times, suggesting that a deal is on the way. However, Michael Klein and his Churchill Capital Corp IV has not said a word about the merger. In fact, Klein said earlier this week that his blank-check company was considering a variety of acquisition targets.

“Lucid Motors has always been clear about its intent to go public at some point in order to accelerate the adoption and global availability of Lucid’s exclusive electric vehicle and sustainability technologies,” said Lucid Motors in a statement. “Currently, our focus continues to be on bringing Lucid Air to production in spring of this year, with the strong support of key investors and our partners at the Public Investment Fund.”

Of course, we don’t know if this deal is going to happen. That’s despite the activity we have seen in the stock. Investors have to understand that there is a lot of risk and a lot of speculation here. However, should the deal really go through, the price right now may still appear cheap to some investors. That is because many people see Lucid Motors as a true rival to Tesla in the luxury space.

[Read More] Are These The Best Health Care Stocks To Watch This Week? 3 In Focus

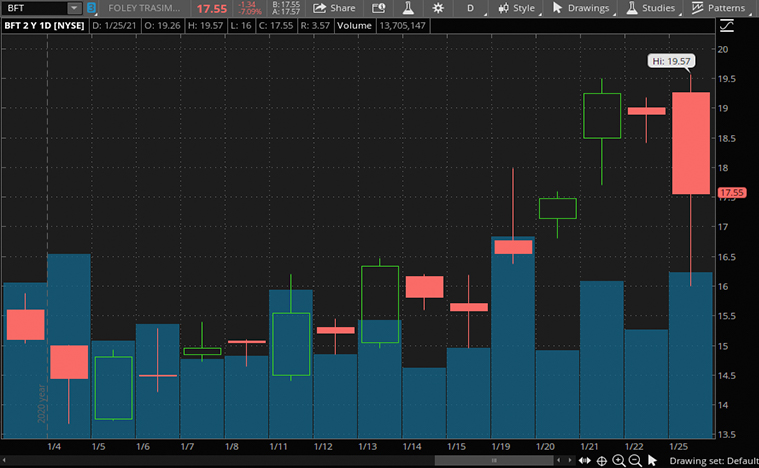

Foley Trasimene Acquisition II (Paysafe)

Coming up next, Foley Trasimene Acquisition II is another trending SPAC stock in the market. The company’s stock price has climbed more than 20% in the past week. For those unfamiliar, the company aims to dominate the U.S. gaming market with payment solutions Skrill and Neteller (formerly known as Moneybookers) through the acquisition of Paysafe Group. You could say it’s offering a similar service to PayPal (NASDAQ: PYPL). The difference? PayPal offers users the ability to trade cryptocurrencies, while Paysafe allows its users to engage in online gambling.

These online wallets could be a great value for the company. You see, when you go to a physical casino, the first thing you probably want to do is to get your chips straight to the table, right? You wouldn’t want to queue up to get the credit for the game. The same thing applies here. Banks and credit card providers could be very time-consuming, not to mention that they can charge a high fee if you want to engage in online gambling.

The real play here is U.S. gaming. With online gambling increasingly getting legalized, there could be a big opportunity here. These online wallets are fairly convenient if you like online gaming. It’s impressive how Paysafe could operate efficiently in various jurisdictions. What’s more, Paysafe counts notable private equity firms Blackstone Group and CVC Capital Partners among its shareholders. With all these in mind, is BFT stock the best bet on the rise in online gambling?

[Read More] Top Dividend Stocks To Buy In 2021? 6 For Your List

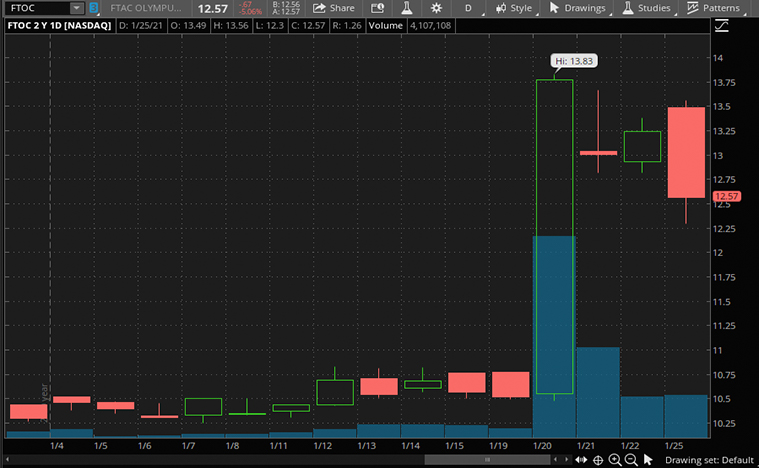

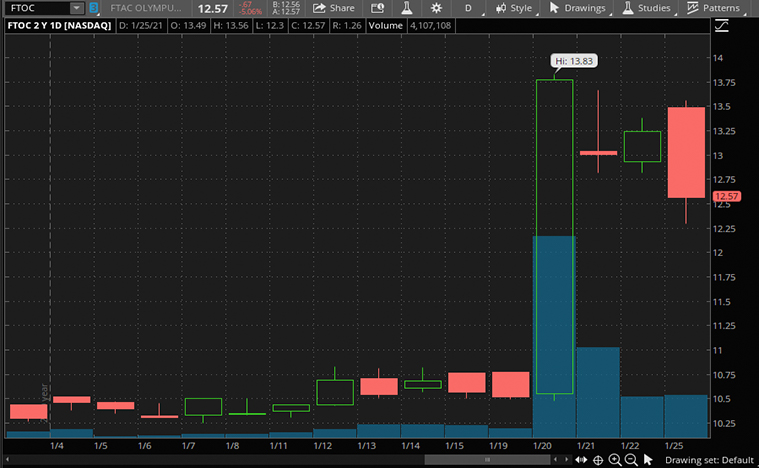

Ftac Olympus Acquisition (Payoneer)

Last but not least, we have another fintech play here. For the uninitiated, Payoneer offers online money transfers and digital payment services and has seen a boost to its business during the COVID-19 pandemic. Unlike other companies that had to lay off employees during the pandemic, Payoneer has been doing the opposite. It hired more employees as the business grew. On January 20, Bloomberg cited sources saying that Ftac is in talks to take Payoneer public. And that led to a rally in FTOC stocks in the past week.

So why is it worth putting FTOC stock on your watch list? Payoneer makes it possible for any business anywhere to transact as easily globally as they do locally. Besides payments, the company’s services also include working capital, tax solutions, and risk management. Payoneer has a huge presence and is currently operating in roughly 200 countries with a total of 1,500 employees. It’s not only Paysafe that has attracted strong backings from notable investors, Payoneer too. The company has Wellington Management, Viola Ventures, Pingan, and others as their backers. What’s more, it supports a large number of platforms like Airbnb (NASDAQ: ABNB) and Amazon.com (NASDAQ: AMZN).

Like in the case with Churchill Capital Corp IV, all we have at this point is an unconfirmed report. We can’t stress often enough the risks of purchasing something on rumors alone. Yet, if the deal goes through, we could be looking at bigger things ahead. Considering all that, could FTOC stock be one of the most exciting SPAC stocks to watch this week?

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.