Note: The following is an excerpt from this week’s Earnings Trends report. You can access the full report that contains detailed historical actual and estimates for the current and following periods, please click here>>>

Here are the key points:

- Total earnings for the 245 S&P 500 companies that have reported results are up +11.6% from the same period last year on +5.1% higher revenues, with 80.0% beating EPS estimates and 66.9% beating revenue estimates.

- The picture emerging from the 2024 Q4 earnings season continues to be one of strength and improving outlook, with the companies not only coming ahead of estimates but also providing reassuring guidance for the coming quarters.

- For the Tech sector, we now have Q4 results for 68.3% of the index’s market capitalization in the S&P 500 index. Total earnings for these companies are up +23.2% from the same period last year on +8.8% higher revenues, with 88.9% beating EPS estimates and 77.8% beating revenue estimates. This is a notably better performance from these Tech companies relative to other recent periods.

- Looking at 2024 Q4 as a whole, combining the results for the 112 index members that have come out with estimates for the still-to-come companies, total S&P 500 earnings are currently expected to be up +11.9% from the same period last year on +5.3% higher revenues.

Spending Like Drunken Sailors

Alphabet GOOGL became the latest member of the Mag 7 club to stick to its ever-rising spending on building out its artificial intelligence infrastructure. This is in line with the trend we saw earlier from Microsoft MSFT and Meta Platforms META, who showed no inclination of having second thoughts on their equally aggressive AI-focused spending plans in the wake of China’s DeepSeek results.

Alphabet plans to spend +47% more this year, with a capex budgeted target of $75 billion. Meta and Microsoft plan to spend $60 billion and $80 billion on capex, with many analysts projecting an even bigger final tally for Microsoft.

Alphabet shares were down following the release, but the market’s disappointment had more to do with trends in the company’s business. Microsoft had issues in its cloud business as well that weighed on the stock price following its quarterly release.

The cloud issue may have been the primary contributor to the market’s negative reaction to the Alphabet and Microsoft reports, but it’s fair to assume that investors would have liked to see some humility and introspection from these Tech leaders, given the uncertain payoff.

Capex questions aside, we must remember that the Mag 7 players are extraordinarily profitable and still growing impressively. Alphabet’s Q4 earnings increased +28.3% from the year-earlier period to $26.5 billion on a +12.9% increase in revenues to $81.6 billion. In comparison, Microsoft’s Q4 earnings were up ‘only’ +10.2% from the year-earlier level to $24.1 billion, with Meta earnings also increasing +48.7% to $20.8 billion.

In essence, the primary justification that these companies have put forward for these huge capex plans is to ensure their primacy in the coming artificial intelligence world, which will be critical to the sustainability of their enormous earnings power.

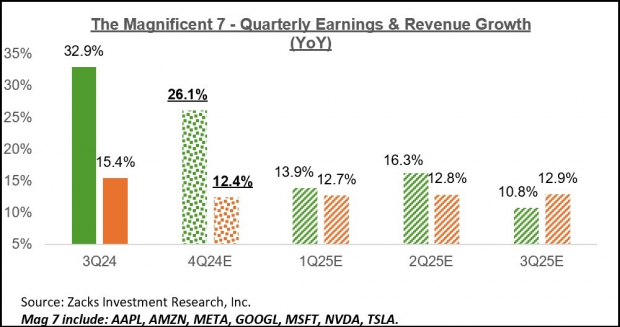

For Q4, Mag 7 earnings are expected to be up +26.1% from the same period last year on +12.4% higher revenues, as the chart below shows.

Image Source: Zacks Investment Research

Tech to Remain a Key Growth Driver

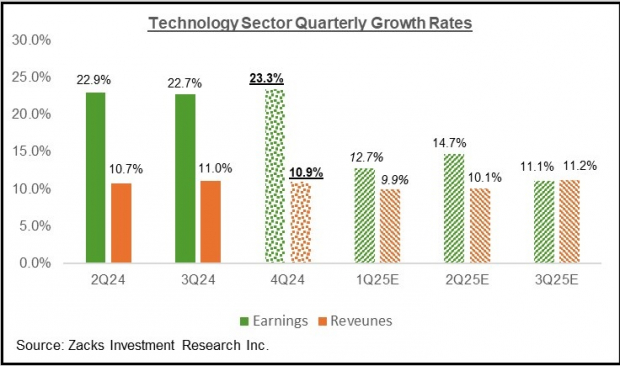

The Tech sector has been a significant growth driver in recent quarters, and the trend is expected to continue in 2024 Q4 and beyond. For Q4, Tech sector earnings are expected to be up +23.3% from the same period last year on +10.9% higher revenues, the 6th quarter in a row of double-digit earnings growth.

This would follow the sector’s +22.7% earnings growth on +11% higher revenues in 2024 Q3. As the chart below shows, the sector’s growth trajectory is expected to continue in the coming quarters.

Image Source: Zacks Investment Research

In addition to the Tech sector’s strong growth profile, the sector is also among the few sectors whose earnings outlook is steadily improving. This shows up in the revisions trend for the Tech sector for both Q4 and full year 2025.

The Earnings Big Picture

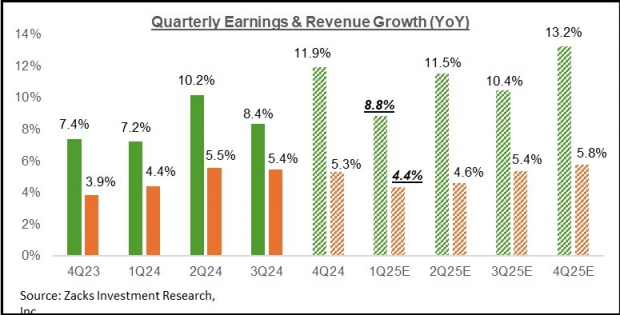

The chart below shows expectations for 2024 Q4 in terms of what was achieved in the preceding four periods and what is currently expected for the next four quarters.

Image Source: Zacks Investment Research

As you can see in the above chart, total S&P 500 earnings for the current period (2025 Q1) are currently expected to be up 8.8% from the same period last year on +4.4% high revenues.

Estimates for the period have been coming down since the quarter got underway, as the chart below shows.

Image Source: Zacks Investment Research

The revisions trend is broad-based, with estimates for 15 of the 16 sectors down since the start of January (Medical is the only sector whose estimates have increased). Sectors suffering the most significant cuts to estimates include Conglomerates, Aerospace, Construction, Basic Materials, Autos, and others.

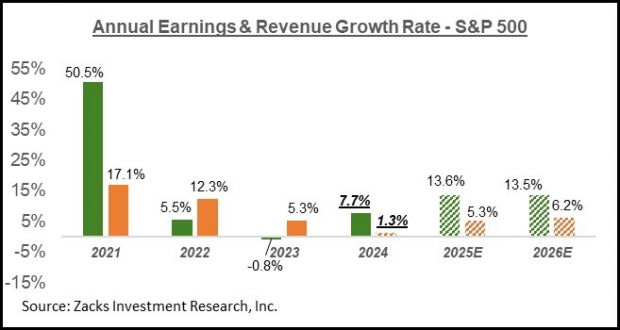

The chart below shows the overall earnings picture on an annual basis.

Image Source: Zacks Investment Research

As you can see, the expectation is for double-digit earnings growth in each of the next two years, with the number of sectors enjoying strong growth notably expanding from the narrow base we have been seeing lately.

In fact, 2025 is expected to have all 16 Zacks sectors enjoy earnings growth, with 8 of the 16 Zacks sectors expected to produce double-digit earnings growth. Unlike the last two years, when the Mag 7 group drove all or most of the aggregate earnings growth, we will have double-digit S&P 500 earnings growth in 2025, even without the contribution from this mega-cap group.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Microsoft Corporation (MSFT) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.